Remote Work in 2026: How Digital Job Platforms Are Rebuilding the Global Workforce

The world of work in 2026 bears little resemblance to the office-centric structures that dominated even a decade earlier, and for the executives, founders, and policy shapers who follow FinanceTechX, this is no longer a speculative trend but a strategic reality that touches every dimension of business, from capital allocation and talent acquisition to regulation, sustainability, and risk management. What began as an emergency response during the pandemic years has consolidated into a durable operating model in which remote and hybrid work are embedded into corporate strategy, national labor policy, and individual career planning across North America, Europe, Asia, Africa, and South America.

Remote work is now a mainstream, multi-sector phenomenon. Professionals in finance, compliance, cybersecurity, data science, education, healthcare, and legal services treat remote or hybrid roles as standard career options rather than exceptions. Companies in the United States, United Kingdom, Germany, Canada, Australia, France, Italy, Spain, Netherlands, Switzerland, China, Singapore, Japan, South Korea, Brazil, South Africa, and beyond actively design workforce strategies around distributed teams. For readers of FinanceTechX Business, this shift is not simply about employee preferences; it is about the structural reconfiguration of value chains, operating models, and the global economy.

In that context, remote job platforms have become critical infrastructure. They are no longer passive job boards but sophisticated, AI-enabled ecosystems that mediate trust, verify identity, curate opportunities, and orchestrate cross-border collaboration at scale. They shape who gets access to opportunity, how companies build teams, and how professionals construct their digital identities. For a publication like FinanceTechX, which sits at the intersection of fintech, AI, global markets, and green innovation, understanding these platforms is central to understanding where work, capital, and innovation are heading next.

From Emergency Measure to Strategic Operating Model

The normalization of remote work has been driven by a convergence of economic, technological, and social forces. Initially, lockdowns forced enterprises to test large-scale remote operations under duress. What followed was an unexpected discovery: for many knowledge-intensive roles, productivity not only held but in some cases improved when employees were given flexibility, digital tools, and outcome-based performance metrics. Organizations such as Microsoft, Shopify, and Deloitte moved from temporary remote policies to enduring hybrid or remote-first frameworks, while fintech leaders like Stripe, Revolut, and Wise institutionalized global hiring as a core competitive advantage.

This was reinforced by macroeconomic and policy developments. Governments in Europe, Asia, and North America adjusted labor rules, tax regimes, and visa frameworks to support cross-border digital work, while regulators focused on data protection, cybersecurity, and fair labor standards in virtual environments. Institutions such as the International Labour Organization and OECD began to analyze the long-term implications of telework on productivity, inequality, and social protection, providing the evidence base for more permanent policy responses. Interested readers can review broader labor market analysis through organizations like the International Labour Organization.

At the same time, enterprises faced acute skills shortages in areas such as cybersecurity, AI engineering, and regulatory compliance. Remote hiring became a practical solution to access specialized talent in India, Singapore, Poland, Nigeria, Kenya, or Argentina, without the friction of relocation. This intersected directly with themes covered on FinanceTechX Economy, where the reallocation of work across borders is now recognized as a driver of both growth and structural change.

Why Remote Platforms Became Core Market Infrastructure

For decision-makers, the significance of remote job platforms lies in their ability to orchestrate three critical functions at global scale: visibility, trust, and matching. These platforms provide global visibility by aggregating opportunities from multiple jurisdictions and sectors, enabling a risk analyst in Toronto to access roles in Zurich, or a data scientist in Bangalore to secure contracts with a bank in London. They build trust by screening employers, verifying workers, and deploying fraud-detection systems that filter out scams and low-quality postings that once undermined online labor markets. They enhance matching by using artificial intelligence and data analytics to align skills, experience, and preferences with specific roles, significantly reducing search friction for both sides.

This triad of visibility, trust, and matching has turned leading platforms into quasi-market utilities for the digital labor economy. For readers who follow FinanceTechX Fintech, the parallels with payment networks or trading venues are clear: platforms define standards, set expectations, and concentrate flows of value and information, thereby shaping the evolution of the market itself.

The Major Platforms Shaping Remote Careers in 2026

LinkedIn: The Professional Graph as Hiring Engine

LinkedIn has consolidated its position as the default infrastructure for white-collar careers, and its remote jobs functionality in 2026 is deeply integrated into the broader professional graph. Rather than functioning as a standalone job board, it uses AI-driven recommendation engines to analyze skills, endorsements, learning history, and network connections to surface relevant remote and hybrid roles. For employers, LinkedIn's talent insights, verified work histories, and company branding tools make it a primary channel for sourcing mid- to senior-level professionals in finance, technology, consulting, and emerging digital sectors.

Remote hiring on LinkedIn is particularly prevalent in the United States, United Kingdom, Germany, Canada, and Singapore, where enterprises rely on the platform to build distributed teams spanning time zones from Asia-Pacific to Europe and North America. The integration of LinkedIn Learning means that candidates can close skill gaps in areas such as cloud computing, ESG reporting, or AI ethics while simultaneously positioning themselves for roles that require those capabilities. Readers can explore the remote roles and learning ecosystem via the LinkedIn Jobs portal.

FlexJobs: Curated, Low-Risk Remote Careers

FlexJobs has built its reputation on curation and risk reduction, positioning itself as a premium destination for professionals seeking legitimate, career-advancing remote and hybrid roles rather than ad-hoc gigs. Every posting is manually vetted, which significantly reduces exposure to fraudulent or low-quality opportunities. This emphasis on trust resonates strongly with mid-career professionals in the United States, Canada, Australia, and Europe who may be transitioning from traditional corporate roles into flexible work arrangements but still require stability, benefits, and clear career progression.

FlexJobs is particularly relevant for sectors where remote work has expanded rapidly but where regulatory and reputational risks are high, such as healthcare administration, education, financial services, and legal compliance. A compliance officer in France or an education specialist in New Zealand can rely on FlexJobs to filter out dubious offers and focus on roles aligned with their expertise and long-term objectives. Executives evaluating remote hiring channels can review the platform's approach directly through FlexJobs.

We Work Remotely: Community-Driven Talent for Digital Businesses

We Work Remotely has evolved into a central hub for technology-driven organizations seeking professionals who are already proficient in remote collaboration. Initially dominated by software engineering and design roles, the platform now features product management, marketing, customer success, and operations positions for companies across North America, Europe, and increasingly Asia and South America. Its value lies in a combination of simplicity and community; the interface is straightforward, but the surrounding ecosystem of remote-work practitioners, best practices, and informal networks creates a powerful signal for both employers and candidates.

Startups in Berlin, London, Amsterdam, San Francisco, and Sydney use We Work Remotely to tap into a global pool of talent that is comfortable with asynchronous communication, distributed decision-making, and outcome-based performance. For founders and hiring managers, this reduces onboarding friction and cultural mismatch. Interested organizations can examine current listings and community resources via We Work Remotely.

Remote.co: A Knowledge Hub for Distributed Organizations

Remote.co occupies a distinctive position at the intersection of job board and knowledge center. In addition to remote job listings, it offers extensive guidance on building and managing distributed teams, covering topics such as performance management, communication norms, legal frameworks, and employee wellbeing. This dual focus makes it valuable for both HR leaders designing global workforce strategies and professionals seeking to understand the realities of long-term remote careers.

The platform's emphasis on transparency around culture, expectations, and operational practices helps mitigate some of the classic risks of remote arrangements, such as isolation, misalignment, and burnout. Its thought leadership, often aligned with perspectives from organizations like Harvard Business Review or Gallup, contributes to broader debates about the future of work and organizational design. Executives evaluating remote culture strategies can explore insights and roles on Remote.co.

Upwork: Enterprise-Grade Global Freelance Infrastructure

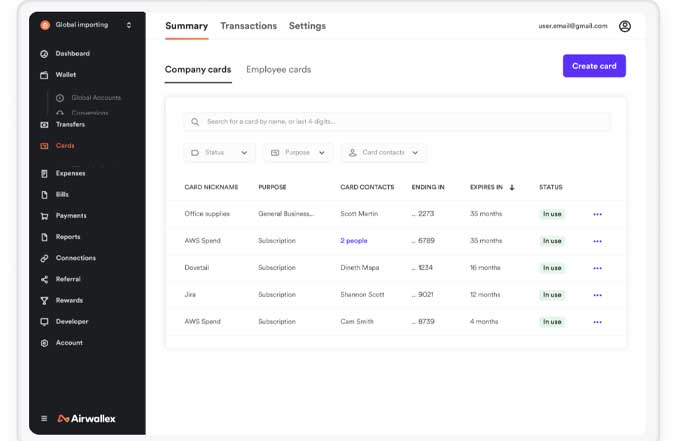

Upwork has transitioned from a general freelance marketplace to a critical layer of global professional services infrastructure. In 2026, it supports complex, long-term engagements in domains such as blockchain development, AI research, financial modeling, regulatory reporting, and digital transformation. Large enterprises, including Fortune 500 companies, use Upwork to assemble flexible, project-based teams that complement internal capabilities, while startups rely on it to access specialized expertise they cannot yet justify hiring full time.

For professionals, Upwork functions as a platform for building a diversified, global client portfolio. A fintech strategist in Singapore, a data analyst in Poland, or a UX designer in Brazil can structure their work as a portfolio of recurring engagements with clients in the United States, United Kingdom, Switzerland, and Japan, with payment protection, dispute resolution, and reputation systems providing a foundation of trust. The platform's AI-driven matching and enterprise dashboards have made it attractive to procurement and HR teams seeking both flexibility and governance. Stakeholders can review its capabilities at Upwork.

Remote OK: Transparency and Time-Zone Intelligence

Remote OK has distinguished itself through radical transparency around compensation, location constraints, and company remote policies. In a market where opaque salary ranges and ambiguous "remote" labels can erode trust, Remote OK's explicit filters for salary, region, and time zone alignment are highly valued by both candidates and employers. This is particularly relevant for cross-continental collaboration, where time zone overlap can materially affect team cohesion and project delivery.

Developers, data engineers, and product managers in Spain, Italy, Finland, Norway, and Denmark use Remote OK to identify roles with organizations in North America or Asia that explicitly accommodate their working hours. For fast-growing digital businesses in Germany, Sweden, or Singapore, the platform offers access to talent that understands remote-first norms and expects clarity on compensation and working practices. Current openings and filters can be examined at Remote OK.

Indeed: Scale and Localization for Remote Hiring

Indeed remains one of the most extensive employment platforms globally, and its remote-specific filters have transformed it into a powerful tool for both multinational corporations and local employers offering flexible work. Unlike niche platforms that focus heavily on technology roles, Indeed covers a broad spectrum including healthcare, education, legal services, finance, and public sector functions, making it especially relevant in markets where remote work is diffusing beyond the digital core.

Its localized portals in the United States, United Kingdom, Germany, France, Japan, Brazil, and South Africa enable candidates to search for remote roles that comply with local labor laws, language requirements, and cultural expectations, while still connecting them to global employers. For HR leaders designing multi-country hiring strategies, Indeed provides reach, analytics, and integrations with applicant tracking systems. Remote opportunities across geographies can be explored through Indeed.

Fiverr Pro and Specialist Marketplaces

Beyond generalist platforms, specialist marketplaces such as Fiverr Pro have gained traction for high-skill, project-based work in design, marketing, data analytics, and niche technical domains. Fiverr Pro distinguishes itself from the original gig-oriented Fiverr marketplace by emphasizing vetted professionals, higher price points, and more complex deliverables, making it suitable for SMEs and corporates seeking expert support without long procurement cycles. Executives can review the curated professional tiers at Fiverr Pro.

In parallel, sector-specific platforms have emerged for legal services, medical consulting, or academic research, reflecting a broader trend toward verticalization. For readers of FinanceTechX Founders, these specialist platforms illustrate how new ventures can capture value by focusing on depth, governance, and domain expertise rather than generic scale.

Regional Patterns in the Remote Work Ecosystem

North America: Innovation, AI-Driven Hiring, and Hybrid Norms

In the United States and Canada, remote work has settled into a hybrid equilibrium, with many organizations maintaining physical hubs while hiring aggressively across state and national borders. Platforms like LinkedIn, Indeed, and FlexJobs dominate, supported by a dense ecosystem of applicant tracking systems, AI screening tools, and video-interview platforms. The U.S. Bureau of Labor Statistics and similar agencies provide detailed data on remote and hybrid employment patterns, which inform corporate workforce planning; interested readers can review current trends via the U.S. Bureau of Labor Statistics.

North American organizations are also at the forefront of integrating AI into recruitment and performance management, raising complex questions about bias, transparency, and regulatory compliance. These developments intersect closely with the themes covered on FinanceTechX AI, where algorithmic decision-making and talent analytics are now central to strategic HR.

Europe: Regulated Flexibility and Cross-Border Labor Mobility

In Europe, remote work operates within a highly regulated environment that emphasizes worker protections, data privacy, and cross-border mobility. The European Union has advanced frameworks on telework, digital services, and social protections that shape how platforms handle data, contracts, and tax obligations. GDPR compliance, in particular, has forced platforms and employers to adopt rigorous data governance practices, enhancing trust but also raising operating costs. Readers can learn more about data protection standards through the European Commission's data protection portal.

Countries such as Germany, France, Netherlands, Sweden, and Spain actively promote flexible work as part of broader competitiveness and sustainability strategies, while also supporting employees' rights to disconnect and maintain work-life balance. For organizations hiring across European borders, platforms must navigate a mosaic of local regulations, which in turn pushes them toward higher standards of transparency and compliance - a theme that resonates with coverage on FinanceTechX Security.

Asia: Balancing Tradition, Digital Ambition, and Talent Exports

Across Asia, remote work adoption reflects a complex balance between long-standing preferences for in-person collaboration and ambitious digitalization agendas. Singapore, South Korea, Japan, and China have all invested heavily in digital infrastructure, AI, and fintech, creating fertile ground for remote and hybrid roles in technology, finance, and research. At the same time, cultural norms and corporate hierarchies in some markets still favor physical presence, making hybrid models more prevalent than fully remote arrangements.

Countries such as India, Philippines, and Malaysia continue to play pivotal roles as global service hubs, but instead of relying solely on traditional BPO structures, individual professionals increasingly use platforms like Upwork, Fiverr Pro, and LinkedIn to contract directly with overseas clients. Policy initiatives, including digital skills programs and startup incentives, support this evolution and contribute to the broader digital economy discussed on FinanceTechX World.

Africa and South America: Opportunity, Inclusion, and Currency Diversification

In Africa and South America, remote work platforms provide a powerful channel for integrating skilled workers into the global economy, often in contexts where local labor markets cannot fully absorb the growing number of graduates. Professionals in Nigeria, Kenya, and South Africa offer software development, design, analytics, and content services to clients in Europe and North America, while specialists in Brazil, Argentina, and Chile serve as key talent pools for fintech and SaaS companies worldwide.

These engagements provide not only employment but also currency diversification, as professionals earn in dollars, euros, or pounds, which can be particularly valuable in economies facing inflation or currency volatility. Governments are gradually recognizing the macroeconomic benefits of this inflow and experimenting with digital nomad visas, tax incentives, and startup programs. Broader macroeconomic context for these regions can be explored via resources from the World Bank and the International Monetary Fund.

For FinanceTechX readers interested in inclusive growth, this trend highlights how digital labor platforms can support development objectives, skills transfer, and entrepreneurial ecosystems, especially when combined with targeted education initiatives such as coding bootcamps and online universities, themes that align with FinanceTechX Education.

Oceania: Lifestyle, Hybrid Leadership, and Asia-Pacific Integration

In Australia and New Zealand, remote work is closely tied to lifestyle and talent attraction strategies. Enterprises in Sydney, Melbourne, and Auckland use remote and hybrid policies to attract global talent while retaining local staff who seek flexibility. Professionals in law, finance, and consulting increasingly serve clients across Asia-Pacific, leveraging time-zone advantages to collaborate with teams in Singapore, Hong Kong, Tokyo, and San Francisco.

Governments in the region maintain robust labor and data protection frameworks, which makes Oceania attractive for companies that prioritize regulatory stability and ESG alignment. This combination of lifestyle appeal, regulatory maturity, and regional integration positions Australia and New Zealand as important nodes in the global remote work network.

Technology, Security, and the New Trust Architecture

The rise of remote work platforms is inseparable from advances in AI, cybersecurity, and collaboration tools. AI systems underpin candidate screening, skills inference, and compensation benchmarking; cybersecurity frameworks protect identities, transactions, and confidential data; and modern collaboration suites enable work across continents in real time.

AI-driven recruitment raises questions about fairness and transparency, prompting regulators and industry bodies to consider standards for algorithmic accountability. Organizations such as NIST in the United States have begun to issue guidance on trustworthy AI, which influences how platforms design and audit their systems. Readers can explore these guidelines via the NIST AI resource center.

Cybersecurity has become non-negotiable. Platforms deploy multi-factor authentication, encryption, and anomaly detection to guard against account takeovers, payment fraud, and data breaches. For corporates hiring remotely, vendor due diligence now includes assessments of platform security posture, aligning with risk management frameworks familiar to readers of FinanceTechX Security. The Cybersecurity and Infrastructure Security Agency in the United States and equivalent bodies in Europe and Asia provide best-practice guidance that increasingly informs contractual requirements; more information is available from the Cybersecurity and Infrastructure Security Agency.

Collaboration platforms such as Slack, Microsoft Teams, Zoom, and Notion integrate with job sites and HR systems, creating end-to-end digital employee journeys from application to onboarding and daily operations. Mastery of these tools has become a baseline professional requirement, and their usage patterns feed into analytics that inform workforce planning and performance management - a trend closely watched in FinanceTechX AI coverage.

Sustainability, Urban Transformation, and Green Fintech

Remote and hybrid work also intersect with sustainability, an area of increasing importance for FinanceTechX readers focused on green fintech and ESG. Reduced commuting, business travel, and office space usage contribute to lower carbon emissions, while distributed work enables companies to rethink real estate footprints and urban planning. Studies cited by organizations like the World Resources Institute and local transport authorities indicate measurable reductions in congestion and pollution in cities where remote work remains prevalent; readers can learn more about sustainable business practices from the World Resources Institute.

This creates opportunities for green fintech solutions that measure, finance, and report on the environmental impact of workforce strategies. Tools that quantify emission reductions from remote policies, or financial products that incentivize low-carbon operating models, align naturally with the themes covered on FinanceTechX Environment and FinanceTechX Green Fintech. For organizations pursuing net-zero targets, remote work is no longer merely an HR issue; it is a lever within the broader sustainability and capital-markets narrative.

Remote Work, Crypto, and Cross-Border Payments

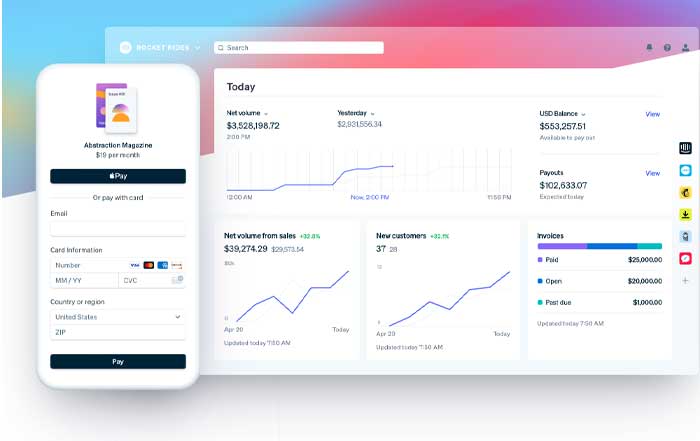

As remote work globalizes income streams, cross-border payments and taxation become more complex. Traditional banking rails can be slow and expensive for freelancers and remote employees in emerging markets, which has accelerated interest in fintech solutions that offer faster, cheaper, and more transparent international transfers. Platforms increasingly integrate with digital wallets, multi-currency accounts, and specialized remittance services, while some professionals experiment with crypto-assets and stablecoins for cross-border payments.

Regulators, including the Financial Stability Board and Bank for International Settlements, monitor these developments closely, focusing on consumer protection, AML/CFT compliance, and financial stability. Readers who follow FinanceTechX Crypto and FinanceTechX Banking will recognize that remote work is quietly becoming one of the demand-side drivers for innovation in cross-border payment infrastructure. Stakeholders can review global policy discussions via the Bank for International Settlements.

Redefining Careers: Skills, Identity, and Entrepreneurial Mindset

For individual professionals, the remote work era changes the calculus of career development. Instead of being anchored to a single employer or city, careers are increasingly constructed around portable skills, digital reputation, and networks that transcend geography. Profiles on LinkedIn, portfolios on Upwork or Fiverr Pro, and contributions to open-source projects or professional communities now function as core components of professional identity.

This shift rewards continuous learning and adaptability. Professionals must invest in technical skills, digital literacy, cross-cultural communication, and self-management. They must also navigate questions of taxation, retirement planning, and insurance in multi-jurisdictional contexts, which in turn creates opportunities for fintech innovators to design products tailored to remote workers and digital nomads. For readers of FinanceTechX Jobs, this represents both a challenge and an opening: the most resilient careers will be those built on a combination of deep expertise, platform fluency, and entrepreneurial thinking.

The Strategic Lens for FinanceTechX Readers

For the FinanceTechX audience - spanning founders, investors, policymakers, and senior executives - remote job platforms are not peripheral HR tools but strategic levers that influence access to talent, cost structures, innovation capacity, and ESG performance. They sit at the intersection of technology, regulation, capital, and human capital, touching nearly every vertical covered on FinanceTechX, from AI and crypto to banking, security, and green fintech.

Understanding how these platforms operate, how they differ across regions, and how they are shaped by evolving regulatory and technological landscapes is essential to designing resilient strategies in 2026 and beyond. As remote work continues to blur the lines between local and global, physical and digital, employment and entrepreneurship, the organizations that thrive will be those that treat remote platforms as core infrastructure - integrating them into talent strategy, risk management, sustainability goals, and long-term value creation.

In that emerging landscape, experience, expertise, authoritativeness, and trustworthiness are the true currencies. Remote platforms are the marketplaces where those currencies are discovered, priced, and deployed, and they will remain central to how the global workforce - and the global economy - evolves over the rest of this decade.