Secure Wallet Technology in 2026: The New Backbone of Global Digital Finance

The financial ecosystem in 2026 is defined by pervasive digitalization, real-time data flows, and an unprecedented convergence of banking, fintech, and decentralized finance. At the center of this transformation sits secure wallet technology, which has become the primary interface of trust between individuals, businesses, and financial institutions. For the global audience of FinanceTechX, spanning markets from the United States and Europe to Asia, Africa, and Latin America, understanding secure wallets is no longer a niche technical interest but a core competency for navigating modern finance safely and strategically. As digital payments, tokenized assets, and embedded finance spread across sectors and borders, secure wallets increasingly determine who participates in the digital economy, on what terms, and with what level of protection.

From Digital Convenience to Critical Infrastructure

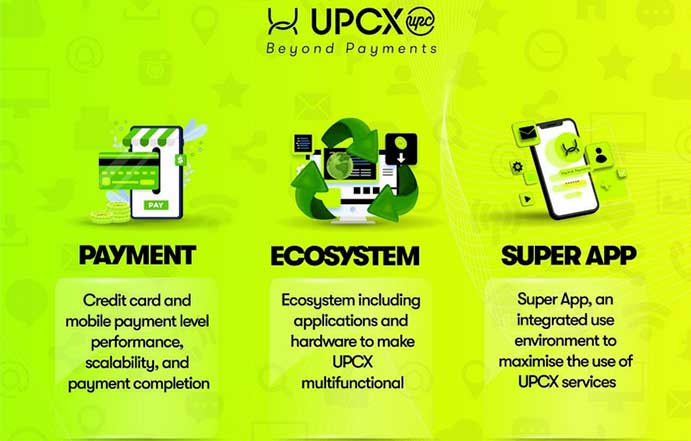

The evolution of digital wallets over the last two decades illustrates how a convenience feature has become critical financial infrastructure. Early platforms such as PayPal, Apple Pay, and Google Wallet introduced consumers in North America, Europe, and parts of Asia to the idea that digital payments could be both simple and relatively secure, enabling online commerce and contactless payments at scale. Their success laid the groundwork for a new generation of wallets, including those integrated into banking apps and super-app ecosystems, that now underpin large segments of retail and corporate transactions worldwide. Readers can explore how these developments intersect with broader fintech innovation to understand their strategic implications.

The advent of blockchain technology brought a second wave of disruption with cryptocurrency wallets such as Coinbase Wallet, MetaMask, and regionally focused solutions in markets like Singapore, South Korea, and Brazil. These tools gave users direct control over digital assets, from Bitcoin and Ether to stablecoins and tokenized securities, and popularized the distinction between custodial and non-custodial wallets. Custodial wallets, typically managed by exchanges or fintech platforms, offered ease of use and integrated services, while non-custodial wallets emphasized self-sovereignty and eliminated reliance on centralized intermediaries. As tokenization spreads to real-world assets, including equities, bonds, and real estate, wallets are evolving into multi-asset control panels that connect traditional markets with emerging decentralized ecosystems.

Today, wallet technology extends far beyond simple storage of payment credentials or crypto keys. Modern wallets integrate identity verification, loyalty and rewards, cross-border remittances, and access to decentralized applications, sitting at the intersection of payments, banking, and capital markets. In this context, secure wallet architecture is not just a technical design decision but a strategic choice that influences business models, regulatory exposure, and customer trust. For organizations assessing digital transformation strategies, the wallet has become a central component of their overall business and customer engagement architecture.

Why Security Has Become Non-Negotiable

As digital transaction volumes have surged across regions from the United States and the United Kingdom to India, Nigeria, and Brazil, cybercriminals have followed the money. Digital wallets now hold bank account credentials, card data, authentication tokens, and private keys controlling crypto and tokenized assets, making them highly attractive targets for fraud, theft, and extortion. Incidents ranging from phishing-driven account takeovers to sophisticated exchange breaches have reinforced the reality that any weakness in wallet security can result in direct financial losses, regulatory penalties, and lasting reputational damage.

Modern secure wallets therefore rely on layered defenses that combine cryptographic techniques, device-level security, and behavioral analytics. Encryption of sensitive data, secure enclave technologies on smartphones, and end-to-end protected communication channels form the baseline. Biometric authentication, including fingerprint and facial recognition, has become standard in many markets, particularly in North America, Europe, and advanced Asian economies such as Japan and South Korea. At the same time, the growth of hardware wallets and hardware security modules reflects renewed appreciation for physical separation as a defense against remote attacks. For a deeper understanding of how these mechanisms complement traditional banking controls, readers can explore the dedicated coverage of banking security and innovation on FinanceTechX.

Security is no longer treated as a product feature to be marketed but as a fundamental element of risk management and governance. In institutional contexts, secure wallet frameworks are now routinely evaluated by internal audit, compliance, and external regulators, particularly where they connect to payment systems, securities settlement, or decentralized finance protocols. This shift from optional add-on to core control function is reshaping the way both incumbents and fintech challengers design, test, and deploy wallet solutions.

Regulation as a Catalyst for Secure Wallet Standards

Around the world, regulators have moved from observing digital wallet growth to actively shaping its secure development. In Europe, the Revised Payment Services Directive (PSD2) and follow-on initiatives such as the European Digital Identity framework and EBA Guidelines on security have embedded strong customer authentication, data protection, and incident reporting into the fabric of wallet operations. These rules have pushed providers to adopt multi-factor authentication, transaction risk analysis, and rigorous third-party oversight, especially where wallets are integrated with open banking interfaces. Those interested in how these frameworks fit into broader European policy can review background material from institutions such as the European Commission and the European Banking Authority.

In the United States, regulators including the Securities and Exchange Commission (SEC), the Federal Reserve, and the Consumer Financial Protection Bureau (CFPB) have intensified scrutiny of digital wallets that handle securities-like tokens, stablecoins, or embedded credit. Their actions, alongside evolving guidance from the Financial Crimes Enforcement Network (FinCEN), are driving wallet providers to strengthen anti-money laundering (AML) controls, sanctions screening, and consumer disclosure practices. Comparable developments can be observed in the United Kingdom through the Financial Conduct Authority (FCA), and in Canada and Australia through their respective prudential and market regulators, all of which maintain extensive public resources for businesses seeking compliance clarity.

Asia has become a particular focal point of regulatory sophistication. The Monetary Authority of Singapore (MAS) and Japan's Financial Services Agency (FSA) have established detailed regimes for digital payment token services and wallet custodians, integrating capital requirements, technology risk management standards, and cybersecurity expectations. These frameworks are influencing policy discussions in emerging markets from Thailand and Malaysia to South Africa and Brazil, where authorities are balancing financial inclusion goals with fraud prevention and systemic stability. Global bodies such as the Financial Stability Board and the Bank for International Settlements continue to publish analyses and recommendations on digital asset and wallet risk, reinforcing the view that secure wallet practices are now integral to global financial stability.

Secure Wallets at the Heart of the Crypto and DeFi Economy

The crypto economy, spanning cryptocurrencies, stablecoins, non-fungible tokens (NFTs), and decentralized finance (DeFi), has turned wallets into indispensable tools for participating in new forms of value creation and transfer. In markets like the United States, Germany, Singapore, and the United Arab Emirates, institutional investors and corporates are increasingly engaging with digital assets, while retail adoption remains strong in regions such as Latin America and parts of Africa. In all of these contexts, secure wallets determine whether users can safely hold, trade, and deploy assets across exchanges, lending protocols, and tokenized investment platforms.

Non-custodial wallets, where users control their own private keys, are central to DeFi participation. They connect directly to smart contracts on networks such as Ethereum, Solana, and emerging layer-2 solutions, enabling lending, staking, derivatives, and yield strategies without traditional intermediaries. However, the same autonomy that empowers users also places the burden of key management, transaction verification, and phishing defense squarely on the individual or institution. Custodial wallets, offered by exchanges like Binance and Kraken, or by regulated digital asset custodians, provide a different model, emphasizing ease of use, recovery mechanisms, and institutional-grade controls, at the cost of introducing counterparty risk. Readers who follow the evolving crypto landscape on FinanceTechX will recognize that the choice between these models has strategic implications for both risk and opportunity.

As tokenization extends to securities, real estate, and even carbon credits, secure wallet design must accommodate complex regulatory classifications, cross-jurisdictional compliance, and integration with traditional market infrastructures. International standard-setters such as the International Organization of Securities Commissions and national securities regulators are increasingly focused on how wallet architectures affect investor protection and market integrity. For sophisticated participants, understanding wallet security is now an essential part of due diligence on any digital asset strategy.

Artificial Intelligence as a Security Multiplier

Artificial intelligence has become a powerful ally in the effort to secure wallets against increasingly sophisticated attacks. Machine learning models embedded within wallet platforms and payment networks continuously analyze transaction patterns, device fingerprints, geolocation data, and behavioral signals to detect anomalies indicative of fraud or account compromise. Global payment networks such as Visa and Mastercard have invested heavily in AI-driven risk engines that operate in milliseconds, blocking suspicious transactions before funds leave the system and providing real-time alerts to users and merchants. Those interested in the broader intersection of AI and finance can explore FinanceTechX's dedicated coverage of AI in financial services.

AI-based security is not limited to card networks. Fintech platforms, neobanks, and crypto wallet providers increasingly deploy similar models to monitor login activity, wallet connections to decentralized applications, and patterns of asset movement across chains. By combining supervised and unsupervised learning, these systems can adapt to evolving fraud techniques, including AI-generated phishing content and deepfake-based social engineering. Organizations such as the National Institute of Standards and Technology and the ENISA European Union Agency for Cybersecurity provide guidance on secure AI deployment, emphasizing transparency, robustness, and governance as essential complements to technical capability.

In parallel, AI is being used to enhance user experience in secure ways, for example by dynamically adjusting authentication requirements based on real-time risk assessments. This risk-based approach allows high-friction checks when anomalies are detected, while keeping everyday interactions smooth for legitimate users, a critical consideration in competitive consumer markets across North America, Europe, and Asia-Pacific.

The Enduring Role of Hardware Wallets and Physical Security

Despite the rapid growth of cloud-based wallets and super-app integrations, demand for hardware wallets and physical security solutions has accelerated, particularly among high-net-worth individuals, family offices, and institutional asset managers. Devices such as Ledger Nano X and Trezor Model T physically isolate private keys from internet-connected devices, reducing exposure to malware, remote exploits, and certain forms of phishing. The principle is straightforward: if the private key never leaves a secure hardware environment and transactions require physical confirmation, the attack surface is significantly reduced.

Enterprise environments extend this concept through hardware security modules (HSMs) and multi-party computation (MPC) solutions used by custodians, exchanges, and tokenization platforms. These systems integrate with trading venues, including traditional equity and derivatives markets and digital asset exchanges, to enable secure signing of high-value transactions and automated workflows. As tokenized instruments begin to intersect with traditional stock exchange infrastructure, robust hardware-based key management is becoming a prerequisite for regulatory approval and institutional trust.

The resurgence of interest in physical security reflects a broader lesson: in a hyper-connected world, strategic disconnection at critical points remains a powerful defense. Organizations that combine well-managed hardware controls with strong operational processes, including key rotation, access segregation, and disaster recovery, are better positioned to withstand both targeted attacks and systemic shocks.

Wallets as Engines of Business Model Innovation

Secure wallet technology has moved from being a back-end utility to a front-line enabler of new business models across sectors and geographies. In the United States, Europe, and Asia-Pacific, embedded finance strategies increasingly rely on wallets integrated into e-commerce platforms, ride-hailing apps, gaming ecosystems, and enterprise software. Companies like Block, Inc. (formerly Square) and Stripe have expanded their offerings to include multi-currency, multi-rail wallets that support both fiat and digital assets, enabling merchants and platforms to accept diverse payment methods and to manage treasury functions more flexibly.

In emerging markets, wallets are often synonymous with financial inclusion. Services such as M-Pesa in Kenya and GCash in the Philippines have demonstrated that mobile wallets can bring millions of previously unbanked or underbanked individuals into the formal financial system, enabling savings, credit, insurance, and cross-border remittances. These developments have macroeconomic implications, supporting small business formation, household resilience, and local economy growth. Organizations such as the World Bank and the International Monetary Fund regularly highlight digital wallets as key tools for improving financial access and efficiency in developing and emerging economies.

For corporates, secure wallets facilitate new forms of loyalty and ecosystem engagement, such as tokenized reward points, partner marketplaces, and subscription-based services. They also enable more efficient cross-border operations by integrating with real-time payment systems and digital currency rails, reducing settlement times and foreign exchange friction. For FinanceTechX readers involved in corporate strategy, product development, or treasury, wallets increasingly represent not just a payment method but a strategic platform for value creation and customer retention.

Sustainability, Green Fintech, and Wallet Responsibility

Environmental considerations have become an integral part of digital finance strategy, particularly as public awareness of the energy consumption associated with some blockchain networks has grown. Secure wallet providers are responding by integrating tools that help users understand and mitigate the environmental impact of their activities. Some wallets now display estimated carbon footprints for specific transactions or asset holdings, while others partner with offset providers to allow users to support renewable energy or reforestation projects alongside their financial activity. Those interested in the intersection of finance and sustainability can explore FinanceTechX's coverage of green fintech trends.

At the protocol level, the migration of major networks from proof-of-work to proof-of-stake and other energy-efficient consensus mechanisms has significantly reduced energy intensity, a shift documented by organizations such as the Cambridge Centre for Alternative Finance and initiatives like the Crypto Climate Accord. Wallets that connect to these networks and communicate their environmental characteristics transparently support more informed decision-making by both retail and institutional users. Companies like Ripple, which has made public commitments to carbon neutrality, and various proof-of-stake ecosystems are positioning themselves as leaders in sustainable digital finance, and wallets are the primary channel through which users experience and evaluate these claims.

As regulators, particularly in Europe and markets such as Canada and New Zealand, increasingly require climate-related disclosures and sustainable finance reporting, secure wallets that integrate environmental metrics and compliant reporting features will gain strategic importance for both financial institutions and corporates.

Talent, Skills, and the Wallet Security Workforce

The rapid expansion of wallet-based financial infrastructure has created a strong and sustained demand for specialized talent. Cybersecurity experts with experience in cryptography, key management, and secure software development are needed across banks, fintechs, big tech firms, and specialized digital asset custodians. Blockchain developers capable of integrating wallets with smart contracts, cross-chain bridges, and institutional trading systems are in particularly high demand in hubs such as the United States, the United Kingdom, Germany, Singapore, and the United Arab Emirates. FinanceTechX's jobs and careers coverage frequently highlights how these roles are evolving and where regional opportunities are emerging.

Education and professional development ecosystems are responding accordingly. Universities in North America, Europe, and Asia now offer degree programs and executive courses in digital finance, blockchain engineering, and cybersecurity, often developed in collaboration with industry partners. Professional bodies such as ISACA, the CFA Institute, and the Global Association of Risk Professionals (GARP) have introduced or expanded certifications that address digital asset custody, wallet security, and technology risk management. International organizations such as the OECD and the World Economic Forum regularly publish frameworks and insights on the skills required for the future of work in digital finance.

For individual professionals, building expertise in secure wallet technology is increasingly a way to enhance career resilience and relevance, whether they are technologists, risk managers, compliance officers, or product leaders. The convergence of security, regulation, and customer experience in wallet design ensures that multidisciplinary skills are particularly valued.

Founders, Innovators, and the Trust Imperative

The secure wallet landscape is shaped not only by large incumbents but also by founders and innovators who challenge assumptions about how value and identity should be managed in digital environments. Figures such as Vitalik Buterin, co-founder of Ethereum, and Jack Dorsey, co-founder of Block, Inc., have championed the principles of decentralization and self-sovereignty, arguing that users should have direct control over their digital assets and data. Startups across Europe, North America, and Asia are experimenting with new wallet paradigms, including social recovery mechanisms, human-readable addressing, and privacy-preserving transaction models.

On platforms focused on founders and entrepreneurial ecosystems, a consistent theme emerges: trust is the decisive factor in wallet adoption. Transparent governance, open-source codebases, independent security audits, and clear communication about risk and responsibility are increasingly seen as competitive differentiators. Innovators recognize that even the most advanced technical security can be undermined if users do not understand how to use wallets safely or do not believe that providers will act in their best interests during crises.

This trust imperative extends to how wallet providers interact with regulators, industry peers, and the broader public. Collaborative initiatives, such as shared security standards, incident information-sharing forums, and coordinated responses to major vulnerabilities, play a growing role in strengthening the ecosystem as a whole. Organizations such as the FIDO Alliance and the Linux Foundation support open standards and infrastructure that underpin secure authentication and decentralized technologies, and many wallet innovators actively contribute to these efforts.

Culture, Education, and the Human Layer of Security

Secure wallet technology ultimately operates within a broader culture of security and digital literacy. Even the most robust cryptographic systems can be compromised if users fall victim to social engineering, reuse weak passwords, or neglect backup procedures for recovery phrases and hardware devices. Governments, industry associations, and educational institutions worldwide are therefore investing in public awareness campaigns and training programs that address the human layer of wallet security. In the United States, initiatives such as Cybersecurity Awareness Month emphasize best practices for protecting digital accounts, while European and Asian governments run similar campaigns tailored to local contexts.

Financial institutions and fintech platforms are incorporating security education directly into their wallet interfaces, using contextual prompts, interactive tutorials, and just-in-time alerts to guide users away from risky behavior. These efforts align with broader digital literacy goals promoted by organizations such as UNESCO and the International Telecommunication Union, which highlight secure digital participation as a prerequisite for inclusive economic development. FinanceTechX's own coverage of security and risk reflects the growing recognition that technology, policy, and user behavior must align to create genuinely resilient systems.

For enterprises, building a culture of wallet security involves regular training, robust access control policies, segregation of duties, and incident response planning. As more corporate treasuries, investment desks, and operational teams interact with wallets-both fiat and digital asset-based-internal governance frameworks must evolve to match the new risk profile.

Secure Wallets as the Digital Nervous System of Global Finance

By 2026, secure wallets have moved to the center of global finance, functioning as the digital nervous system through which value, identity, and data flow across borders and platforms. In North America and Europe, they anchor open banking ecosystems, enabling consumers and businesses to aggregate accounts, authorize third-party services, and manage complex financial lives from a single interface. In Asia, particularly in China, India, Singapore, and South Korea, wallets are deeply embedded in super-apps and real-time payment infrastructures, supporting everything from everyday shopping and transport to investment and healthcare. In Africa and parts of South America, mobile wallets continue to leapfrog legacy banking infrastructure, providing secure access to payments and savings for millions who previously lacked formal financial services.

This global convergence is complemented by increasing integration between traditional and decentralized finance. Wallets now routinely connect to both bank accounts and blockchain networks, enabling users to move funds between fiat and digital assets, participate in tokenized investments, and access decentralized applications. International organizations such as the G20 and the Basel Committee on Banking Supervision are actively exploring how these developments affect cross-border payments, capital flows, and systemic risk, reinforcing the notion that secure wallet technology is now a matter of macroeconomic importance.

For FinanceTechX readers, this context underscores why staying informed about wallet trends is essential, whether their focus is on world and regional developments, corporate strategy, investment, or policy design. Secure wallets are no longer a peripheral concern but a central pillar of how money and value move in a digital-first world.

The Road Ahead: Interoperability, Identity, and Intelligent Wallets

Looking toward 2030, several themes are likely to shape the next phase of secure wallet evolution. Interoperability remains a central challenge and opportunity. With hundreds of wallet providers operating across different networks, standards, and regulatory regimes, seamless movement of assets and credentials is still far from universal. Industry efforts around open standards for identity, messaging, and token formats, supported by organizations such as the World Wide Web Consortium (W3C), aim to create a more interconnected wallet ecosystem where users can switch providers without losing control of their assets or data.

Digital identity is another transformative frontier. Many governments in Europe, Asia, and beyond are exploring or piloting wallet-based digital identity frameworks that would allow citizens and residents to store and present credentials for everything from banking and healthcare to education and voting. Secure wallets could become the primary container for verified identity attributes, professional certifications, and even health records, making them indispensable for accessing both public and private services. As these initiatives mature, alignment between identity standards, privacy regulations, and wallet security will be critical.

Finally, wallets are becoming more intelligent. By combining AI, real-time data, and user-defined preferences, next-generation wallets are expected to act as proactive financial assistants, optimizing payment routes, suggesting savings and investment actions, and automatically managing routine tasks such as bill payments and cross-border transfers. For businesses, intelligent wallets could dynamically manage liquidity across accounts and currencies, execute hedging strategies, and integrate environmental or social criteria into financial decision-making. These developments will further blur the line between wallet, bank, and advisor, raising new questions about responsibility, transparency, and regulation.

For the global community that turns to FinanceTechX for insight into fintech, business, AI, crypto, and green finance, secure wallet technology represents a nexus where all these themes converge. By engaging deeply with the technical, regulatory, and strategic dimensions of wallets, readers position themselves not only to protect their own assets and organizations but also to help shape a more secure, inclusive, and sustainable financial future.