Digital Literacy in 2026: The Strategic Currency of Global Business and Fintech

Digital literacy has moved from a strategic advantage to a structural prerequisite for participation in the global economy, and by 2026 this shift is fully visible across every domain that FinanceTechX covers, from fintech and banking to crypto, AI, green finance, and the wider business ecosystem. For organizations, regulators, founders, and consumers in markets as diverse as the United States, United Kingdom, Germany, Singapore, South Africa, and Brazil, the ability to understand, evaluate, and responsibly deploy digital technologies is now inseparable from competitiveness, resilience, and long-term trust.

As FinanceTechX engages daily with decision-makers, founders, and innovators across regions and sectors, one theme consistently emerges: digital literacy has become the core capability that links financial innovation with real economic value, social inclusion, and sustainable growth. It is no longer enough to know how to use digital tools; stakeholders must understand the underlying mechanics, the regulatory and ethical implications, and the systemic risks that accompany rapid digital transformation. This perspective is particularly relevant in 2026, as artificial intelligence, decentralized finance, tokenized assets, and green fintech mature from experimental concepts into mainstream infrastructure.

Explore how FinanceTechX tracks this transformation across global business and finance.

Redefining Digital Literacy for a Hyper-Connected Financial System

Digital literacy in 2026 extends far beyond operational familiarity with software or devices. It encompasses a sophisticated blend of technical understanding, critical thinking, regulatory awareness, and ethical judgment. In the context of financial services and modern business, a digitally literate professional is expected not only to navigate cloud platforms or digital banking interfaces, but also to understand how blockchain consensus mechanisms work, how machine learning models influence credit or risk decisions, and how data is stored, governed, and protected across borders.

For leaders and teams engaging with fintech, literacy includes the ability to interpret algorithmic outputs, question model assumptions, and recognize when automated systems may embed bias or systemic vulnerabilities. Executives in large banks, asset managers, and technology companies must be able to translate technical concepts into strategic decisions, weighing innovation opportunities against regulatory constraints such as the EU's AI Act or evolving data protection rules. Professionals who operate in cross-border markets also need to understand how different jurisdictions-from US regulators like the SEC and CFTC to European and Asian supervisory bodies-frame issues such as digital assets, stablecoins, and open banking.

This deeper, multidimensional view of literacy is now central to the way FinanceTechX approaches analysis for its audience. Rather than treating digital skills as a narrow IT concern, the platform frames them as a foundational competence for modern corporate governance, risk management, and long-term value creation. Learn how this perspective informs coverage of global business transformation.

Digital Literacy as a Core Pillar of Competitive Business Strategy

As digital transformation has accelerated, organizations in North America, Europe, and Asia-Pacific have begun to treat digital literacy as a central component of corporate strategy, not a peripheral training initiative. Boards and C-suites at institutions such as JPMorgan Chase, HSBC, BNP Paribas, and leading technology firms recognize that sustained growth now depends on a workforce capable of understanding data flows, automation, and cyber risk at a granular level.

In the United States and Canada, major enterprises are embedding literacy into enterprise-wide reskilling programs, often in partnership with universities and large technology providers. In Germany, France, and the Nordic countries, national strategies for digitalization encourage companies to integrate training in data analytics, cybersecurity, and AI governance into performance and compliance frameworks. These initiatives are not purely defensive; they enable organizations to redesign operating models, launch digital-first products, and personalize services at scale.

Where digital literacy is weak, the cost is visible in stalled transformation projects, failed fintech partnerships, and heightened vulnerability to fraud or operational disruptions. Where it is strong, organizations can adopt advanced technologies-such as AI-driven risk engines or embedded finance platforms-with greater confidence and speed. This is particularly evident in sectors like digital payments and online lending, where firms with digitally literate teams have been able to pivot quickly in response to regulatory changes and evolving customer expectations. FinanceTechX continues to follow how these shifts reshape global job markets and skills requirements.

Fintech Innovation: Why Literacy Determines Who Wins

Fintech remains one of the most dynamic arenas of the global economy, and by 2026 the gap between digitally literate and illiterate players has widened significantly. Startups and incumbents building solutions in areas such as instant cross-border payments, embedded insurance, and decentralized finance rely on teams that can bridge deep technical expertise with regulatory, behavioral, and economic insight.

Founders and product leaders in leading hubs like London, New York, Singapore, Berlin, and Sydney must understand smart contract architectures, token economics, data interoperability standards, and the nuances of licensing regimes across multiple regions. They also need to design user experiences that assume varying levels of consumer literacy, from sophisticated crypto traders to first-time mobile banking users in emerging markets. Without this holistic literacy, even technically sound products can fail due to poor risk controls, misalignment with regulation, or user confusion.

In parallel, investors-from venture capital firms like Andreessen Horowitz and Sequoia Capital to institutional asset managers-are scrutinizing the digital literacy of founding teams as a core due diligence criterion. A deep understanding of AI, blockchain, data security, and compliance is now seen as a proxy for execution capability and long-term viability. FinanceTechX regularly observes that the most resilient fintech companies are those that treat literacy as a strategic asset, embedding continuous learning into culture and governance. Readers can follow these founder-driven dynamics in more detail on the FinanceTechX founders channel.

For broader context on how fintech is evolving globally, FinanceTechX's fintech hub provides ongoing analysis and case studies.

AI-Driven Finance: Literacy as a Safeguard and Accelerator

Artificial intelligence is now deeply integrated into core financial functions, from credit scoring and market surveillance to wealth management and regulatory reporting. Tools powered by generative AI, natural language processing, and reinforcement learning are being deployed by global banks, neobanks, insurers, and asset managers. However, the performance and safety of these systems depend heavily on the digital literacy of those who build, supervise, and use them.

Professionals who interact with AI in banking and capital markets must understand how training data quality affects bias, how model drift can undermine predictive accuracy, and how explainability techniques can be used to satisfy regulators and internal audit teams. Regulators in Europe, Singapore, and Japan now expect senior management to demonstrate a baseline understanding of AI risk, including issues around fairness, transparency, and accountability. Leading organizations are therefore investing in AI literacy not only for data scientists, but also for relationship managers, risk officers, and compliance professionals.

For FinanceTechX, AI is both a subject of coverage and a lens through which to interpret broader shifts in financial services. The platform's focus on Experience, Expertise, Authoritativeness, and Trustworthiness aligns closely with the global debate on responsible AI, where informed oversight is crucial to maintaining confidence in automated decision-making. Readers can explore how AI is reshaping finance, work, and regulation in the dedicated AI section. For a broader understanding of AI's economic impact, resources from organizations such as the OECD and World Economic Forum provide additional global context.

Digital Literacy as a Driver of Economic Resilience and Inclusion

At the macro level, digital literacy has become a decisive factor in national and regional competitiveness. Countries like Singapore, South Korea, Finland, and Denmark have embedded digital education into school curricula and adult training systems, viewing literacy as essential infrastructure alongside physical connectivity. These investments have strengthened their fintech sectors, attracted cross-border capital, and positioned them as testbeds for digital currencies, real-time payments, and AI-enabled regulation.

In large economies such as the United States, China, and India, policy frameworks increasingly link digital literacy with goals around productivity, innovation, and financial inclusion. Government agencies collaborate with private sector players and academic institutions to scale training in cloud computing, cybersecurity, and data science, recognizing that digitally capable workforces are better equipped to adapt to automation and structural shifts in labor markets. International bodies like the International Monetary Fund and World Bank have highlighted digital skills as a key enabler for inclusive growth, particularly in low- and middle-income economies where mobile money and digital lending are expanding access to finance.

FinanceTechX's coverage of the global economy consistently shows that economies with strong literacy programs weather shocks-whether geopolitical, technological, or environmental-more effectively than those without. Digital skills allow firms and workers to pivot to remote operations, engage in cross-border e-commerce, and access diversified sources of capital. Readers interested in the intersection of digital transformation and macroeconomic performance can explore more through the FinanceTechX economy channel.

Cybersecurity, Trust, and the Culture of Digital Responsibility

As financial systems digitize, cyber risk has become one of the most significant threats to economic stability and corporate reputation. High-profile incidents involving ransomware, data breaches, and compromised crypto platforms have demonstrated that even sophisticated institutions are vulnerable when digital literacy is lacking at any layer of the organization.

Security is no longer solely the domain of specialized IT teams. Front-line staff, executives, third-party partners, and end-users all play a role in protecting financial infrastructure. A digitally literate workforce understands how to recognize phishing attempts, manage credentials, interpret security alerts, and comply with policies around data handling and device usage. At the board level, literacy enables more informed oversight of cyber strategy, budget allocation, and incident response readiness.

From a consumer perspective, literacy is equally critical. Individuals must know how to secure digital wallets, verify the authenticity of financial apps, and interpret privacy policies. Governments and regulators in regions including the EU, UK, Australia, and Singapore are increasingly pairing cybersecurity regulations with public education campaigns, recognizing that systemic resilience depends on widespread awareness. Trusted sources such as ENISA, NIST, and national cybersecurity centers provide frameworks that organizations can adapt to their own training programs.

FinanceTechX places particular emphasis on the link between security and trust in fintech, recognizing that sustained adoption of digital finance depends on users feeling confident that their assets and data are protected. The platform's security section examines these issues across banking, crypto, and payments.

Crypto, Blockchain, and the Imperative of Informed Participation

By 2026, cryptocurrencies, stablecoins, and tokenized assets have become embedded in mainstream financial discussions, even as regulatory frameworks remain in flux. Central banks in regions such as Europe, China, and the Caribbean have advanced pilots or early deployments of central bank digital currencies (CBDCs), while private sector initiatives continue to experiment with tokenizing everything from real estate to carbon credits.

In this environment, digital literacy is the primary defense against both market risk and misconduct. Institutional investors must understand smart contract logic, custody models, consensus mechanisms, and the nuances of on-chain versus off-chain governance. Regulators and policymakers require sufficient technical knowledge to draft rules that balance innovation with consumer protection, drawing on guidance from bodies such as the Bank for International Settlements and the Financial Stability Board.

For retail users, literacy can be the difference between responsible participation and severe financial loss. Understanding private keys, multi-signature wallets, transaction fees, and the permanence of on-chain activity is essential before engaging with decentralized finance platforms or speculative tokens. Education initiatives by exchanges, industry associations, and NGOs are increasingly focused on building this baseline literacy, particularly in regions where crypto adoption is high but formal financial education is limited.

FinanceTechX tracks these developments closely, emphasizing both the opportunities and the risks that digital assets present to portfolios, payment systems, and regulatory regimes. Readers can follow developments in crypto markets and regulation via the dedicated crypto section.

Stock Exchanges, Tokenization, and the New Market Skillset

Traditional stock exchanges in New York, London, Frankfurt, Tokyo, Hong Kong, and Toronto have undergone profound digital transformation, with algorithmic trading, smart order routing, and real-time risk analytics now standard components of market infrastructure. At the same time, experiments with tokenization and distributed ledger technology are beginning to reshape how securities are issued, traded, and settled.

In this context, digital literacy is indispensable for both institutional and retail investors. Market participants must understand how algorithmic strategies can affect liquidity and volatility, how dark pools and alternative trading systems operate, and how tokenized instruments differ from conventional equities or bonds in terms of settlement, custody, and legal rights. Regulators and exchanges are responding with enhanced disclosure requirements and investor education programs, but ultimately, the responsibility to interpret and apply this information rests with market participants themselves.

FinanceTechX observes that as tokenized and traditional markets converge, the boundary between fintech and capital markets continues to blur. Investors who cultivate strong digital literacy are better positioned to navigate this hybrid environment, identify mispriced risks, and engage with innovative products such as digital green bonds or fractionalized infrastructure assets. For readers tracking these shifts in market structure, the FinanceTechX stock exchange channel offers ongoing analysis.

Green Fintech, ESG, and the Literacy of Sustainable Finance

Sustainability has become a defining theme of financial innovation, with green fintech solutions emerging to support carbon accounting, climate risk modeling, sustainable investing, and impact measurement. Platforms that integrate environmental, social, and governance (ESG) data into investment processes rely on advanced analytics, satellite imagery, IoT data, and AI-driven scenario analysis.

Digital literacy is essential for interpreting these tools accurately. Asset managers, corporate treasurers, and sustainability officers must understand how ESG scores are constructed, how climate models incorporate physical and transition risks, and how to distinguish credible sustainability claims from greenwashing. Regulators and standard-setting bodies, including the International Sustainability Standards Board and the Task Force on Climate-related Financial Disclosures, are pushing for greater transparency and comparability, but the usefulness of these frameworks depends on users being able to interpret complex data.

In markets across Europe, Asia, North America, and Africa, green fintech is also playing a role in democratizing access to sustainable investment products. Retail platforms allow individuals to align portfolios with climate or social objectives, but only those with sufficient literacy can evaluate the trade-offs involved. FinanceTechX treats this intersection of digital innovation and sustainability as a core editorial focus, recognizing that the future of finance will be both digital and green. Readers can delve deeper into these themes through the platform's green fintech section. For broader insights into sustainable business practices, resources from organizations such as the UN Environment Programme Finance Initiative and CDP complement this coverage.

Education, Reskilling, and the Future of Work in a Digital Financial World

The rapid evolution of digital finance has profound implications for education and labor markets. Universities in the United States, United Kingdom, Germany, Singapore, and Australia are expanding programs that blend finance, computer science, data analytics, and law, reflecting the demand for hybrid professionals who can operate at the intersection of technology and regulation. Executive education programs increasingly feature modules on AI ethics, digital asset regulation, and cyber risk governance.

For mid-career professionals, reskilling is no longer optional. Automation and AI are reshaping roles in areas such as operations, compliance, customer service, and risk management. Workers must acquire new competencies in data interpretation, digital communication, and tool configuration, even if they are not directly involved in coding or system design. Governments in Scandinavia, Canada, New Zealand, and Singapore have launched national upskilling initiatives, often supported by tax incentives and public-private partnerships, to prevent structural unemployment and ensure inclusive participation in the digital economy.

FinanceTechX engages with these issues from a practical perspective, highlighting how organizations can design effective training programs and how individuals can position themselves for emerging roles in fintech, cyber, AI governance, and digital product design. The platform's education coverage offers insight into evolving curricula and learning models. For readers focused on career strategy and labor market trends in fintech and digital finance, the jobs section provides complementary analysis.

Banking, Embedded Finance, and Literacy at the Edge of the Financial System

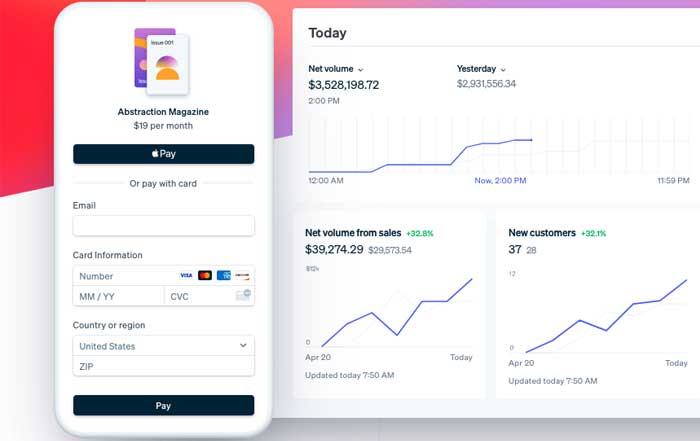

Banking has shifted from a branch-centric model to a platform-driven, API-enabled ecosystem in which financial services are increasingly embedded into non-financial contexts such as e-commerce, mobility, and logistics. Traditional banks in Europe, North America, and Asia are partnering with fintechs and technology companies to deliver banking-as-a-service, real-time payments, and digital identity solutions.

In this environment, digital literacy is crucial not only for bank employees but also for partners and end-customers. Product managers in retail and technology firms must understand regulatory obligations when integrating financial products into their platforms. Developers must handle sensitive financial data in compliance with privacy and security standards. Consumers need to recognize when they are interacting with a regulated financial service, understand the implications for deposit insurance or investor protection, and know how to address disputes or fraud.

FinanceTechX views this evolution of banking as a key test of digital literacy at the edge of the financial system, where boundaries between sectors blur and responsibility can become opaque. The platform's banking hub explores these structural changes and their implications for risk, competition, and inclusion. Complementary analysis from institutions such as the Bank for International Settlements and European Central Bank further illustrates how regulators are responding to the rise of platform-based finance.

A Long-Term Outlook: Digital Literacy as the Defining Competence of Modern Finance

Looking beyond 2026, the trajectory of digital literacy suggests that it will remain the defining competence for organizations and individuals seeking to thrive in a financial system shaped by AI, quantum computing, tokenization, and climate-aligned capital flows. The pace of technological change will not slow, and new paradigms-from autonomous financial agents to programmable money at scale-will introduce fresh opportunities and risks.

For businesses, this reality demands a shift from one-off training initiatives to embedded cultures of continuous learning. Governance structures must ensure that boards and executives remain conversant with emerging technologies, that risk and compliance teams have the literacy to challenge automated systems, and that innovation teams are grounded in ethical and regulatory considerations. For individuals, it underscores the need to treat digital literacy as a lifelong endeavor, updating skills in response to new tools, platforms, and regulatory expectations.

On a global scale, the degree to which digital literacy is distributed equitably will influence whether digital finance narrows or widens existing inequalities between and within countries. International organizations, governments, companies, and educational institutions all share responsibility for ensuring that literacy is not confined to elite centers but extends to underserved communities in Africa, South Asia, Latin America, and beyond.

Within this evolving landscape, FinanceTechX positions itself as a trusted partner to its audience, providing analysis, context, and perspective that help leaders, founders, and professionals navigate complexity with confidence. The platform's news section offers ongoing coverage of how digital literacy, regulation, and innovation intersect in real time. As finance continues to digitize and globalize, the ability to understand and responsibly harness technology will remain the most critical currency of all-shaping not only corporate balance sheets and investment returns, but also the resilience, inclusiveness, and sustainability of the world's financial systems.