Open Banking in 2026: The Architecture of a New Global Financial Ecosystem

As 2026 unfolds, open banking has progressed from a niche regulatory initiative into a defining pillar of the global financial system, reshaping how consumers, enterprises, financial institutions, regulators, and technology providers interact with money and data. For readers of FinanceTechX.com, this transformation is not an abstract technology trend but a practical, structural shift that is determining which organizations will lead in the next decade of financial services, which markets will capture the greatest economic value, and which business models will prove resilient in a world defined by intelligent, interoperable financial infrastructure.

Across the United States, United Kingdom, European Union, and key markets in Asia, Africa, and South America, open banking has matured into a broad open finance paradigm that extends far beyond basic account aggregation. It now encompasses real-time payments, digital identity, embedded finance, tokenized assets, and AI-driven decisioning, integrating financial capabilities into every layer of the digital economy. Readers who follow the evolution of fintech platforms and business models can explore related coverage at FinanceTechX Fintech, where these developments are examined through the lens of founders, investors, and established financial institutions.

What distinguishes the current moment is not only the sophistication of technology but the convergence of regulatory alignment, consumer expectations, institutional strategies, and macroeconomic pressures. This convergence has created a global environment in which data mobility, standardized APIs, and secure interoperability are no longer optional enhancements; they have become prerequisites for competitiveness, resilience, and innovation. For a business audience seeking to navigate this environment, the open banking story is ultimately about experience, expertise, authoritativeness, and trustworthiness-principles that underpin the editorial mission of FinanceTechX.com and guide its analysis of financial transformation.

From Compliance to Competitive Advantage: The Journey to Open Finance

The origins of open banking are rooted in regulatory action, particularly in Europe, where PSD2 and the work of the European Banking Authority forced incumbent banks to grant licensed third parties access to payment account data. In the United Kingdom, the mandates of the Competition and Markets Authority triggered a wave of innovation by compelling the largest banks to open their APIs, a development that is still shaping competitive dynamics and consumer behavior. Those interested in the UK regulatory trajectory can review official guidance on the UK Government financial services pages.

Initially, many banks approached these mandates as a compliance obligation, investing only enough to meet minimum standards. However, as fintechs in North America, Europe, and Asia-Pacific demonstrated how open APIs could enable new value propositions-ranging from personal finance management and SME cash-flow analytics to instant lending and subscription optimization-financial institutions began to recognize that open banking could serve as a strategic enabler rather than a regulatory burden. Firms such as Visa, Mastercard, Plaid, and Token.io emerged as critical infrastructure providers, connecting banks, fintechs, and non-financial platforms across borders and industries. Profiles of founders and executives orchestrating these shifts are frequently highlighted at FinanceTechX Founders.

By 2023 and 2024, the industry narrative had evolved from open banking to open finance, as regulators and market participants extended data portability and interoperability to encompass investments, pensions, insurance, loans, and even certain categories of alternative assets. Jurisdictions such as Australia and Brazil pushed ahead with consumer data right regimes that spanned multiple sectors, embedding financial data-sharing into broader digital economy strategies. Analysts tracking cross-country policy developments often turn to organizations like the OECD for comparative assessments of these frameworks.

In 2025 and now 2026, open finance has become the stepping stone toward integrated open data ecosystems, where financial information is combined with data from healthcare, mobility, telecommunications, and energy to create sophisticated, cross-sector services. Markets such as Singapore and South Korea, supported by strong digital identity infrastructures, are at the forefront of this transition, enabling citizens and businesses to consent to data-sharing across multiple domains through unified identity wallets. For readers seeking a broader geopolitical and macro-financial context, FinanceTechX World provides ongoing analysis of how these models influence regional competitiveness and global capital flows.

Real-time payments, digital wallets, blockchain-based settlement rails, and advanced analytics have all contributed to this evolution, turning static account data into a dynamic resource that can be used to deliver personalized, context-aware services at scale. Institutions such as the World Bank and International Monetary Fund regularly explore how these ecosystems affect financial stability and inclusion, and their latest assessments can be accessed via the IMF's official site.

As open finance matures, the competitive battlefield is shifting from product-centric differentiation to experience-centric value creation. Banks, fintechs, and technology platforms are now measured by the quality, security, and personalization of their services, as well as their ability to orchestrate partner ecosystems. This shift has deep implications for onboarding, credit assessment, wealth management, insurance pricing, and compliance automation, and it intensifies the focus on cyber resilience-a theme examined in depth at FinanceTechX Security.

Regulatory Convergence and the New Rules of Engagement

Regulatory momentum remains one of the most powerful forces shaping open banking's trajectory. Policymakers across North America, Europe, Asia, and Africa increasingly view data mobility and interoperability as drivers of competition, innovation, and inclusion, while also recognizing their implications for systemic risk, privacy, and consumer protection. Global standard-setters such as the Financial Stability Board and the Bank for International Settlements influence the direction of these frameworks, and their analyses are closely followed by financial executives and regulators alike. Readers interested in the intersection of regulation and macroeconomics can find complementary perspectives at FinanceTechX Economy.

In the United States, the long-anticipated rulemaking on personal financial data rights by the Consumer Financial Protection Bureau is crystallizing a formal, regulated open banking environment, moving the market beyond bilateral data-sharing agreements and screen-scraping practices. This shift is expected to accelerate innovation in sectors such as lending, payments, and wealth management while imposing clearer obligations on data aggregators and financial institutions. Details on the evolving US framework can be found on the CFPB's official website.

The United Kingdom continues to refine its Open Banking Roadmap and expand into open finance, transitioning from a mandate-driven approach to a commercially oriented model focused on premium APIs, ecosystem governance, and sustainable funding structures. The Bank of England and related authorities are shaping this next chapter, and their communications, accessible through the Bank of England site, are widely regarded as bellwethers for global policy thinking.

Within the European Union, the evolution from PSD2 to PSD3 and the Financial Data Access framework is redefining the scope of data-sharing, authentication, and liability. These initiatives are designed to harmonize practices across member states, enable cross-sector data use cases, and support digital identity integration. The European Commission provides official updates on these legislative processes and their implications for banks, fintechs, and data intermediaries.

In Asia-Pacific, jurisdictions including Singapore, Japan, South Korea, Thailand, and Malaysia are implementing sophisticated open banking and open finance frameworks that balance innovation with strong consumer safeguards. The Monetary Authority of Singapore, in particular, has become a reference point for progressive yet risk-aware regulation, and its guidance is available on the MAS website.

Emerging economies in Africa and South America are leveraging open banking as a catalyst for financial inclusion and digital transformation. South Africa and Brazil stand out for their sandbox environments, interoperable instant payment systems, and consumer-centric data regulations that encourage competition while maintaining oversight. The World Bank regularly publishes case studies and impact evaluations of these initiatives.

As regulatory frameworks gradually converge, cross-border financial services become easier to scale, and consumer trust is reinforced by clear rules on data access, consent, and security. For executives tracking these developments in real time, FinanceTechX News offers ongoing coverage of legislative milestones and supervisory actions.

Real-Time Payments: The Transactional Core of Open Banking

At the heart of open banking's practical impact lies the rapid rollout of real-time payment systems, which have transformed how money moves within and across borders. Instant settlement capabilities underpin many of the most compelling open banking use cases, from pay-by-bank e-commerce flows to just-in-time payroll and treasury optimization. In markets such as the United States, United Kingdom, Brazil, India, and Singapore, real-time payment rails have become essential infrastructure for both banks and fintechs. The Federal Reserve provides detailed insights into the role of instant payments in the US financial system.

In the United States, the coexistence of the FedNow Service and The Clearing House's RTP Network has widened access to instant payments, enabling community banks, credit unions, and fintechs to offer faster disbursements, improved liquidity management, and enhanced customer experiences to both consumers and enterprises. These developments are reshaping business models in sectors such as payroll, insurance, and gig-economy platforms, themes frequently explored at FinanceTechX Business.

The United Kingdom's Faster Payments Service and Europe's SEPA Instant Credit Transfer scheme continue to serve as global benchmarks for instant payment design and governance. Their influence extends beyond Europe, informing the strategies of central banks and payment system operators worldwide. More information on these schemes and their technical frameworks is available through the European Payments Council.

In Brazil, the success of PIX has fundamentally altered consumer and merchant payment behavior, driving down cash usage, reducing card dependency, and enabling a wave of fintech innovation targeted at SMEs and the informal sector. The Central Bank of Brazil documents the system's adoption metrics and policy evolution.

India's UPI has emerged as one of the most influential real-time payment and open API ecosystems globally, supporting interoperability among banks, fintechs, and big tech platforms. Its architecture has become a reference model for policymakers in other regions, and detailed information is available from the National Payments Corporation of India.

Across Asia-Pacific, initiatives to link national instant payment systems-such as cross-border QR payments between Singapore, Thailand, and Malaysia-are demonstrating how regional integration can support tourism, trade, and remittances. For a broader view of these regional dynamics, readers can refer to ongoing coverage at FinanceTechX World.

These real-time infrastructures are not merely faster pipes; they enable new layers of value-added services, from automated reconciliation and dynamic discounting to subscription billing and marketplace payouts. As open banking APIs connect these rails to digital platforms, the line between banking and commerce continues to blur.

AI as the Strategic Intelligence Layer

Artificial intelligence has become the intelligence layer that transforms open banking data into actionable insight, risk signals, and personalized experiences. With standardized, consent-based access to richer datasets, banks and fintechs across the United States, United Kingdom, Germany, Singapore, Japan, and South Korea are deploying AI models for credit scoring, portfolio optimization, fraud detection, and operational efficiency. Readers interested in the intersection of AI and financial services can explore specialized analysis at FinanceTechX AI.

AI's impact is particularly visible in credit decisioning, where models ingest transaction histories, cash-flow patterns, and alternative data to evaluate SMEs and consumers who may have limited traditional credit histories. This approach is helping to narrow financing gaps in both developed and emerging markets. Global policy and ethical considerations around AI deployment are tracked by institutions such as the OECD AI Observatory, whose work is closely followed by regulators and industry leaders.

In fraud prevention and cybersecurity, AI-powered behavioral analytics and anomaly detection systems are becoming indispensable, as the attack surface expands with each new API and digital channel. Technology leaders including IBM, Microsoft, Google, and Stripe are investing heavily in machine learning models that can identify suspicious activity in real time and orchestrate automated responses. Many of these technologies and their security implications are examined through a financial lens at FinanceTechX Security.

Generative AI is also redefining customer engagement. Intelligent financial assistants embedded in mobile apps across Canada, Australia, Netherlands, and other markets can now synthesize data from multiple accounts, forecast cash flows, and provide scenario-based advice in natural language. The broader economic and societal implications of such AI-driven services are frequently discussed by organizations such as the World Economic Forum.

Specialized fintech lenders, including firms like Kabbage, OnDeck, and Tide, have shown how AI and open banking data can support near-instant underwriting decisions for SMEs across United States, United Kingdom, Europe, Africa, and Asia, often in partnership with banks or payment platforms. Research from organizations such as CGAP illustrates how these models can expand access to credit while highlighting the need for responsible data use and model governance.

As AI capabilities advance, governance, explainability, and bias mitigation are becoming central concerns for boards and regulators. Financial institutions that can combine robust risk management with AI-driven innovation are likely to define best practice in the coming decade.

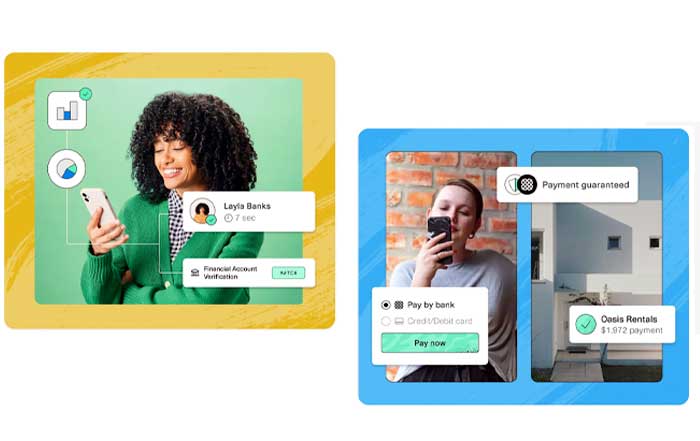

Embedded Finance and the Expansion of Financial Boundaries

One of the most visible outcomes of open banking is the rise of embedded finance-the integration of financial services into non-financial customer journeys. For business leaders, this trend represents both a threat and an opportunity, as distribution shifts to digital platforms where users already spend their time. Detailed analyses of these models and their implications for incumbents and challengers are regularly featured at FinanceTechX Business.

Global platforms such as Shopify, Uber, Revolut, Stripe, Square, and Amazon leverage open banking APIs to offer payments, working capital, accounts, and wallets directly within their ecosystems, often delivering faster onboarding and more tailored products than traditional financial channels. This integration is particularly pronounced in markets like the United States, United Kingdom, Germany, Netherlands, and Australia, where digital commerce penetration is high and regulatory frameworks support innovation.

Open banking also facilitates the growth of account-to-account payment options, enabling merchants to reduce reliance on card networks and interchange fees while benefiting from real-time settlement. In Europe, these trends intersect with broader payments modernization efforts led by bodies such as the European Central Bank.

In Asia-Pacific, embedded finance is tightly interwoven with digital identity, super apps, and cross-border e-commerce. In Singapore, Japan, South Korea, and India, consumers increasingly access loans, insurance, investments, and savings products from within ride-hailing, messaging, or marketplace applications. The strategic implications of these super app ecosystems for global competition are explored in regional context at FinanceTechX World.

Corporate finance and treasury operations are undergoing their own embedded transformation, as enterprise software providers such as SAP, Oracle, and Intuit integrate banking and payment capabilities directly into ERP and accounting platforms, automating reconciliation, cash positioning, and risk management.

In Africa, South America, and parts of Southeast Asia, embedded finance plays a central role in advancing financial inclusion, enabling microloans, pay-as-you-go utilities, micro-insurance, and digital remittances via mobile devices. Organizations like the United Nations Development Programme highlight how these models contribute to development goals when coupled with consumer protection and digital literacy initiatives.

For fintech founders and product leaders, embedded finance represents a powerful route to scale, as discussed frequently in founder-focused coverage at FinanceTechX Founders, where case studies illustrate how API-first strategies can unlock new distribution and revenue models.

Digital Identity, Security, and the Foundations of Trust

No open banking ecosystem can thrive without robust digital identity and security frameworks. As APIs proliferate and data-sharing becomes more pervasive, the ability to authenticate users reliably, manage consent, and protect data integrity is central to both regulatory compliance and customer confidence. This theme is a recurring focus at FinanceTechX Security, where cyber risk is examined from a financial and strategic perspective.

Across the United States, United Kingdom, Germany, Japan, Singapore, and Australia, banks and fintechs deploy multi-factor authentication, behavioral biometrics, and tokenization to safeguard access to accounts and services. Global best practices and reference architectures are captured in frameworks such as the NIST Cybersecurity Framework, which many institutions use as a benchmark.

In Europe, eIDAS 2.0 and emerging digital identity wallets aim to provide citizens and businesses with interoperable, secure credentials that can be used across borders and sectors, including financial services. These initiatives are part of the broader EU digital strategy, outlined on the European Commission's digital pages.

Asia-Pacific markets continue to innovate with identity systems such as Singapore's Singpass, Japan's MyNumber, and South Korea's PASS, which underpin secure access to both public and private services. In emerging markets, identity-driven inclusion is advancing through systems like India's Aadhaar and Kenya's Huduma Namba, whose development and impact are documented by the World Bank's ID4D initiative.

Cybersecurity vendors including Cisco, Palo Alto Networks, and CrowdStrike are heavily involved in protecting financial infrastructures from increasingly sophisticated threats, while agencies such as the Cybersecurity & Infrastructure Security Agency offer guidance and threat intelligence that financial institutions use to harden their defenses.

Ultimately, consumer trust depends not only on technological safeguards but also on transparent consent mechanisms, clear data usage policies, and effective recourse in the event of breaches or misuse. For businesses designing products in this environment, trust-by-design is becoming as important as user experience, a topic frequently examined from a commercial perspective at FinanceTechX Business.

Open Banking, Digital Assets, and the Tokenized Future

By 2026, the global cryptocurrency and digital asset landscape has moved further into the regulatory mainstream, intersecting increasingly with open banking infrastructures. For readers following this convergence, FinanceTechX Crypto provides ongoing analysis of how banks, exchanges, and regulators are shaping the next phase of digital asset adoption.

Banks in the United States, United Kingdom, Switzerland, Germany, Singapore, Japan, and South Korea now offer or pilot regulated digital asset custody, tokenized fund structures, and blockchain-based settlement platforms. Institutions such as JPMorgan, HSBC, Goldman Sachs, and Standard Chartered are building proprietary networks and collaborating with fintechs to streamline cross-border payments, repo, and securities settlement. The International Organization of Securities Commissions provides guidance on regulatory standards for digital asset markets.

Blockchain-based payment networks, including Ripple, Stellar, and Visa B2B Connect, are used to reduce settlement times and foreign exchange costs in cross-border transactions, often in conjunction with traditional correspondent banking systems. The Bank for International Settlements continues to analyze the implications of these innovations for monetary policy and financial stability.

Central bank digital currencies and regulated stablecoins are advancing in jurisdictions such as China, Sweden, Singapore, Brazil, and Canada, with varying design choices and policy objectives. The Atlantic Council CBDC Tracker offers a global overview of these initiatives and their status.

Open banking APIs serve as critical bridges between bank accounts and digital asset platforms, enabling compliant on- and off-ramps for exchanges and wallets operated by firms like Coinbase, Kraken, Revolut, and Gemini. This connectivity supports integrated financial experiences in which users can manage fiat and digital assets within unified interfaces, a trend with significant implications for portfolio construction and risk management, as discussed at FinanceTechX Economy.

In emerging markets across Africa, South America, and Asia, blockchain-based remittances, tokenized savings, and mobile crypto wallets are being used to address high transfer costs, currency volatility, and limited access to traditional banking. Global coordination on standards and safeguards remains essential, and bodies such as the Financial Stability Board provide important guidance, available through the FSB website.

Economic, Social, and Talent Implications of Open Banking

The economic and social impact of open banking extends well beyond the financial sector, influencing productivity, inclusion, competition, and labor markets. As digital financial infrastructure becomes more pervasive, its effects on global and regional economies are increasingly visible, a topic regularly covered in FinanceTechX World.

In advanced economies across North America, Europe, and Asia-Pacific, open banking contributes to operational efficiency through automation, instant payments, and data-driven decisioning. These efficiencies enhance resilience and profitability for banks and corporates while enabling more tailored products and pricing for consumers in markets such as the United States, United Kingdom, Germany, Netherlands, and Switzerland.

In emerging regions across Africa, South America, and Southeast Asia, the combination of open banking, mobile connectivity, and digital identity is expanding access to savings, credit, and insurance for previously underserved populations. This expansion supports entrepreneurship, job creation, and more inclusive growth, themes analyzed by the International Monetary Fund and other development institutions.

The rise of open banking is also reshaping labor markets, driving demand for skills in AI engineering, data science, cybersecurity, compliance, and digital product design in financial hubs such as United States, Canada, Germany, United Kingdom, and Australia. Executives and professionals tracking these shifts can find insights into evolving talent demands and career paths at FinanceTechX Jobs.

Environmental and sustainability considerations are increasingly integrated into open finance strategies, as standardized data and interoperable systems make it easier to track ESG metrics, carbon footprints, and green investment flows in markets like France, Italy, Spain, Netherlands, Sweden, and Finland. For readers focused on climate-related finance and green innovation, FinanceTechX Environment and FinanceTechX Green Fintech highlight how open data models support sustainable finance.

The Road Ahead: Interoperable, Intelligent, and Inclusive Finance

Looking toward the second half of the decade, the next chapter of open banking will be defined by deeper interoperability, closer collaboration between incumbents and challengers, and the fusion of AI, real-time payments, and tokenization into cohesive financial ecosystems. Banks across North America, Europe, and Asia-Pacific are evolving into platform businesses, orchestrating networks of partners that span fintech, big tech, and non-financial sectors. These shifts will increasingly be reflected in public market valuations and capital flows, topics examined at FinanceTechX Stock Exchange.

AI will continue to act as the strategic intelligence layer, enabling real-time risk management, hyper-personalization, and autonomous financial operations, while blockchain and instant payment rails provide the transactional backbone for programmable, always-on financial services. These capabilities will extend into adjacent sectors such as mobility, retail, healthcare, and education, with macroeconomic implications explored in depth at FinanceTechX Economy.

Regulatory frameworks in the United States, United Kingdom, European Union, Singapore, Japan, and other leading jurisdictions will increasingly set global norms for data-sharing, security, and digital identity, influencing how emerging markets design their own systems and how cross-border services are structured.

At the center of this transformation is the principle of consumer and business empowerment. Open banking and open finance are redefining how individuals and organizations control their financial data, choose their providers, and access capital and services across borders. For readers of FinanceTechX.com, this evolution is tracked not only as a technology story but as a structural reconfiguration of global finance, one that intersects with every topic covered across FinanceTechX Fintech, FinanceTechX Business, and the broader FinanceTechX network.

As 2026 progresses, open banking stands at the core of the next major wave of financial innovation. By enabling secure, consent-based data-sharing, fostering competition, amplifying AI-driven intelligence, and supporting cross-industry collaboration, it lays the groundwork for a more efficient, transparent, and inclusive financial system. For FinanceTechX.com, this is not simply a technological evolution; it is an opportunity to chronicle and interpret the reimagining of global finance in a way that equips decision-makers with the insight they need to build trustworthy, resilient, and forward-looking institutions in an increasingly interconnected world.