Japan's Corporate Fintech Revolution in 2026: How Leadership Roles Are Redefining Finance

In 2026, Japan occupies a pivotal position in the global financial technology landscape, where decades of conservative banking practices, intricate corporate networks, and consensus-driven governance are now converging with a decisive, and increasingly irreversible, digital shift. The country's financial architecture, long anchored by keiretsu relationships and main-bank systems, is being re-engineered through fintech innovation that touches everything from retail payments and wealth management to capital markets, digital assets, and green finance. For the audience of FinanceTechX, which closely follows developments in fintech, business strategy, artificial intelligence, crypto, jobs, and sustainability across North America, Europe, and Asia, Japan's experience offers a revealing case study in how an advanced economy can modernize without abandoning institutional stability and trust.

Unlike the United States or the United Kingdom, where disruption has often been driven by venture-backed startups intent on displacing incumbents, Japan's fintech evolution has been shaped primarily by collaboration between large financial institutions and technology conglomerates. Major banking groups such as Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), and Mizuho Financial Group have partnered with or invested in technology leaders including SoftBank, Rakuten, and LINE to build platforms that integrate digital payments, credit, investment, insurance, and loyalty ecosystems. This model of "corporate-centric innovation" has produced a distinctive set of leadership and specialist roles inside Japanese institutions, roles that now determine how quickly the country can adapt to global shifts in regulation, consumer behavior, digital assets, and sustainability.

From the perspective of FinanceTechX, which covers global developments across fintech, business, world markets, AI, crypto, and green fintech, understanding these corporate roles provides a lens into how Japan balances innovation with prudence and how its institutions are positioning themselves against peers in the United States, the United Kingdom, Singapore, Germany, and beyond. It also highlights where the most compelling opportunities now lie for international professionals, founders, and investors seeking to engage with Japan's increasingly outward-looking fintech ecosystem.

Strategic Leadership: From Digital Transformation to Global Positioning

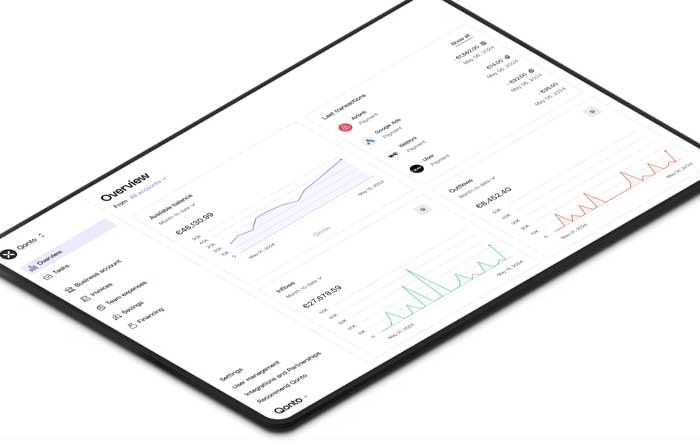

The first wave of fintech adoption in Japan was incremental, focusing on digitizing existing banking services, but by 2026 the agenda for corporate leaders has expanded to full-scale business model redesign. At the center of this shift stands the Chief Digital Transformation Officer (CDTO), a role that has matured from a technology liaison into a board-level strategist responsible for reconfiguring how banks and conglomerates create, distribute, and monetize financial services. Within organizations such as Rakuten Bank, PayPay Bank, and LINE Financial, CDTOs are not only overseeing mobile banking and cashless payment rollouts but are also orchestrating embedded finance initiatives that integrate lending, insurance, and investment products directly into e-commerce, mobility, and lifestyle platforms. In a country where cash usage remained high well into the 2010s, the CDTO's mandate now includes driving behavioral change among both customers and employees, aligning legacy IT with cloud-native architectures, and ensuring that digital channels deliver the same reliability and trust that Japan's brick-and-mortar banks have historically guaranteed.

Parallel to this transformation agenda, Chief Risk Officers (CROs) and Chief Compliance Officers (CCOs)-often combined in Japan as Chief Risk and Compliance Officers (CRCOs)-have seen their responsibilities expand significantly as fintech scale and complexity have grown. Japan's early decision to regulate cryptocurrency exchanges under the oversight of the Financial Services Agency (FSA), and its alignment with Financial Action Task Force (FATF) standards, created a demanding environment for entities such as bitFlyer, Coincheck, and SBI VC Trade. CRCOs in these firms are now charged with implementing advanced anti-money laundering analytics, transaction monitoring, and sanctions screening tools, often using AI models developed in partnership with technology providers and academic institutions. Their work is closely watched by regulators worldwide who study Japan's approach to digital asset oversight through resources such as the Bank for International Settlements and the International Monetary Fund, where Japanese policymakers and corporate representatives are active participants in ongoing debates around crypto supervision and systemic risk.

Strategic leadership has also extended into corporate venture and ecosystem building. The SoftBank Vision Fund, alongside the domestic venture arms of MUFG, SMBC, and Mizuho, has become a central conduit between Japan's incumbents and global fintech startups. Executives overseeing these investment and partnership portfolios are increasingly tasked with identifying technologies that can be integrated into Japanese operations-ranging from AI-driven underwriting and regtech to cross-border payments and digital identity-while also helping portfolio companies navigate Japan's regulatory and cultural landscape. For FinanceTechX readers tracking cross-border deal flow, these roles illustrate how corporate Japan is leveraging capital and distribution strength to remain relevant in a fintech world where innovation cycles are accelerating across the United States, Europe, and Asia.

Deep Technology Roles: AI, Data, Blockchain, and Security

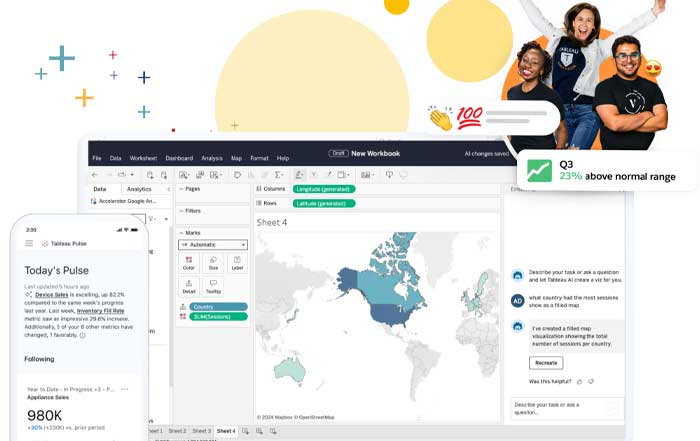

Beneath the C-suite, a new layer of technology-centric leadership has become indispensable to Japan's fintech ambitions. Directors of AI and Data Science now operate at the intersection of quantitative finance, customer analytics, and risk management within institutions such as NTT Data, Fujitsu, and Hitachi, which provide core systems and advanced analytics to banks, insurers, and brokerages. These leaders are responsible for building machine learning pipelines that enhance credit scoring, personalize product recommendations, and detect fraud in real time, while ensuring that models comply with emerging guidelines on fairness, explainability, and data protection. As global best practices around AI governance evolve, professionals in these roles regularly benchmark against standards and research from organizations such as the OECD, World Economic Forum, and leading academic centers, integrating those insights into Japanese corporate frameworks.

Blockchain and distributed ledger technologies have likewise created a distinct class of specialists in Japan's financial sector. Blockchain architects and digital asset engineers within SBI Holdings, Nomura Holdings, and Japan Exchange Group (JPX) are designing tokenization platforms for bonds, equities, and real-estate assets, often in collaboration with technology firms in Singapore, Switzerland, and the United States. These initiatives build on earlier experiments in security token offerings and pilot projects with international partners, and they reflect a broader global trend toward digitizing capital markets infrastructure that is also visible in hubs like London and New York. For readers who follow market structure developments through FinanceTechX stock exchange coverage, Japan's progress in tokenized markets is a critical indicator of how quickly traditional exchanges can evolve without undermining market integrity.

The growing digitalization of financial services has also elevated the role of Chief Information Security Officers (CISOs) and cybersecurity executives, particularly as Japanese institutions expand cloud adoption and API-based integration with third-party fintech partners. Companies such as Trend Micro and NTT Security provide threat intelligence, endpoint protection, and incident response capabilities that underpin the resilience of Japan's banking and payments infrastructure. CISOs in large financial groups must now manage a complex risk landscape that includes state-sponsored attacks, ransomware targeting critical financial infrastructure, and supply-chain vulnerabilities introduced through vendor relationships. For FinanceTechX readers, many of whom operate in markets with similar exposures, Japan's emphasis on layered defense and regulatory-driven cyber resilience echoes trends documented by entities such as ENISA in Europe and the Cybersecurity and Infrastructure Security Agency in the United States, and aligns with ongoing discussions covered in FinanceTechX security insights.

Payments, Super-Apps, and the Re-Design of Everyday Finance

Digital payments remain one of the most visible expressions of Japan's fintech transition, and they have catalyzed a range of new corporate roles that blend technology, marketing, and ecosystem strategy. Platforms such as PayPay, Rakuten Pay, and LINE Pay have transformed how consumers in Tokyo, Osaka, and regional cities pay for transportation, retail purchases, and online services, bringing Japan closer to the cashless norms long established in China, Sweden, and South Korea. Executives responsible for Payment Strategy and Ecosystem Development manage complex relationships with merchants, card networks, telecommunications providers, and regulators, ensuring that their platforms remain interoperable, secure, and attractive to both users and partners.

These leaders are tasked with optimizing user acquisition and retention in a market where demographic realities are unique: Japan's aging population and high urban density create a dual imperative to design interfaces that are intuitive for older users while also meeting the expectations of younger, digitally native consumers. Many of these strategies mirror global best practices discussed by organizations such as the Bank for International Settlements and the World Bank, which have examined how digital payments can drive financial inclusion and economic efficiency. For readers of FinanceTechX who are comparing payment ecosystems across regions, Japan's journey from cash-dominance to mainstream QR and NFC payments underscores the role of corporate coordination and government incentives in accelerating adoption, a theme closely related to broader banking sector changes covered on the site.

Digital Assets, Crypto, and the Institutionalization of Web3

By 2026, Japan's digital asset sector has moved decisively beyond its early volatility and scandals into a more institutional, regulated phase. The collapse of Mt. Gox more than a decade earlier proved to be a catalyst for one of the world's most comprehensive crypto regulatory frameworks, and that infrastructure now supports a growing ecosystem of exchanges, custodians, and tokenization platforms. Within major financial institutions such as Nomura Holdings, MUFG, and SBI Holdings, Heads of Digital Asset Strategy oversee initiatives that span spot crypto trading, derivatives, tokenized securities, and custody solutions for institutional investors. These executives must navigate a global regulatory mosaic that includes evolving rules from the U.S. Securities and Exchange Commission, the European Securities and Markets Authority, and Asian regulators, while ensuring alignment with Japan's own FSA guidelines.

In parallel, specialized Crypto Compliance Officers and Regulatory Affairs Directors manage the interface between corporate operations and supervisory expectations. Their work involves implementing rigorous know-your-customer and transaction monitoring systems, coordinating with law enforcement when necessary, and contributing feedback to regulators on emerging issues such as decentralized finance (DeFi), stablecoin regulation, and travel-rule implementation. As other jurisdictions look to Japan's experience in balancing innovation and consumer protection, these professionals increasingly participate in international working groups and industry associations, engaging with resources like the Financial Stability Board and research from central banks around the world. For FinanceTechX readers seeking a structured view of how digital assets intersect with macroeconomic and market dynamics, these developments connect directly with ongoing economy and crypto analyses on the platform.

Talent, Employment, and the Hybrid Skills Imperative

The expansion of corporate fintech roles in Japan has reshaped the country's employment landscape, creating strong demand for professionals who can bridge finance, technology, and regulation. Data scientists, blockchain engineers, cybersecurity analysts, AI product managers, and digital product strategists are now embedded across banks, brokers, insurers, and technology conglomerates. Human resources leaders have responded by building dedicated fintech recruitment teams, often targeting candidates not only from Japan but also from the United States, India, Singapore, and European hubs such as London, Berlin, and Amsterdam.

Japan's government has complemented these corporate efforts with immigration and labor policies designed to attract highly skilled professionals in digital fields, including streamlined visa categories and incentives for innovation in financial services. As a result, Tokyo, Osaka, and Fukuoka have become increasingly visible on the global fintech careers map, competing with Singapore, Hong Kong, and Sydney for talent. For professionals tracking opportunities through FinanceTechX jobs coverage, the message is clear: Japan now values hybrid profiles that combine quantitative expertise, coding skills, and an understanding of regulatory and cultural nuances, and is willing to offer career progression paths that were less accessible in earlier decades.

Corporate training and reskilling programs have also intensified. Institutions like Fujitsu and Hitachi collaborate with universities and banks to develop curricula in cloud computing, AI for risk management, and blockchain development. These initiatives align with broader trends documented by organizations such as the World Bank and UNESCO, which emphasize lifelong learning as a prerequisite for digital economies. As FinanceTechX continues to explore the education dimension of fintech transformation, readers can delve deeper into these themes through education and skills in financial technology, where Japan's approach is increasingly cited as an example of how incumbents can upskill at scale.

Sustainability, ESG, and the Rise of Green Fintech

Sustainability has moved from a peripheral concern to a core strategic pillar for Japanese financial institutions, and fintech is now central to how environmental, social, and governance (ESG) objectives are operationalized. Sustainable Finance Directors and ESG Product Leads within Mizuho Financial Group, Nomura Asset Management, and other major players are working with fintech teams to develop digital tools that track carbon emissions, evaluate climate risk, and channel capital toward green projects. These tools often integrate data from international frameworks and initiatives led by bodies such as the Task Force on Climate-related Financial Disclosures and the International Sustainability Standards Board, ensuring that Japanese products remain compatible with expectations in Europe, North America, and Asia.

New roles such as Environmental Risk Analysts and Climate Data Scientists are emerging at the intersection of finance, technology, and environmental science. These professionals use AI-driven models to assess how climate scenarios could affect loan portfolios, insurance liabilities, and investment performance, supporting both risk management and opportunity identification. Their work resonates with global conversations around sustainable finance that are closely followed by FinanceTechX readers, and it aligns with the platform's dedicated environment and green fintech coverage. For international investors seeking to understand how ESG is being embedded into financial infrastructure, Japan's corporate fintech initiatives offer a concrete example of how digital tools can make sustainability data more transparent, comparable, and actionable.

AI, Automation, and the Redesign of Operating Models

Artificial intelligence and automation have become integral to how Japanese corporations run their financial businesses, prompting the creation of roles such as Chief AI Officer, Head of Intelligent Automation, and AI Ethics Lead. Within Mitsubishi UFJ Financial Group, for instance, AI is applied to credit risk modeling, operational process automation, and customer service chatbots that handle high volumes of inquiries while escalating complex cases to human advisors. These deployments not only improve efficiency and reduce costs but also raise questions about algorithmic accountability, bias, and transparency-issues that AI leaders must address in collaboration with compliance, legal, and human resources teams.

AI-driven automation is also reshaping trading and asset management. Quantitative teams in securities firms and asset managers are building algorithmic trading strategies that leverage machine learning and alternative data sources, while risk officers and regulators scrutinize these models to ensure they do not amplify market instability. The interplay between innovation and oversight in this domain is reflected in research and guidance from entities such as the Bank for International Settlements and leading academic finance departments, and it mirrors themes explored in FinanceTechX AI analysis. For FinanceTechX's global readership, Japan's experience demonstrates how AI can be integrated into financial operations without sacrificing the prudence and reliability that institutional investors and regulators demand.

Globalization, Competition, and Japan's Position in the Fintech Race

As fintech ecosystems in the United States, the United Kingdom, Singapore, and China continue to mature, Japanese corporate leaders responsible for Global Strategy and Expansion face the challenge of ensuring that their institutions remain competitive and relevant. These executives oversee cross-border partnerships, investments, and product launches, coordinating efforts between Tokyo and global hubs such as New York, London, Singapore, and Sydney. They must align products with different regulatory regimes, manage currency and operational risks, and tailor offerings to local customer expectations while preserving the brand values and risk culture that define Japanese institutions.

Japan's comparative advantage lies in its combination of technological sophistication, regulatory clarity, and a reputation for reliability and long-term commitment. However, maintaining this edge requires continuous benchmarking against international peers, informed by analysis from organizations such as the World Bank, the OECD, and regional development banks that track financial innovation across continents. For FinanceTechX readers who monitor these dynamics through world and business coverage, Japan's trajectory illustrates how an advanced economy can compete not by mimicking every aspect of Silicon Valley or Shenzhen, but by leveraging its own strengths in governance, risk management, and industrial collaboration.

Looking Ahead: What Japan's Corporate Fintech Evolution Means for FinanceTechX Readers

By 2026, Japan's fintech story has become one of deliberate but accelerating transformation, driven less by sudden disruption and more by a systematic redesign of corporate roles, competencies, and partnerships. From CDTOs and CRCOs to AI directors, blockchain architects, ESG strategists, and global expansion leaders, the country's institutions are building an integrated leadership architecture that touches every dimension of modern finance. For professionals considering career moves, this architecture offers a wide spectrum of roles that combine technical depth with strategic influence, particularly for those willing to operate at the intersection of finance, technology, and regulation. For founders and investors, it signals a market where collaboration with incumbents is often the most effective route to scale, and where corporate partners can provide both capital and distribution on a global stage.

For FinanceTechX, Japan's experience is directly relevant to its mission of helping readers understand how fintech is reshaping business, markets, and societies worldwide. The themes that emerge from Japan-hybrid leadership roles, the institutionalization of crypto, AI-driven operating models, talent transformation, and the integration of ESG into digital finance-are the same themes that will define fintech in the United States, Europe, and the rest of Asia over the coming decade. As FinanceTechX continues to expand its coverage across fintech, crypto, economy, environment, and world markets, Japan's corporate fintech journey will remain a key reference point for readers seeking to anticipate where global financial technology is heading, and how leadership, trust, and innovation can be combined to shape a more resilient and inclusive financial system.