Remote Fintech Jobs in 2026: How Borderless Work Is Redefining Finance, Talent, and Growth

Remote Work as a Structural Shift in Global Fintech

By 2026, remote work in financial technology has moved far beyond a pandemic-era contingency and has become a structural pillar of how the industry operates, scales, and competes. What began as an emergency response to COVID-19 has matured into a sophisticated operating model that allows fintech firms to recruit globally, operate continuously across time zones, and build products for a digital-first customer base that expects instant, secure, and personalized financial services. For readers of Financetechx, who regularly track developments across fintech, business, and the broader world economy, the shift to remote fintech jobs is now central to understanding competitive dynamics in the sector.

The global financial technology ecosystem has grown more complex and interconnected, powered by advances in cloud computing, high-speed connectivity, artificial intelligence, blockchain, and advanced cybersecurity architectures. In this environment, remote work is not a marginal experiment but an operational expression of fintech's core values: agility, scalability, and continuous innovation. Leading players such as Stripe, Revolut, Wise, and Coinbase have institutionalized distributed workforces, building systems that allow engineers, data scientists, compliance specialists, and product teams in dozens of countries to collaborate securely on the same platforms. Their approach demonstrates that high regulatory standards and robust security can coexist with fully remote or hybrid operating models, provided that governance, technology, and culture are aligned.

This evolution has fundamentally altered the geography of opportunity. Historically, access to high-impact fintech roles required proximity to hubs such as New York, London, Singapore, or San Francisco. Today, professionals in South Africa, Brazil, India, Eastern Europe, or Southeast Asia can participate in cutting-edge projects without relocating, while firms in the United States, the United Kingdom, Germany, Canada, Australia, and across Asia and Africa can access a deeper, more diverse pool of skills. The result is a more inclusive global labor market, where career progression is increasingly determined by expertise and performance rather than postal codes or visa status.

How Remote Work Is Reconfiguring the Fintech Workforce

The nature of financial technology makes it particularly suited to distributed work. Digital banking, payments, lending, wealth management, and crypto platforms are inherently global in their user bases and regulatory exposure; they require teams that understand multiple markets and can respond in real time to events across regions. Distributed teams operating in staggered time zones now provide many firms with a form of "follow-the-sun" coverage that would be impossible with a purely co-located workforce.

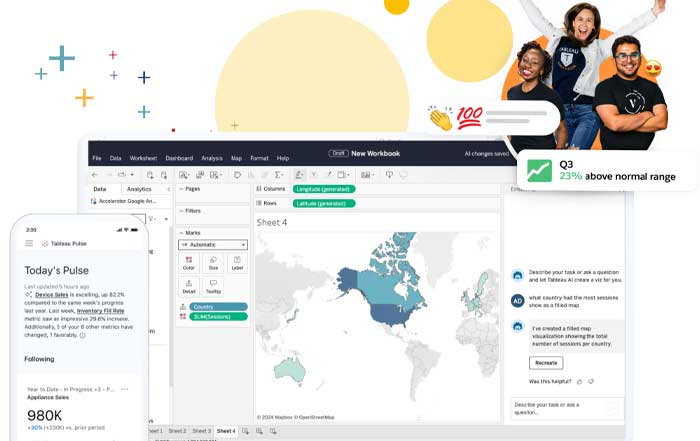

By mid-2025 and into 2026, industry surveys from organizations such as the World Economic Forum and Deloitte have consistently shown that a majority of fintech companies operate on hybrid or remote-first models. Collaboration platforms like Zoom, Slack, and Microsoft Teams have become the basic infrastructure of daily operations, while more specialized tools handle secure code collaboration, data governance, and regulatory reporting. Companies including PayPal and Block (formerly Square) have expanded remote options particularly for engineering, data, design, and risk roles, while maintaining regional hubs in New York, London, Dublin, Berlin, Singapore, and Sydney for client-facing and regulatory engagement functions.

For professionals, this has decoupled career trajectories from local labor market conditions. A data engineer in Bangalore can now lead core infrastructure projects for a Toronto-based payments startup; a risk analyst in Madrid can oversee European compliance for a Singaporean digital bank; a UX researcher in Cape Town can shape the customer journey for a UK-based wealthtech platform. These examples illustrate a structural change that Financetechx regularly highlights in its jobs and economy coverage: the emergence of a truly borderless talent market in financial services, where digital collaboration tools and standardized development practices make geography a secondary consideration.

This reconfiguration is not only about cost optimization. Executives increasingly recognize that distributed teams are a strategic asset, enabling resilience against regional shocks, improving coverage of local regulations, and enriching product design with culturally diverse perspectives. In a sector where trust, usability, and regulatory compliance are as critical as price, the ability to integrate insights from customers and experts in North America, Europe, Asia, Africa, and South America has become a decisive competitive advantage.

High-Growth Remote Roles Across the Fintech Value Chain

The expansion of remote work has coincided with an explosion in demand for specialized skills across the fintech value chain. In 2026, the most sought-after remote roles cluster around data, AI, blockchain, cybersecurity, compliance, customer experience, and digital product development, each reflecting fundamental shifts in how financial services are designed and delivered.

Data scientists and machine learning engineers are at the forefront of this transformation. Fintech firms increasingly rely on advanced analytics to drive credit decisioning, real-time fraud detection, personalized offers, and dynamic pricing. As models become more sophisticated and regulators in the United States, the European Union, the United Kingdom, and Asia tighten expectations around model risk management and explainability, demand has surged for professionals who combine quantitative expertise with knowledge of financial regulation. Readers can explore how these trends intersect with automation and decision intelligence through Financetechx AI analysis.

Blockchain engineers and smart contract developers have also become central to the remote fintech labor market, particularly as tokenization, decentralized finance (DeFi), and institutional digital asset strategies move from experimentation to production. Developers who understand Ethereum, Solana, Polkadot, and emerging layer-2 architectures, along with secure coding practices and auditing methodologies, are in high demand from both crypto-native firms and traditional financial institutions experimenting with tokenized deposits, securities, and real-world assets. Global adoption of digital assets, tracked by entities such as the Bank for International Settlements, has reinforced the need for cross-border expertise that is naturally suited to remote collaboration.

Compliance, risk, and legal professionals have experienced a parallel surge in demand. The proliferation of cross-border operations means that even mid-sized fintechs must navigate regimes as varied as GDPR in Europe, SEC and FINRA rules in the United States, FCA requirements in the United Kingdom, and evolving frameworks in jurisdictions such as Singapore, Brazil, South Africa, and the United Arab Emirates. Remote hiring allows firms to engage local specialists in each jurisdiction, building distributed compliance teams that monitor regulatory change, maintain licensing, and advise on product design. Resources such as the Financial Stability Board and OECD provide global perspectives that these professionals routinely draw upon in their work.

Customer experience roles have likewise become more strategic. As digital banks and neobrokers compete on usability and trust, product designers, UX researchers, and customer success managers are responsible for translating complex financial products into intuitive, inclusive experiences. Institutions like N26 and Chime have demonstrated that frictionless onboarding, transparent pricing, and responsive support can be decisive in markets from Germany and Spain to the United States. Remote CX teams now operate across continents, providing localized language support and cultural understanding while feeding insights back to central product squads.

Regional Patterns in Remote Fintech Employment

The geography of remote fintech work in 2026 reflects both longstanding financial hubs and fast-growing innovation centers. In the United States, New York and the San Francisco Bay Area remain magnets for capital and leadership talent, but firms increasingly recruit remote contributors from across North America, including secondary cities in Texas, Colorado, and the Midwest, where deep engineering and analytics talent pools have formed. Regulatory clarity around digital assets and open banking, shaped in part by agencies like the Consumer Financial Protection Bureau, continues to influence hiring priorities.

In the United Kingdom, London's fintech ecosystem has adapted to post-Brexit realities by deepening ties with Europe, North America, and Asia, while recruiting remote talent throughout the continent. The Financial Conduct Authority has actively engaged with digital innovators, creating a regulatory sandbox that has encouraged experimentation in areas such as embedded finance and regtech. Remote specialists in countries including France, Spain, Italy, and the Netherlands now routinely support UK-based platforms, especially in engineering, compliance, and marketing.

Germany has consolidated its status as a European leader in digital banking and investing, with firms like N26 and Trade Republic building distributed engineering hubs across Central and Eastern Europe. Canada continues to punch above its weight in payments, blockchain, and AI-driven finance, supported by strong research ecosystems in Toronto, Montreal, and Vancouver, and by cross-border collaboration with US firms. Australia and New Zealand have seen robust growth in wealthtech and regtech, with Sydney and Melbourne anchoring regional operations that draw remote talent from across the Asia-Pacific region.

Emerging markets have become particularly dynamic. In Africa, countries such as Nigeria, Kenya, and South Africa have leveraged mobile money and digital wallets to expand financial inclusion, creating demand for product managers, security engineers, and risk experts who understand local infrastructure and consumer behavior. Organizations like the Africa Fintech Network and the World Bank have highlighted how these ecosystems are increasingly integrated into global value chains via remote work. In South America, Brazil leads with Nubank and a rapidly expanding ecosystem of payments, credit, and insurance innovators, many of which now maintain remote-first development and analytics teams.

For readers seeking a broader macro and regional context, Financetechx regularly explores these dynamics in its world and economy sections, examining how regulatory reforms, capital flows, and demographic trends shape remote employment patterns in fintech.

AI and Automation as Force Multipliers for Distributed Teams

Artificial intelligence and automation have become the connective tissue that enables remote fintech teams to operate effectively at scale. Beyond product features such as robo-advisors, AI underwriting, and chatbots, these technologies now underpin internal workflows, talent acquisition, and operational resilience.

In recruitment, AI-driven platforms analyze candidate profiles across borders, matching skills, experience, and portfolio work with detailed role requirements. Tools integrated into platforms like LinkedIn and Glassdoor help hiring managers identify suitable candidates in markets ranging from the United States and the United Kingdom to India, Brazil, and Nigeria, while also supporting diversity and inclusion goals by reducing certain forms of bias. Automated assessments and coding challenges have become standard for remote technical hiring, enabling objective evaluation at scale.

Once teams are in place, AI supports remote collaboration and productivity. Natural language processing enables real-time translation and sentiment analysis in global meetings, while intelligent project management systems allocate tasks based on availability, skill sets, and historical performance data. In customer-facing operations, AI-augmented chatbots and virtual assistants handle routine inquiries, allowing human agents-often working remotely-to focus on complex, high-value interactions. For deeper coverage of these developments, readers can consult Financetechx AI insights, which examine both the opportunities and governance challenges associated with AI in finance.

At the same time, the rise of AI has created new categories of remote work: model risk managers, AI ethicists, data governance leads, and algorithmic auditors. Regulators in the European Union, the United States, and Asia are increasingly focused on explainability, fairness, and accountability in AI-driven financial decisions, pushing firms to build multidisciplinary teams that combine data science, legal, and policy expertise. Many of these roles are well-suited to remote arrangements, as they rely on documentation, code review, and digital collaboration rather than physical presence.

Compliance, Security, and Trust in a Distributed Environment

Remote work in financial services is only sustainable when underpinned by robust compliance and cybersecurity frameworks. In 2026, the most credible fintech firms treat security and regulatory adherence as foundational, not as afterthoughts, recognizing that a single breach or compliance failure can erase years of brand-building and damage trust with regulators and customers alike.

On the regulatory front, fintechs must navigate overlapping regimes that govern data protection, payments, capital markets, and consumer protection. The General Data Protection Regulation (GDPR) in the European Union, PCI DSS for payment card security, anti-money laundering rules shaped by the Financial Action Task Force, and national digital banking regulations across Asia, Africa, and the Americas all impose stringent expectations on how data is collected, stored, and processed. Remote work complicates these requirements, as employees may access sensitive systems from multiple jurisdictions, each with different legal constraints.

To manage this complexity, many firms are building distributed compliance teams composed of specialists based in key regulatory centers such as London, Frankfurt, Singapore, New York, and Zurich, as well as in emerging hubs like Lagos and São Paulo. These professionals work remotely but operate within tightly controlled access and monitoring frameworks, often supported by regtech solutions that automate reporting, transaction monitoring, and sanctions screening.

Cybersecurity has become even more central in a remote-first world. Cloud-native architectures, API-driven integrations, and widespread use of collaboration tools expand the attack surface, making identity and access management, endpoint security, and continuous monitoring non-negotiable. Global security providers such as IBM Security and CrowdStrike have developed solutions tailored to distributed organizations, while fintechs themselves invest heavily in zero-trust architectures, hardware security modules, and advanced encryption. Incident response and threat intelligence teams, frequently operating remotely and across time zones, now play a critical role in preserving operational continuity.

Readers interested in the evolving interplay between remote work, cybersecurity, and regulatory risk can explore Financetechx Security coverage, which examines best practices for building resilient digital infrastructures in financial services.

Career Paths and Skills for Remote Fintech Professionals

For individual professionals, remote fintech work in 2026 offers both unprecedented opportunity and heightened expectations. The most successful remote careers are built on a combination of deep technical or domain expertise, strong digital communication skills, and a proactive approach to continuous learning.

Core technical competencies include software engineering, data science, blockchain development, cloud architecture, information security, and product management, often complemented by domain knowledge in payments, lending, wealth management, or insurance. At the same time, knowledge of regulatory frameworks, from GDPR and MiCA in Europe to open banking rules in the United Kingdom and Australia, is increasingly valuable even for non-legal roles, as product decisions must anticipate compliance implications from the outset.

Soft skills have become equally critical. Remote teams rely on written communication, documentation, and asynchronous collaboration, making clarity, responsiveness, and cultural sensitivity essential. Professionals who can work effectively across time zones, manage ambiguity, and build trust through digital channels are particularly well-positioned to assume leadership roles in distributed organizations.

Continuous learning is supported by a rich ecosystem of digital education platforms. Providers such as Coursera, edX, and Udemy offer specialized programs in fintech, blockchain, AI, and cybersecurity, many developed in partnership with leading universities and industry players. For readers seeking structured pathways into or within the sector, Financetechx Education highlights training options, certifications, and emerging skills that employers prioritize.

Remote experience is also proving to be a powerful incubator for entrepreneurship. Many founders of new fintech ventures in regions such as Southeast Asia, Eastern Europe, and Africa have spent years working in distributed teams for global firms, gaining insight into product-market fit, regulatory strategy, and cross-border operations before launching their own startups. Financetechx Founders coverage at financetechx.com/founders.html regularly profiles these journeys, illustrating how remote work can serve as both a career path and a launchpad for innovation.

Crypto, Blockchain, and the Decentralized Workforce

Cryptocurrencies and blockchain technologies have been among the most powerful drivers of remote fintech employment. From their inception, these ecosystems have been organized around decentralization, open-source collaboration, and global participation, with teams and communities that rarely, if ever, share a physical office.

Decentralized finance platforms and foundational networks such as Ethereum, Solana, and Polkadot are maintained by globally distributed communities of core developers, validators, security researchers, and governance participants. Many of these contributors operate as independent contractors or members of decentralized autonomous organizations (DAOs), compensated through tokens or hybrid arrangements. Their work spans protocol design, smart contract development, economic modeling, and legal structuring, and it is almost entirely remote by design.

Centralized exchanges and digital asset service providers, including Binance, Coinbase, and Kraken, have also leaned heavily into remote-first models. Their operations require round-the-clock coverage for trading, customer support, security monitoring, and regulatory reporting, making globally distributed teams a necessity rather than a convenience. As institutional investors and traditional banks in the United States, the United Kingdom, Switzerland, Singapore, and the Middle East expand their digital asset strategies, hybrid professionals who understand both conventional financial infrastructure and blockchain-based systems have become particularly valuable.

To follow how crypto and blockchain continue to shape remote work and financial innovation, readers can consult Financetechx Crypto insights, which explore developments ranging from tokenization to regulatory shifts in major jurisdictions.

Sustainability, Green Fintech, and the Environmental Dimension of Remote Work

Environmental considerations have become a strategic theme in fintech, and remote work is increasingly recognized as part of the industry's sustainability toolkit. By reducing commuting, downsizing office footprints, and optimizing energy usage through cloud infrastructure, remote-first organizations can materially lower their carbon emissions. This is particularly relevant in regions such as Europe, Canada, and parts of Asia-Pacific, where regulatory and investor pressure around climate disclosures and net-zero commitments has intensified.

Green fintech-solutions that link financial services with climate and environmental objectives-has grown rapidly in markets such as Germany, the Netherlands, the Nordics, the United Kingdom, and Singapore. Companies offering carbon accounting, climate risk analytics, sustainable investment platforms, and green lending products often operate with highly distributed teams, reflecting both the global nature of climate challenges and the need for localized data and expertise. Professionals in these firms may be based in Europe, Asia, Africa, or the Americas, working together on tools that help corporates, investors, and consumers align capital with sustainability goals.

Remote fintech jobs also enhance resilience in regions already affected by climate-related disruptions. By enabling knowledge workers in vulnerable areas to participate in the global digital economy without relocating, remote employment can mitigate some of the economic pressures associated with climate migration. Financetechx Environment coverage at financetechx.com/environment.html and Financetechx Green Fintech examine how digital finance, sustainability, and remote work intersect in practice.

Outlook to 2030: Remote Fintech as the Default

Looking ahead to 2030, the trajectory is clear: remote and hybrid models will be the default operating structures for most fintech organizations, not the exception. Several forces underpin this expectation. First, the continued expansion of digital finance into new markets will require localized expertise that is most efficiently accessed through remote hiring. Second, competition for top-tier technical talent in AI, cybersecurity, and blockchain will remain intense, compelling firms to widen their search beyond traditional hubs. Third, regulatory and investor scrutiny around operational resilience, sustainability, and inclusion will reward firms that can demonstrate flexible, diversified talent strategies.

New role categories are likely to emerge at the intersection of technology, ethics, and regulation. Specialists in AI governance, algorithmic transparency, DAO legal structures, and cross-border digital identity will become increasingly important. Education providers and employers will respond with targeted reskilling programs, many delivered remotely, to address persistent skills gaps. For ongoing analysis of how these macro trends shape employment and economic structures, readers can turn to Financetechx Economy and Financetechx News, which track policy developments, capital flows, and labor market data across regions.

At the same time, traditional financial institutions in the United States, Europe, and Asia are adopting many of the practices pioneered by fintechs, including remote engineering hubs, flexible work arrangements, and digital-first customer engagement. This convergence suggests that the distinction between "fintech" and "finance" will continue to blur, while the expectations for remote-capable, digitally fluent professionals will rise across the entire industry.

Conclusion: Financetechx and the Era of Borderless Fintech Careers

Remote fintech jobs in 2026 represent far more than a change in workplace logistics; they signal a fundamental reshaping of how financial services are built, governed, and experienced. The combination of cloud infrastructure, AI, blockchain, and secure collaboration tools has enabled a model in which talent can be sourced from anywhere, products can be iterated continuously, and regulatory complexity can be managed with distributed expertise. For professionals, this unlocks career paths that span continents and sectors; for companies, it offers resilience, diversity of thought, and access to scarce skills; for economies, it creates new channels through which emerging markets can contribute to and benefit from global financial innovation.

As this transformation continues, Financetechx remains committed to providing rigorous, trustworthy coverage of the trends that matter most to decision-makers and practitioners. Whether exploring innovations in banking, analyzing shifts in stock exchanges, tracking developments in AI and security, or profiling founders who build remote-first ventures, the platform is designed to help readers navigate an increasingly complex and interconnected landscape.

The era of borderless fintech careers is still unfolding, but its direction is unmistakable. Organizations that embrace remote work strategically-investing in security, compliance, culture, and continuous learning-will be best positioned to lead. Professionals who cultivate deep expertise, adaptability, and digital collaboration skills will find that geography is no longer a ceiling on their ambitions. In that sense, remote fintech jobs are not just a feature of the current moment; they are a defining characteristic of the future of finance that Financetechx will continue to chronicle and interpret for a global business audience.