Indonesia's Remittance Revolution: How Digital Finance and Policy Are Reshaping a Critical Lifeline

A Strategic Pillar of Indonesia's Financial Future

By 2026, Indonesia's international remittance market has matured into a strategic pillar of the national financial system, underpinning household resilience, macroeconomic stability, and the country's broader digital transformation agenda. With a global diaspora exceeding nine million people spread across Asia, the Middle East, Europe, and North America, remittance flows now sit at the intersection of financial inclusion, fintech innovation, regulatory modernization, and sustainable development. For FinanceTechX, which closely follows the evolution of fintech and digital finance across global markets, Indonesia's experience offers a revealing case study of how an emerging economy can leverage cross-border payments to accelerate structural change while navigating complex risks.

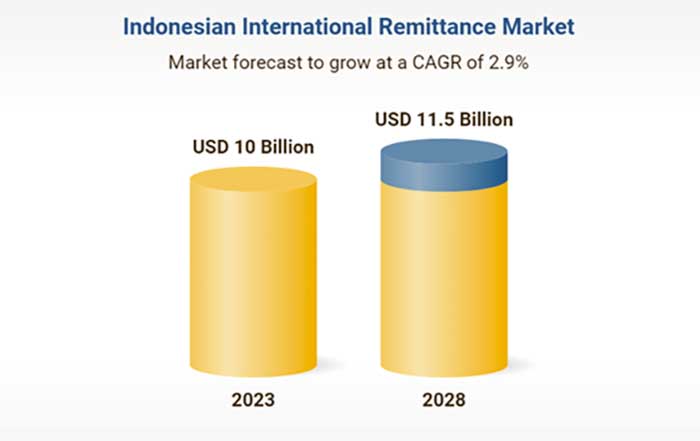

Remittances into Indonesia have consistently amounted to billions of US dollars per year, according to data from Bank Indonesia, making them a significant source of foreign exchange and a stabilizing force during periods of external volatility. These inflows are no longer viewed solely as private transfers between individuals; they are increasingly recognized by policymakers, financial institutions, and international organizations such as the World Bank as a critical component of national development, capital formation, and social protection. As a result, the remittance ecosystem has become a testing ground for new technologies, cross-border payment standards, and regulatory frameworks that are reshaping Indonesia's financial landscape in ways that resonate far beyond its borders.

The Structure and Significance of Indonesia's Remittance Landscape

Indonesia's remittance landscape is shaped by a geographically diverse and socioeconomically varied diaspora. Large communities of Indonesian workers and professionals reside in Malaysia, Singapore, Saudi Arabia, the United Arab Emirates, Hong Kong, Taiwan, South Korea, Japan, and increasingly in the United States, Canada, the United Kingdom, Germany, the Netherlands, and Australia. These communities remit funds through a mix of formal banking channels, licensed money transfer operators, digital platforms, and, in some cases, informal networks. The formalization of these flows has become a priority for regulators and financial institutions seeking to improve transparency, reduce costs, and bring more households into the regulated financial system.

Remittances are deeply embedded in Indonesia's social and economic fabric. In rural and semi-urban regions such as parts of Java, West Nusa Tenggara, and East Nusa Tenggara, they often represent the most reliable and sometimes the only stable source of income for families. These funds are used not only for daily consumption but also to finance education, healthcare, housing improvements, and small-scale entrepreneurial activities. Research by organizations such as the Asian Development Bank and International Labour Organization has repeatedly highlighted the role of remittances in reducing poverty and smoothing income shocks, especially in lower-income communities. In this context, the remittance sector is increasingly seen as a lever for inclusive growth, aligning closely with the themes covered in FinanceTechX's business and economy analysis.

Migrant Workers as the Engine of Cross-Border Flows

At the heart of Indonesia's remittance engine is its migrant workforce, which spans a spectrum from low-skilled workers in domestic services, agriculture, and construction to mid- and high-skilled professionals in healthcare, technology, education, and financial services. Many originate from provinces where local employment opportunities are limited or wages are comparatively low, prompting them to seek better prospects in more developed economies in Asia, the Middle East, and the West. This dynamic has created a long-standing pattern of labor migration that is now being reshaped by demographic shifts, changing labor policies in host countries, and the global competition for talent.

The Indonesian government, through agencies such as BP2MI (the Indonesian Migrant Worker Protection Agency) and in coordination with Bank Indonesia and the Otoritas Jasa Keuangan (OJK), has progressively sought to formalize labor migration and the associated remittance flows. Pre-departure training increasingly includes financial literacy modules, encouraging workers to understand exchange rates, transfer fees, and the risks of informal channels. Bilateral agreements with key destination countries in Asia, the Middle East, and Europe aim to improve worker protections, regulate recruitment practices, and facilitate access to safe, transparent financial services. For many Indonesian households, particularly in lower-income regions, these policy measures translate directly into better security over the money they depend on for survival, education, and long-term planning.

Digital Transformation and Fintech Disruption in Remittances

The most profound change in Indonesia's remittance market over the past decade has been the rapid digitization of cross-border transfers. Traditional remittance models, dominated by physical branches, cash payouts, and opaque pricing, have been challenged by a wave of digital-first providers that use mobile apps, online platforms, and API-based integrations to deliver transfers that are faster, cheaper, and more transparent. Global players such as Wise, Revolut, Remitly, and WorldRemit have expanded their presence in Indonesia's key remittance corridors, while established incumbents like Western Union and MoneyGram have been forced to adapt by enhancing digital offerings and integrating with local banking and wallet ecosystems.

Domestically, leading banks such as Bank Mandiri, Bank Central Asia (BCA), and Bank Negara Indonesia (BNI) have embedded cross-border transfer capabilities into their mobile banking applications, giving customers a unified interface for domestic payments, savings, investments, and international remittances. At the same time, Indonesian digital wallet providers including GoPay, OVO, and Dana are exploring and piloting cross-border services, often through partnerships with regional payment networks and foreign fintech firms. This convergence is creating an ecosystem where remittances are no longer siloed products but integral components of broader digital financial journeys, a trend that aligns with the innovations tracked in FinanceTechX's AI and fintech coverage.

Artificial intelligence and machine learning have become essential enablers of this transformation. AI-driven systems are now widely used to optimize currency conversion, detect fraud, personalize user experiences, and automate compliance checks, enabling providers to scale rapidly while maintaining robust risk controls. For migrant workers and their families, the result is a more intuitive experience where transfers can be initiated within seconds through a smartphone and received directly into bank accounts or mobile wallets, even in remote areas with limited physical banking infrastructure.

Regulatory Evolution and the Pursuit of Financial Inclusion

Indonesia's regulatory framework for remittances has evolved significantly as digitalization has accelerated. Bank Indonesia and OJK have taken a proactive stance in balancing innovation with systemic stability, consumer protection, and the integrity of financial flows. Licensing regimes for payment service providers, remittance operators, and e-money issuers have been refined to ensure that new entrants meet minimum standards for capital adequacy, cybersecurity, governance, and compliance. These measures are informed by global best practices promoted by bodies such as the Bank for International Settlements (BIS) and the Financial Action Task Force (FATF), reflecting Indonesia's desire to align with international norms while tailoring policies to local realities.

A key pillar of regulatory strategy has been the promotion of financial inclusion through remittance-linked services. Authorities have encouraged remittance recipients to open bank accounts or digital wallets, thereby integrating them into the formal financial system and expanding access to savings, credit, insurance, and investment products. The widespread adoption of QRIS (Quick Response Code Indonesian Standard), championed by Bank Indonesia as a unified QR code standard, has further facilitated the transition from cash to digital payments, including for small merchants and micro-entrepreneurs in rural areas. In many cases, remittances are now directly credited into accounts that can be used for everyday transactions via QRIS, which reduces cash handling risks and increases the traceability of funds.

These developments support national priorities around digital transformation and inclusive growth, themes that resonate strongly with the policy-focused analysis available in FinanceTechX's business and economy sections. As regulators refine open banking frameworks and explore data-sharing standards, the potential for more integrated, user-centric remittance solutions continues to expand.

Competitive Dynamics and Ecosystem Convergence

The competitive landscape of Indonesia's remittance market in 2026 is shaped by the interplay between global incumbents, digital disruptors, domestic banks, and local fintech startups. Traditional money transfer operators still retain a loyal customer base, particularly among older migrants and recipients who are more comfortable with cash-based transactions and physical service points. However, their market share is being steadily eroded by digital platforms that emphasize real-time exchange rates, transparent fee structures, and user-friendly mobile experiences.

Global fintechs such as Wise and Remitly have built strong positions in corridors linking Indonesia with the United States, the United Kingdom, Europe, and high-income Asian economies, leveraging technology and regulatory passports from jurisdictions like the United Kingdom's Financial Conduct Authority (FCA) and Monetary Authority of Singapore (MAS). Meanwhile, Indonesian banks and wallets are leveraging their deep local networks and brand trust to offer integrated propositions that combine domestic payments, salary disbursement, bill payments, and cross-border transfers in a single app. This competition is driving continuous improvements in pricing, speed, and service quality, ultimately benefiting migrant workers and their families.

For a global audience of founders, investors, and policymakers following these dynamics, FinanceTechX's world and fintech coverage provides a useful lens on how Indonesia's experience compares with other major remittance markets and where new opportunities may emerge.

Exchange Rates, Macroeconomic Conditions, and Household Welfare

The real value of remittances in Indonesia is closely tied to movements in the Indonesian Rupiah (IDR) and broader macroeconomic conditions. Fluctuations in exchange rates against the US Dollar, Euro, Singapore Dollar, Malaysian Ringgit, and other key currencies can significantly alter the purchasing power of remitted funds. When the rupiah depreciates, families receiving money from abroad often see a boost in local currency terms, which can temporarily support consumption and investment. However, persistent weakness in the currency may also signal underlying economic vulnerabilities, including inflationary pressures and capital outflows, which can erode the long-term benefits of remittances.

Monetary policy decisions by Bank Indonesia, including interest rate adjustments and liquidity management, influence the broader cost environment for remittance providers and the financial sector more generally. Higher domestic inflation raises the cost of living, increasing the dependence of households on overseas income, while also affecting the real returns on savings and investments funded by remittances. For businesses and investors analyzing these dynamics, the macroeconomic context explored in FinanceTechX's economy insights provides essential background on how remittance flows interact with growth, inflation, and exchange rate stability.

Cross-Border Payment Integration and Regional Cooperation

Indonesia's remittance transformation is also being shaped by regional and global initiatives to modernize cross-border payments. Within Southeast Asia, the push for interoperable real-time payment systems has intensified, with projects linking Indonesia's payment infrastructure to counterparts in Singapore, Thailand, Malaysia, and beyond. Initiatives such as cross-border QR code payments and real-time account-to-account transfers, supported by central banks and regulators across ASEAN, are reducing the friction and cost associated with sending money between countries where many Indonesians live and work.

International institutions including the International Monetary Fund (IMF) and the World Bank have prioritized the reduction of remittance costs as part of the global development agenda, in line with the UN Sustainable Development Goals that seek to bring average remittance fees below 3 percent. These efforts have encouraged greater transparency in pricing, the adoption of digital channels, and the development of new standards for messaging and settlement, such as ISO 20022 and initiatives under the G20 Roadmap for Enhancing Cross-Border Payments. For Indonesia, which is deeply integrated into regional labor markets and trade flows, these reforms offer the potential to make remittances more efficient and inclusive, supporting broader economic integration across Asia and beyond.

The intersection of these payment innovations with digital assets and blockchain-based systems is covered extensively in FinanceTechX's crypto section, where the implications for remittances and cross-border finance are analyzed from both a technological and regulatory standpoint.

Central Bank Digital Currency and the Digital Rupiah Vision

One of the most closely watched developments in Indonesia's financial innovation agenda is the exploration of a central bank digital currency, often referred to as the Digital Rupiah. Bank Indonesia has been studying and piloting CBDC architectures in line with global experimentation led by central banks such as the People's Bank of China, the European Central Bank, and the Bank of England, with a particular focus on how digital central bank money could enhance payment efficiency, monetary policy transmission, and financial inclusion.

For remittances, a well-designed CBDC could offer a regulated, programmable, and interoperable instrument for cross-border transfers, potentially enabling near-instant settlement between participating jurisdictions at lower cost and with higher transparency. Collaborative projects among ASEAN central banks and with partners in regions such as Europe and the Middle East could, over time, establish multi-CBDC platforms that directly connect digital currencies, reducing reliance on correspondent banking chains and legacy infrastructure. However, these possibilities also raise complex questions related to data governance, capital flows, exchange rate management, and the role of commercial banks, which regulators are approaching with caution.

For business leaders and financial institutions monitoring CBDC developments and their impact on banking and payments, the banking coverage at FinanceTechX offers ongoing analysis of central bank strategies and the evolving regulatory perimeter.

Security, Compliance, and the Fight Against Financial Crime

As the remittance ecosystem becomes more digital and interconnected, security and compliance have moved to the center of strategic and regulatory discussions. Cybersecurity threats, identity theft, phishing attacks, and sophisticated money laundering schemes all pose significant challenges to providers and regulators. Indonesia's authorities, working in alignment with FATF standards and regional frameworks, have strengthened Know Your Customer (KYC), Anti-Money Laundering (AML), and Counter-Terrorist Financing (CTF) requirements for banks, fintechs, and money transfer operators.

Advanced analytics and AI-based monitoring tools are increasingly deployed to detect anomalies in transaction patterns, flag suspicious activities, and automate reporting obligations. Biometric authentication, device fingerprinting, and strong customer authentication methods are becoming standard features in remittance applications, offering improved protection for migrant workers who may be particularly vulnerable to fraud. For a business audience evaluating these risks and controls, the security analysis on FinanceTechX provides a deeper look at the evolving threat landscape and the best practices that are emerging across markets.

Sustainability, Green Fintech, and the Social Impact of Remittances

Sustainability considerations are progressively influencing how Indonesia's remittance industry is designed and evaluated. From an environmental perspective, the shift from paper-based, branch-heavy processes to digital channels reduces the carbon footprint associated with physical infrastructure and cash logistics. From a social standpoint, remittances are a powerful tool for improving access to education, healthcare, and basic services, particularly in communities where formal safety nets are limited. International organizations such as the UN Development Programme (UNDP) and OECD have emphasized the importance of channeling remittance flows into productive uses, including savings, small business investment, and community development projects.

Indonesian fintech startups and financial institutions are beginning to explore models that integrate remittances with micro-savings, micro-insurance, and impact investing platforms, enabling senders and recipients to allocate a portion of transfers to long-term goals or socially responsible initiatives. These developments align with the broader rise of green fintech, where digital financial tools are used to support climate resilience, renewable energy projects, and inclusive growth. The convergence of remittances and sustainable finance themes is tracked in FinanceTechX's green fintech insights, which showcase how financial innovation can serve both profitability and societal objectives.

Labor Mobility, Skills, and the Changing Profile of the Diaspora

While low- and semi-skilled migrant workers remain the backbone of Indonesia's remittance flows, the profile of the diaspora is gradually diversifying. Increasing numbers of Indonesian professionals in technology, finance, healthcare, academia, and creative industries are building careers in advanced economies such as the United States, United Kingdom, Germany, the Netherlands, Canada, Australia, Singapore, and Japan. These professionals often remit funds not only for family support but also as part of investment, philanthropy, and entrepreneurial activities in Indonesia, including funding startups, property purchases, and local ventures.

Government agencies and private sector organizations are seeking to harness this evolving diaspora profile through engagement platforms, diaspora bonds, and targeted investment vehicles that channel overseas capital and expertise back into the domestic economy. This shift from purely consumption-oriented remittances to more diversified financial linkages mirrors trends seen in other major remittance-receiving countries and opens new avenues for innovation in wealth management, cross-border investing, and digital banking. For readers interested in the intersection of global employment trends, skills mobility, and financial innovation, the jobs and founders coverage at FinanceTechX and founders insights provide additional context.

Global Benchmarks and Lessons for Indonesia's Next Phase

Indonesia's remittance story is often compared with that of other large recipients such as India, the Philippines, and Mexico, which have developed sophisticated frameworks to leverage diaspora income for national development. The Philippines, with its extensive network of Overseas Filipino Worker (OFW) programs and dedicated bank products, has demonstrated how structured engagement and tailored financial services can maximize the benefits of remittances. India has shown how a diverse, highly skilled diaspora can sustain record-breaking inflows that help stabilize the balance of payments and support domestic investment. Mexico's integration of remittances into local banking systems and social programs offers another model of how cross-border transfers can reinforce community resilience.

Indonesia has drawn on these examples while tailoring its approach to local conditions, emphasizing digital inclusion, regulatory modernization, and regional payment integration. Challenges remain, including the need to further reduce costs in certain corridors, extend formal financial access to remote communities, strengthen labor protections, and ensure that rapid innovation does not outpace risk management capabilities. Yet the trajectory is clear: remittances are evolving from a fragmented, cash-heavy market into a digitally enabled, strategically managed component of Indonesia's financial system.

For a global business audience and financial leaders following these developments, FinanceTechX serves as a dedicated platform that connects insights across fintech, banking, crypto, AI, sustainability, and macroeconomics. By examining Indonesia's remittance transformation alongside parallel trends in other regions, FinanceTechX aims to provide the analytical depth and cross-market perspective needed to navigate a world where cross-border financial flows are increasingly digital, integrated, and central to economic resilience.