The Future of Australian Fintech in a Connected, Low-Carbon, AI-Driven World

Australian fintech has entered 2026 not as a promising experiment on the fringes of finance, but as a mature, strategically important pillar of the national economy, tightly interwoven with global capital markets, digital regulation, and climate policy. From the vantage point of financetechx.com, which tracks the convergence of finance and technology across regions and asset classes, Australia now stands out as a testbed where advanced payments, digital banking, blockchain infrastructure, artificial intelligence, and green finance are being deployed at scale, often in partnership with global institutions and technology platforms. This evolution has elevated the country from a regional innovator to a reference point for regulators, founders, and investors from the United States, Europe, and Asia who are seeking practical models for secure, data-driven, and sustainable financial systems.

From Disruption to Integration: How Australian Fintech Grew Up

The Australian fintech story began in earnest in the early 2010s, when a new generation of startups challenged the dominance of the "big four" banks-Commonwealth Bank of Australia, Westpac, National Australia Bank, and ANZ Banking Group-by offering faster, cheaper, and more intuitive digital experiences. What initially appeared to be niche experiments in online payments, peer-to-peer lending, and app-based budgeting soon evolved into a structural shift in how Australians interacted with money. The rise of Afterpay, which helped define the global buy-now-pay-later segment before being acquired by Block, Inc., signaled that Australian innovators could shape consumer finance far beyond their domestic market. Similar trajectories have since emerged in digital wallets, cross-border payments, and wealthtech, reinforcing the perception that Australian fintech is capable of setting global product standards rather than merely following them.

Regulation played a decisive enabling role in this transition from disruption to integration. The introduction of the Consumer Data Right (CDR) and the rollout of open banking, later expanded into energy and telecommunications, created a common data infrastructure that allowed new entrants to compete on user experience, analytics, and personalization, while incumbent institutions retained their scale and balance sheet advantages. By requiring secure, permission-based data sharing, policymakers catalyzed a wave of API-driven innovation that reshaped business models in lending, payments, and digital advisory. Readers who follow broader shifts in digital competition and data-driven business models can explore how open data is transforming markets globally through resources such as the OECD's work on data governance.

The Market in 2026: Scale, Sophistication, and Sector Diversity

By 2026, the Australian fintech ecosystem has moved beyond its startup-centric origins to become a layered, diversified market that includes early-stage ventures, growth-stage scale-ups, and deeply integrated partnerships with major banks, insurers, and asset managers. Industry estimates now place total annual revenue well in excess of AUD 10 billion, with more than 1,000 active firms operating across payments, alternative lending, digital banking, wealthtech, regtech, insurtech, crypto and digital assets, and green finance. Sydney and Melbourne remain the gravitational centers, with Sydney's status as a global financial hub reinforced by innovation platforms such as Stone & Chalk, while Melbourne has deepened its specialization in payments, trading technology, and wealth management. Secondary cities including Brisbane, Adelaide, and Perth have positioned themselves as focal points for blockchain experimentation, mining-linked financial services, and climate-aligned finance.

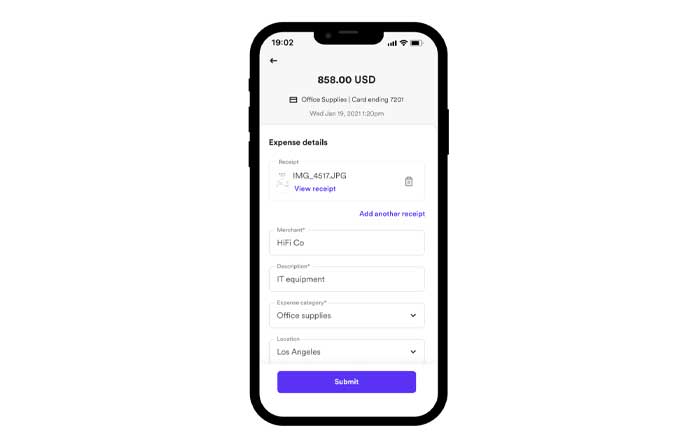

What distinguishes the 2026 landscape is the degree of integration between fintech and the broader business ecosystem. Embedded finance is now a standard feature of e-commerce, mobility, and platform-based service models, with non-financial companies integrating lending, insurance, and payments directly into user journeys. For readers at financetechx.com tracking how these models reshape corporate strategy and sector competition, the coverage at FinanceTechX Business offers a useful lens on how Australian firms are adopting embedded finance and platform economics to compete regionally and globally.

Regulation, Supervision, and the Balance Between Innovation and Stability

The regulatory architecture underpinning Australian fintech has continued to mature, with Australian Securities and Investments Commission (ASIC), the Australian Prudential Regulation Authority (APRA), and the Reserve Bank of Australia playing complementary roles in supervising innovation while maintaining financial stability and consumer protection. Regulatory sandboxes, first introduced to allow controlled experimentation, have been refined into more structured innovation pathways, enabling startups and incumbents to co-develop products under defined risk, reporting, and consumer-outcome frameworks. This has been particularly important for complex domains such as digital assets, algorithmic lending, and AI-enabled advisory, where the potential for systemic and conduct risk is high.

Open banking has evolved into a broader open data regime anchored in the Consumer Data Right, with progressive expansion into sectors such as superannuation and insurance under active consideration. This cross-sector approach is increasingly viewed by international observers as a template for a competitive yet safe data economy, with regulators in the United Kingdom, the European Union, and Singapore closely monitoring Australian experience as they refine their own frameworks. Those interested in comparative regulatory developments can follow global perspectives through institutions such as the Bank for International Settlements and the Financial Stability Board, which regularly reference Australia's policy experiments in their analysis of digital finance.

Capital Flows, Global Investors, and Cross-Border Expansion

On the capital side, Australian fintech has remained attractive despite global cycles of tightening and risk repricing. Domestic venture firms, corporate venture arms of major banks, and international investors from the United States, Europe, and Asia continue to deploy capital into high-growth segments including instant payments, cross-border remittances, digital wealth platforms, and regtech. The presence of global players such as Stripe, Revolut, Wise, and PayPal in the Australian market, often operating alongside or in partnership with local innovators, underscores the country's strategic importance as both a test market and a regional hub for Asia-Pacific expansion.

At the same time, Australian fintechs have become more outward-looking, targeting markets such as Singapore, Hong Kong, Japan, South Korea, and, selectively, the United States and the United Kingdom. These expansions are frequently structured through licensing partnerships, joint ventures, or white-label technology offerings that leverage Australia's strengths in compliance, risk management, and user-centric product design. For investors and market participants following how fintech valuations translate into public and private capital markets, the analysis at FinanceTechX Stock Exchange provides additional context on listings, exits, and cross-border financing structures.

Technology Engines: AI, Data, Blockchain, and Security

The technological foundation of Australian fintech in 2026 is dominated by advanced analytics and artificial intelligence. Machine learning models are now embedded across the value chain, from real-time fraud detection and transaction monitoring to dynamic pricing in lending, portfolio optimization in wealth management, and personalized nudges in budgeting and savings applications. Major banks and leading fintechs are investing heavily in model governance, explainability, and bias mitigation frameworks, recognizing that trust in AI-driven decisions is as critical as accuracy. For those seeking deeper analysis of these developments, FinanceTechX AI explores how AI is reshaping financial services, risk management, and customer interaction across regions.

Blockchain and distributed ledger technology have also progressed from proof-of-concept experiments to production-grade infrastructure in several domains. Tokenization of real-world assets, including real estate, commodities, and carbon credits, is gaining traction, supported by evolving regulatory clarity around custody, settlement, and investor protection. Australian exchanges and custodians are experimenting with blockchain-based settlement systems that promise shorter cycles, lower operational risk, and more transparent audit trails. These trends align with broader international moves toward tokenized markets, as documented by organizations such as the World Economic Forum and the International Monetary Fund, which see tokenization as a structural shift in capital market infrastructure.

Cybersecurity has become a top-tier strategic priority following several high-profile incidents in the broader Australian corporate sector. Fintechs and incumbents alike are investing in zero-trust architectures, advanced encryption, behavioral biometrics, and, increasingly, research into quantum-resistant cryptography. Collaboration between financial institutions, cybersecurity specialists, and public agencies has intensified, with information-sharing frameworks and joint response protocols designed to contain and remediate breaches more effectively. Readers can explore how these security imperatives intersect with product design and regulatory expectations at FinanceTechX Security.

Core Segments: Payments, Lending, Wealth, and Digital Assets

Payments remain the most visible expression of fintech's impact on everyday life. The New Payments Platform (NPP), supported by the Reserve Bank of Australia, has continued to expand its capabilities, enabling real-time, data-rich payments between individuals, businesses, and government entities. Overlay services built on top of the NPP are enabling request-to-pay functionality, automated reconciliation for small and medium-sized enterprises, and more sophisticated subscription and billing models. Mobile wallets and contactless payments have become ubiquitous, with solutions from Apple Pay, Google Pay, Samsung Pay, Zip Co, and others competing on convenience, rewards, and integration with broader digital ecosystems. Internationally, Australia is now frequently cited alongside Sweden and the Netherlands in analyses by organizations such as the Bank for International Settlements as a leading example of high-adoption digital payments markets.

In lending and alternative finance, marketplace lenders, invoice financing platforms, and specialized SME credit providers are using alternative data and AI-driven scoring models to serve segments that have historically struggled to access bank credit. These include early-stage startups, gig-economy workers, and businesses in regional areas. While this has improved financial inclusion, it has also prompted regulators to tighten oversight of responsible lending practices and algorithmic transparency, particularly in light of global debates about fairness and discrimination in automated decision-making. For a broader view of how these trends intersect with traditional banking models, readers can refer to FinanceTechX Banking, which examines the evolving relationship between banks and fintech challengers.

Wealth management and digital advisory have undergone a parallel transformation. Robo-advisors and app-based investment platforms have democratized access to diversified portfolios, exchange-traded funds, and global equities, often with low minimum balances and transparent, flat-fee pricing. Australian platforms such as Raiz Invest and Spaceship have continued to refine their offerings, integrating behavioral insights, educational content, and ESG-aligned portfolios to appeal to younger cohorts. The integration of environmental, social, and governance considerations has become mainstream, with institutional investors and retail platforms alike drawing on frameworks from bodies such as the UN Principles for Responsible Investment to structure and report on sustainable portfolios.

Cryptocurrency and broader digital asset services have moved into a more regulated phase. Exchanges such as CoinSpot and Independent Reserve now operate under tighter licensing and capital requirements, anti-money-laundering controls, and consumer disclosure rules. Institutional interest has shifted from speculative trading toward applications in decentralized finance, tokenized funds, and programmable money for cross-border trade. The global regulatory environment remains fluid, with the Financial Action Task Force and national authorities refining standards on travel rules, stablecoins, and custody. Within this context, Australian policymakers have sought to balance innovation with systemic risk safeguards. For readers tracking these developments, FinanceTechX Crypto provides ongoing coverage of digital asset regulation, market structure, and institutional adoption.

Green Fintech, Climate Risk, and Sustainable Finance

One of the defining characteristics of Australian fintech in the second half of the 2020s is the growing alignment with climate objectives and sustainable finance. Startups and established institutions are building tools that allow consumers and businesses to measure, reduce, and offset the environmental impact of their financial decisions. These include transaction-level carbon footprint trackers embedded in banking apps, platforms for investing in renewable energy and climate infrastructure, and marketplaces for verified carbon credits. Many of these solutions respond to regulatory and disclosure requirements shaped by frameworks such as the Task Force on Climate-Related Financial Disclosures and, more recently, the work of the International Sustainability Standards Board, which are increasingly embedded into reporting standards across Europe, North America, and Asia-Pacific.

For financetechx.com, which has long highlighted the strategic importance of climate-aligned finance, Australian developments in green fintech offer a concrete illustration of how financial innovation can support national and corporate net-zero commitments. The dedicated coverage at FinanceTechX Green Fintech and FinanceTechX Environment examines how these tools are being integrated into mainstream banking, asset management, and corporate treasury functions, and how they are influencing investor expectations in markets from Europe to Asia.

Founders, Talent, and the Changing Nature of Financial Careers

The continued dynamism of Australian fintech depends heavily on its founders and talent pipeline. Many of the sector's leading entrepreneurs are former executives or technologists from major banks, consulting firms, and global technology companies who bring deep domain expertise and international networks. High-profile figures such as Nick Molnar of Afterpay and Larry Diamond of Zip Co have helped establish a template for globally ambitious Australian fintech ventures, inspiring a new generation of founders who are more comfortable building for international markets from day one. Incubators and accelerators including Stone & Chalk, H2 Ventures, and university-linked innovation hubs have institutionalized support structures for these founders, providing mentorship, regulatory guidance, and access to early-stage capital.

From a labor market perspective, fintech is reshaping the profile of financial careers in Australia. Demand is strong for data scientists, machine learning engineers, cybersecurity specialists, product managers, and compliance professionals who understand digital business models. Hybrid roles that combine financial literacy, coding skills, and regulatory knowledge are increasingly common, reflecting the interdisciplinary nature of digital finance. Remote and hybrid work patterns have enabled firms to tap talent beyond Sydney and Melbourne, distributing high-value roles into regional centers and, in some cases, into other countries. Readers interested in how these shifts translate into concrete career opportunities can explore FinanceTechX Jobs, which tracks fintech-related roles and skills trends across markets.

Education providers have responded to this demand by launching specialized degree programs in fintech, data analytics, and cybersecurity, often in partnership with industry. Short-course offerings and professional certifications have proliferated, enabling mid-career professionals to reskill or upskill as automation and AI alter traditional roles in banking, insurance, and asset management. This evolving talent ecosystem is discussed further at FinanceTechX Education, which examines how universities, bootcamps, and corporate training programs are aligning curricula with the needs of a digitized financial system.

Macroeconomic Impact and Australia's Global Position

At the macroeconomic level, fintech is now recognized as a contributor not only to innovation and productivity, but also to financial inclusion and resilience. Digital payments and alternative lending platforms have helped small and medium-sized enterprises, freelancers, and regional communities access services that were historically concentrated in major urban centers or reserved for larger corporates. This has supported entrepreneurship and job creation across Australia, while also reinforcing the stability of the financial system by diversifying funding channels. Broader analysis of how fintech interacts with inflation dynamics, monetary policy transmission, and economic growth can be found at FinanceTechX Economy, which places Australian developments in a global macro context.

Internationally, Australia is now widely viewed as a key node in the global fintech network. Its regulatory frameworks, digital payments infrastructure, and climate-aligned finance initiatives are studied by policymakers in Europe, North America, and Asia. The country's active participation in forums such as the Singapore FinTech Festival, Money20/20, and the Intersekt FinTech Festival has reinforced its role as a convening platform where regional and global players exchange ideas, strike partnerships, and test cross-border solutions. Reports from the World Bank and other multilateral institutions frequently reference Australia when highlighting best practices in digital financial inclusion and open data regimes.

Looking Toward 2030: Scenarios, Risks, and Strategic Choices

As the industry looks toward 2030, several structural themes will shape the trajectory of Australian fintech. The first is the deepening of AI integration, with predictive and generative models likely to transform customer interaction, credit risk assessment, and investment management. This will require robust governance frameworks, ethical guidelines, and regulatory oversight to maintain trust and prevent systemic biases. The second is the gradual tokenization of financial and real assets, which could redefine how ownership, collateral, and liquidity are managed across markets, but will also raise complex questions about legal enforceability, cross-border regulation, and cybersecurity.

A third theme is the continued fusion of fintech with climate and nature-related finance, as regulators and investors increasingly demand granular, auditable data on environmental impacts and transition plans. Australian fintechs are well placed to build the data and analytics infrastructure required for this transition, but they will need to navigate evolving global standards, including those emanating from the Network for Greening the Financial System and related initiatives. Finally, geopolitical fragmentation and shifts in global trade patterns could reshape cross-border payment networks, data flows, and capital allocation, requiring Australian firms to diversify partnerships and maintain operational resilience in a more uncertain global environment.

What It Means for FinanceTechX Readers

For the global audience of financetechx.com, spanning founders, institutional investors, policymakers, and technology leaders from the United States, Europe, Asia, and beyond, the Australian fintech experience offers a compact but powerful case study in how regulation, technology, and entrepreneurial talent can be combined to build a competitive, trusted, and increasingly sustainable financial system. The country's journey from early disruption to mature integration illuminates many of the issues that now confront financial sectors worldwide: how to manage the risks and opportunities of AI; how to design open data regimes that foster competition without undermining privacy; how to embed climate objectives into core financial products; and how to develop a talent base capable of operating at the intersection of finance, technology, and regulation.

As financetechx.com continues to track developments across fintech, banking, crypto, AI, green finance, and global markets, Australian fintech will remain a central reference point. Readers can follow ongoing coverage through dedicated sections such as FinanceTechX Fintech, FinanceTechX Banking, FinanceTechX Crypto, and FinanceTechX World, which situate Australian innovation within the broader shifts reshaping financial systems from North America and Europe to Asia, Africa, and South America. In doing so, the platform aims to provide a trusted, globally informed perspective on how markets like Australia are helping to define the future architecture of finance.