The 10 Biggest U.S. Fintech Companies Redefining Global Finance in 2026

The United States remains the epicenter of financial technology in 2026, with its leading fintech companies now operating as critical infrastructure for the global economy rather than as peripheral disruptors. These organizations process trillions of dollars in annual transaction volume, support hundreds of millions of users across North America, Europe, Asia, and beyond, and increasingly influence regulatory agendas, labor markets, and competitive dynamics in traditional banking and capital markets. For FinanceTechX, which is dedicated to tracking how technology reshapes finance, business, and the global economy, understanding the role of these firms is not merely about rankings or valuations; it is about assessing the architecture of the next financial era and the implications for stakeholders from founders and regulators to institutional investors and policymakers. Readers seeking broader context on these themes can explore the dedicated hubs on fintech, banking, stock exchanges, and the economy, where these shifts are examined in depth.

In 2026, the top U.S. fintech players combine scale, technological sophistication, and regulatory maturity to a degree unmatched in any other market. They operate at the intersection of payments, banking, crypto, data infrastructure, and AI, while competing and collaborating with incumbent banks, big tech platforms, and emerging challengers from Europe, Asia, and Latin America. Their evolution illustrates how experience, expertise, authoritativeness, and trustworthiness have become decisive assets in a sector once defined mainly by speed and disruption.

Stripe: Operating System for the Internet Economy

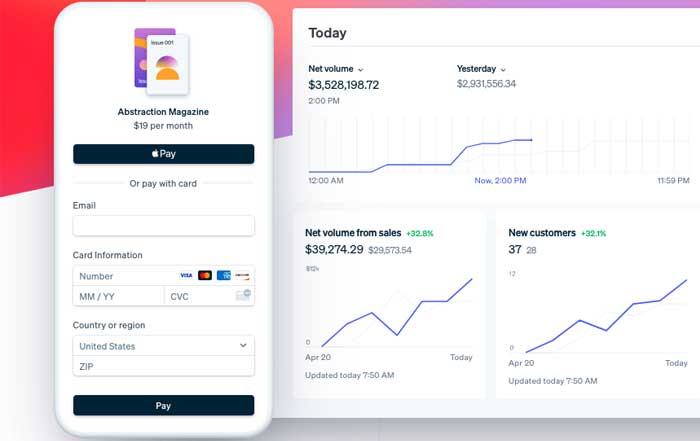

Stripe has cemented its position as one of the most consequential financial infrastructure providers globally. Founded in 2010 by Patrick Collison and John Collison, the company has grown from a developer-friendly payment gateway into a broad financial stack underpinning digital commerce in the United States, Europe, Asia-Pacific, and increasingly in emerging markets. Its platform is now embedded in the operations of global leaders such as Amazon, Shopify, and Lyft, as well as millions of small and medium-sized enterprises.

Stripe's competitive edge lies in its deeply engineered, API-first architecture that abstracts away the complexity of payments, compliance, and localization for businesses operating across multiple jurisdictions. Its offerings span core payments, billing, invoicing, fraud prevention, tax calculation, and embedded finance via products such as Stripe Treasury and Stripe Issuing, which enable companies to offer accounts and cards without building banking infrastructure from scratch. Initiatives like Stripe Atlas continue to support founders and start-ups, particularly in the United States, the United Kingdom, Germany, Singapore, and other innovation hubs, by simplifying company formation and access to financial rails.

From a regulatory and trust perspective, Stripe's trajectory reflects a deliberate strategy: building robust risk, compliance, and security capabilities in parallel with product expansion. The firm invests heavily in machine learning and AI-driven fraud detection, aligning with trends highlighted by institutions such as the Bank for International Settlements that emphasize the systemic importance of resilient payment infrastructures. For FinanceTechX's audience of business leaders and founders, Stripe exemplifies how a fintech can evolve from a narrow product to a foundational layer of the digital economy, a theme explored further in our business coverage.

PayPal: Veteran Fintech Powerhouse in a Platform World

PayPal remains one of the most recognizable and trusted names in digital finance in 2026. Since its origins in the late 1990s and subsequent evolution from a payments innovator into a listed global platform, the company has repeatedly demonstrated its ability to adapt to new paradigms, from e-commerce and mobile to crypto and embedded finance. Its ecosystem, anchored by the core PayPal wallet, includes Venmo for peer-to-peer payments and Braintree as a sophisticated gateway used by leading online merchants.

The company's scale-hundreds of millions of active accounts worldwide-gives it a powerful network effect, particularly in the United States, the United Kingdom, and major European markets such as Germany and France. PayPal's move into digital assets, allowing users to buy and hold cryptocurrencies and stablecoins within its ecosystem, has positioned it as a bridge between traditional financial systems and emerging decentralized networks. This role has attracted close attention from regulators, including the U.S. Securities and Exchange Commission and central banks monitoring the interaction between private digital money and public monetary frameworks.

PayPal's long history of regulatory engagement, risk management, and consumer protection has become a strategic asset as scrutiny intensifies on fintechs' role in systemic stability and data protection. For professionals following how fintech platforms shape employment, financial access, and consumer trust-especially in North America and Europe-FinanceTechX's jobs and economy sections provide deeper analytical context around the company's evolving role.

Block: A Connected Ecosystem for Consumers, Merchants, and Crypto

Block, the parent company of Square and Cash App, has transformed from a niche card-reader start-up founded by Jack Dorsey into a multifaceted ecosystem spanning merchant services, consumer finance, and blockchain innovation. In 2026, Block's impact is visible on both sides of the transaction: small merchants and independent businesses rely on its point-of-sale hardware and software, while tens of millions of consumers use Cash App for payments, salary deposits, stock trading, and Bitcoin investments.

Cash App's cultural resonance, particularly among younger demographics in the United States, has been a key driver of growth. Its intuitive interface, rapid onboarding, and integration of social features have turned it into a gateway to financial services for populations historically underserved by traditional banks. At the same time, Square's merchant solutions compete directly with legacy providers such as Fiserv's Clover and FIS's merchant offerings, especially in markets like the U.S., Canada, the United Kingdom, and Australia, where small business digitization has accelerated.

Block's TBD division and other blockchain initiatives illustrate the company's ambition to play a defining role in decentralized finance and open financial protocols. This direction aligns with broader industry experimentation tracked by organizations such as the World Economic Forum and resonates strongly with FinanceTechX readers interested in the convergence of payments, crypto, and AI-driven financial services. For founders and executives, Block's strategy offers a case study in building a multi-sided financial platform, a topic we continue to explore on our founders vertical.

Robinhood: Retail Market Access and the Governance Challenge

Robinhood remains one of the most influential and scrutinized retail trading platforms in the United States. Founded by Vlad Tenev and Baiju Bhatt, the company's commission-free trading model reshaped the brokerage industry, compelling incumbent firms across North America and Europe to eliminate trading fees. By 2026, Robinhood's product suite spans U.S. equities, options, exchange-traded funds, selected international exposures, crypto trading, cash management, and retirement accounts.

The firm's mission of "democratizing finance" has brought millions of first-time investors into the markets, including younger users in the United States, the United Kingdom, and increasingly in other regions as the company explores international expansion. However, its journey has also underscored the governance and risk challenges facing high-growth fintechs. Episodes such as trading restrictions during the 2021 "meme stock" surge, platform outages, and debates over gamification prompted intense scrutiny from regulators and policymakers, including hearings and investigations documented by bodies such as the U.S. House Financial Services Committee.

In response, Robinhood has invested in compliance, investor education, and transparency, while regulators and investor-protection advocates-from the Financial Industry Regulatory Authority to European supervisory authorities-have tightened expectations for digital brokers. For FinanceTechX readers following the evolution of capital markets access, our stock exchange and education coverage examines how platforms like Robinhood are reshaping market participation and what this means for financial literacy and systemic risk.

Coinbase: Institutionalizing Digital Assets

Coinbase continues to serve as a central gateway to the digital asset economy in 2026. Since its founding by Brian Armstrong and Fred Ehrsam, and especially following its 2021 public listing, Coinbase has transitioned from a retail-focused exchange into a multi-layered platform serving individuals, corporates, and institutions worldwide. Its services now include spot trading, derivatives in selected jurisdictions, institutional custody, staking, stablecoin infrastructure, and developer tools that power Web3 and decentralized applications.

The company's enduring significance lies in its dual identity as both a technology innovator and a key interlocutor with regulators. Coinbase's ongoing engagement with U.S. agencies, European regulators, and international standard-setters such as the Financial Stability Board has placed it at the center of debates over crypto regulation, stablecoins, and market integrity. Its support for stablecoin-based payments and cross-border transfers is particularly relevant for regions where traditional remittance costs remain high, such as parts of Africa, South America, and Southeast Asia.

Despite cycles of volatility in crypto markets, Coinbase's diversified revenue streams and institutional partnerships have helped it maintain influence and credibility. For FinanceTechX readers assessing how digital assets intersect with mainstream finance-from central bank digital currency experiments to tokenized securities-our crypto and world sections provide ongoing analysis of Coinbase's role in the broader ecosystem.

Intuit: Software-Defined Finance for Households and SMEs

Intuit predates the modern fintech wave but has arguably adapted to it more effectively than many younger challengers. With flagship products such as QuickBooks, TurboTax, Mint, and Credit Karma, Intuit has embedded itself into the financial workflows of households and small and medium-sized enterprises across North America, the United Kingdom, and other major markets. Its long history, dating back to 1983, has given it deep domain expertise in tax, accounting, and personal finance.

In 2026, Intuit's strategy centers on harnessing artificial intelligence and data analytics to deliver proactive, personalized financial guidance. Through its AI-driven platforms, small businesses receive real-time cash flow insights and automated bookkeeping, while consumers benefit from tax optimization suggestions, credit monitoring, and tailored recommendations to improve financial health. This approach aligns with the broader trend toward "autonomous finance," in which software anticipates and executes financial decisions within guardrails set by users, a concept explored by research institutions such as the MIT Sloan School of Management.

Intuit's acquisition of Credit Karma extended its reach into credit scoring and consumer decision support, reinforcing its position as a trusted intermediary between individuals and financial products. For FinanceTechX's audience, Intuit illustrates how incumbents can maintain authoritativeness and trust by continuously integrating new technologies, especially AI, into core products, a theme we follow closely in our AI and business coverage.

Chime: Neobanking at Scale

Chime has emerged as the most prominent U.S. neobank, particularly for consumers disillusioned with fee-heavy traditional banking. Founded by Chris Britt and Ryan King, Chime's model focuses on mobile-first checking and savings accounts, early access to direct deposits, automated savings, and credit-building tools, delivered through a streamlined app and supported by partner banks on the back end.

By 2026, Chime serves a broad demographic base across the United States, including many younger, lower-income, and previously underbanked customers. Its revenue model, centered on interchange fees rather than overdraft or maintenance charges, aligns its incentives with customer success and has helped build a reputation for fairness and transparency. This approach is consistent with principles promoted by consumer advocates and regulators, including guidance from the Consumer Financial Protection Bureau on fair access and fee transparency.

Chime's expansion into secured credit cards, small-dollar lending, and employer partnerships reflects a gradual broadening of its value proposition while maintaining a simple, user-centric interface. As neobanking models spread from the U.S. and U.K. to Europe, Asia, and Latin America, Chime's trajectory offers a benchmark for how digital banks can scale responsibly. FinanceTechX explores these dynamics in greater depth in our banking and security sections, where we examine both innovation and risk management in digital retail finance.

Plaid: Infrastructure for Open Finance

Plaid operates largely behind the scenes but has become indispensable to the U.S. and increasingly global fintech ecosystem. Founded by Zach Perret and William Hockey, the company provides the data connectivity layer that allows applications to securely access users' bank and investment account information, subject to consumer consent. Its technology enables personal finance apps, lending platforms, robo-advisors, and payment services to function seamlessly.

In 2026, Plaid sits at the heart of the United States' move toward open banking and broader "open finance," paralleling developments in the United Kingdom and the European Union under frameworks such as PSD2 and the upcoming PSD3, as monitored by bodies like the European Banking Authority. Plaid's partnerships with major U.S. banks and credit unions, as well as fintechs and regulators, have helped shape emerging standards for data access, security, and consumer control.

The company's success is grounded in its focus on security, compliance, and user trust, areas where FinanceTechX's security coverage emphasizes the importance of strong encryption, consent management, and governance. As more countries-from Canada and Australia to Singapore and Brazil-advance their own open data initiatives, Plaid's infrastructure model is likely to play a growing role in enabling cross-border innovation while maintaining regulatory alignment.

SoFi: Toward a Financial Super App

SoFi (Social Finance) has evolved from a niche student loan refinancing provider into a broad-based digital financial institution. With a U.S. banking charter, SoFi now offers checking and savings accounts, personal loans, mortgages, investment services, and insurance products, all integrated into a single mobile-centric platform. Its acquisition of Galileo Financial Technologies expanded its reach into infrastructure, enabling SoFi to power other fintechs' offerings in addition to its own.

By 2026, SoFi's strategy aligns with the "super app" concept prominent in Asia, particularly in markets like China and Singapore, where multi-service platforms dominate consumer digital experiences. SoFi aims to be the primary interface for users' financial lives, from early career stages when student loans and budgeting dominate concerns, through wealth-building and retirement planning. Its brand visibility, bolstered by high-profile assets such as SoFi Stadium in Los Angeles, has strengthened recognition across the United States and attracted interest from international observers considering similar models.

SoFi's emphasis on education, content, and community-providing financial literacy resources and career tools-reinforces its positioning as a long-term partner in users' financial journeys. For FinanceTechX, SoFi's trajectory is highly relevant to readers interested in the convergence of banking, investing, and employment, themes we analyze across our founders, jobs, and education coverage.

Fiserv: A Legacy Titan Powering Modern Payments

Fiserv remains one of the most significant yet often understated players in global financial technology. With origins in the 1980s, the company has long provided core banking systems, payment processing, and digital banking solutions to financial institutions worldwide. Its 2019 acquisition of First Data and the Clover point-of-sale platform transformed Fiserv into a major force in merchant acquiring and in-person payments, competing directly with newer entrants such as Block.

In 2026, Fiserv's influence extends across North America, Europe, and Asia, underpinning services used daily by consumers and businesses, often without their direct awareness. The company invests heavily in real-time payments, cloud migration, and AI-driven fraud detection, aligning with priorities identified by organizations like the Federal Reserve and the European Central Bank as critical to the resilience and modernization of payment systems. Its solutions support banks, credit unions, and merchants of all sizes, from local retailers in the United States and Canada to large financial institutions in Europe and Asia-Pacific.

Fiserv's continued relevance demonstrates that experience and scale, when combined with ongoing innovation, can be a powerful competitive combination. FinanceTechX regularly examines how such legacy providers shape the financial plumbing that underlies consumer-facing innovations, particularly in our economy and banking sections.

FIS: Global Backbone for Banking and Capital Markets

FIS (Fidelity National Information Services) is another cornerstone of global financial infrastructure. With roots dating back to 1968, FIS provides core banking platforms, payment processing, risk management, and capital markets technology to institutions in more than 100 countries. Its acquisition of Worldpay significantly expanded its merchant acquiring and e-commerce capabilities, positioning FIS as a leader in cross-border payments and omnichannel acceptance.

In 2026, FIS supports banks, asset managers, and payment providers across North America, Europe, Asia, and emerging markets, enabling everything from real-time account processing to securities clearing and settlement. The company's strategic focus includes modernizing legacy systems, integrating cloud-native solutions, and exploring blockchain-based settlement and tokenization, in line with exploratory work by entities such as the International Monetary Fund and the Bank of England on the future of money and payments.

FIS's long-standing relationships with regulators and financial institutions give it a high degree of authoritativeness and trust, particularly in areas where operational resilience and compliance are paramount. For FinanceTechX readers tracking how core infrastructure providers influence innovation and competition, FIS represents a critical piece of the global fintech puzzle, intersecting with themes we cover under world and security.

Strategic Themes Shaping U.S. Fintech Leadership in 2026

Collectively, Stripe, PayPal, Block, Robinhood, Coinbase, Intuit, Chime, Plaid, SoFi, Fiserv, and FIS illustrate how U.S. fintech has matured from disruptive insurgency to systemic importance. Their continued evolution is driven by a set of strategic themes that FinanceTechX tracks closely for its global audience.

One defining theme is regulatory evolution. Authorities in the United States, the European Union, the United Kingdom, and key markets in Asia and Latin America are moving toward more comprehensive frameworks for digital assets, data sharing, AI in credit and risk decisions, and operational resilience. The Office of the Comptroller of the Currency and counterparts in Europe and Asia have sharpened expectations around third-party risk, cloud outsourcing, and fintech partnerships, prompting leading firms to invest heavily in compliance and governance. Companies with long regulatory track records, such as PayPal, Intuit, Fiserv, and FIS, often have an advantage in navigating this complexity, while high-growth players like Robinhood and Chime have learned, sometimes painfully, the importance of embedding regulatory expertise early.

Artificial intelligence and automation constitute another critical driver. From fraud detection at Stripe and Fiserv to tax optimization at Intuit and personalized financial guidance at SoFi, AI is becoming deeply woven into financial workflows. Research from institutions like Stanford University's Human-Centered AI Institute highlights both the potential and the risks of algorithmic decision-making in finance, including concerns around bias, explainability, and accountability. FinanceTechX's AI coverage focuses on how leading firms balance innovation with ethical and regulatory expectations in this area.

Competition and consolidation are reshaping the landscape as well. Traditional banks across North America, Europe, and Asia have accelerated digital transformations, often partnering with or acquiring fintech capabilities rather than building everything in-house. Big tech firms-from the United States to China and South Korea-are expanding further into payments, lending, and wealth management, creating new competitive pressures for pure-play fintechs. This environment has fueled mergers, such as SoFi's acquisition of Galileo and Fiserv's acquisition of First Data, and will likely continue to do so as firms seek scale and diversification. FinanceTechX's news and business sections monitor these developments and their implications for market structure.

Global expansion is another central theme. While the top U.S. fintechs are rooted domestically, their growth increasingly depends on international markets, from Europe and the United Kingdom to Singapore, Japan, Brazil, and South Africa. At the same time, regional champions from Europe and Asia are competing more aggressively in cross-border payments, digital banking, and crypto services. Multilateral initiatives and regulatory dialogues-often facilitated by organizations such as the OECD-are helping to harmonize standards, but fragmentation remains a reality that large fintechs must navigate carefully.

Sustainability and green finance are also moving from the periphery to the core of strategy. Programs such as Stripe Climate, and the broader shift toward integrating environmental, social, and governance (ESG) criteria into lending, investment, and payment products, reflect growing expectations from investors, customers, and regulators. Central banks and supervisors, including the Network for Greening the Financial System, are increasingly examining climate-related financial risks and encouraging sustainable finance practices. FinanceTechX's green fintech and environment sections explore how leading U.S. fintechs are responding to these pressures and opportunities.

Why These Companies Matter for the Future of Finance

For the global audience of FinanceTechX, spanning founders, executives, investors, policymakers, and professionals from the United States, Europe, Asia, Africa, and the Americas, the significance of these top U.S. fintech companies goes far beyond their valuations or user numbers. They set technical standards for payment processing, data security, and user experience; they influence regulatory agendas around open banking, crypto, AI, and operational risk; and they shape expectations for what financial services should look like in terms of accessibility, transparency, and personalization.

Each company illustrates a distinct strategic archetype. Stripe and Plaid show how infrastructure providers can quietly become indispensable. PayPal, Fiserv, and FIS demonstrate how legacy experience, when combined with continuous innovation, can sustain leadership. Block, Chime, and SoFi highlight the power of ecosystem thinking-connecting consumers, merchants, and partners in integrated platforms. Robinhood and Coinbase underscore both the transformative potential and the governance responsibilities that come with democratizing access to markets and digital assets. Intuit exemplifies the role of trusted software in making complex financial tasks manageable for households and small businesses.

As the boundaries between finance and technology continue to blur, these organizations embody the qualities that FinanceTechX prioritizes in its coverage: deep domain expertise, operational experience, demonstrable authoritativeness, and a track record of building and maintaining trust at scale. Their decisions in the coming years-on AI deployment, data governance, cross-border expansion, sustainability, and collaboration with regulators-will help determine how inclusive, resilient, and innovative the global financial system becomes.

Readers who wish to stay ahead of these developments can explore FinanceTechX's dedicated hubs on the economy, banking, crypto, stock exchanges, and founders. As these U.S. fintech leaders continue to redefine what is possible in finance, FinanceTechX will remain focused on delivering rigorous, globally relevant analysis that helps businesses and decision-makers navigate the next era of financial innovation.