Fintech in 2026: How a Once-Niche Sector Became the Operating System of Global Finance

Fintech's New Reality in 2026

By 2026, financial technology is no longer a discrete vertical sitting alongside traditional banking and capital markets; it has become the connective infrastructure that underpins how individuals, companies, and institutions across the world move, store, invest, and protect money. What began as a wave of disruptive startups in payments and lending has matured into a complex, globally integrated ecosystem that stretches from mobile money agents in rural Kenya to algorithmic trading desks in New York and London, from embedded finance in European e-commerce to digital banks in Brazil, Singapore, and the Gulf. For the global audience of Financetechx, this shift is not an abstract technological story but a practical transformation that shapes strategy, risk, regulation, and opportunity across every major market and asset class.

The acceleration of fintech between 2020 and 2025, driven by advances in artificial intelligence, blockchain, cloud infrastructure, and open banking, has now given way to a more measured but deeper phase of integration in 2026. Financial incumbents, regulators, and technology platforms have moved from experimentation to large-scale deployment, with fintech now woven into the daily operations of retail banks, insurers, asset managers, and corporates. Consumer expectations, honed by seamless digital experiences in e-commerce and social media, continue to push the sector toward instant, personalized, and ubiquitous financial services, while macroeconomic volatility, geopolitical fragmentation, and climate risk are forcing fintech players to prove resilience, compliance, and long-term value creation.

Against this backdrop, platforms such as Financetechx have become central to decision-makers who need to connect developments in fintech with broader trends in the global economy, regulation, technology, and sustainability. The conversation has moved beyond "fintech versus banks" toward a more nuanced question: how will the evolving partnership between technology and finance reshape business models, capital allocation, and financial inclusion in the United States, Europe, Asia, Africa, and Latin America over the coming decade?

Market Size, Investment Cycles, and Global Trajectory

By 2026, most industry analysts agree that the fintech sector remains on track to exceed a valuation of 400 billion dollars by 2030, yet the path to that figure has been less linear than early projections suggested. Following the exuberant funding cycle of 2021 and the subsequent correction in 2022-2023, capital has become more selective, favoring companies with clear revenue models, robust compliance frameworks, and demonstrable unit economics. According to data collated by organizations such as CB Insights and PitchBook, global fintech funding rebounded in 2024 and 2025, but with a pronounced tilt toward later-stage rounds, infrastructure providers, and B2B platforms rather than pure consumer-facing apps.

North America, and particularly the United States, still captures a substantial share of global fintech investment, anchored by scaled players such as PayPal, Stripe, and Block (formerly Square), as well as a dense ecosystem of specialist lenders, wealthtech firms, regtech providers, and infrastructure startups. The United Kingdom retains its status as Europe's fintech hub despite Brexit-related uncertainty, with Revolut, Wise, and other digital banks and cross-border platforms expanding beyond their home markets. Continental Europe, supported by regulatory frameworks shaped by the European Banking Authority and the European Commission, continues to nurture strong clusters in Germany, France, the Netherlands, and the Nordics, where open banking, embedded finance, and compliance technologies have found fertile ground.

Asia remains the powerhouse of scale, particularly in mobile payments and super-app ecosystems. Ant Group, WeChat Pay, Alipay, Paytm, and Southeast Asian platforms such as Grab and GoTo continue to define what mass-market digital finance looks like at population scale, while Japan and South Korea push forward in digital securities, AI-driven risk models, and blockchain infrastructure. Africa, meanwhile, has moved from being seen purely as a mobile money case study to an increasingly sophisticated laboratory of fintech innovation, with M-Pesa joined by Nigerian, Kenyan, and South African startups building credit, savings, and merchant platforms atop mobile rails. Latin America, led by Nubank and other regional champions, has emerged as one of the fastest-growing fintech markets globally, with Brazil and Mexico attracting sustained venture and private equity interest.

For executives, founders, and investors who follow developments through Financetechx Business and Financetechx World, the key insight in 2026 is that fintech growth is now structurally embedded in national and regional economic strategies. Governments from the United States and United Kingdom to Singapore, the United Arab Emirates, and Brazil increasingly view fintech as a lever for competitiveness, financial inclusion, and innovation, rather than a peripheral startup sector.

Digital Payments, Embedded Finance, and the New Commerce Stack

Digital payments remain the backbone of fintech, but the nature of payment innovation has evolved. In many markets, the basic shift from cash and cards to mobile wallets and instant transfers has already occurred; the frontier now lies in interoperability, cross-border efficiency, and deep integration into commerce platforms. In Asia, mobile wallets account for the majority of consumer payments in China and a growing share in India, Thailand, and Indonesia, with QR-code standards and real-time payment systems driving down transaction costs and expanding access. In Europe and the United States, instant payment schemes and account-to-account transfers are gradually eroding the dominance of card networks, while big-tech wallets such as Apple Pay and Google Pay have become default options in both online and offline retail.

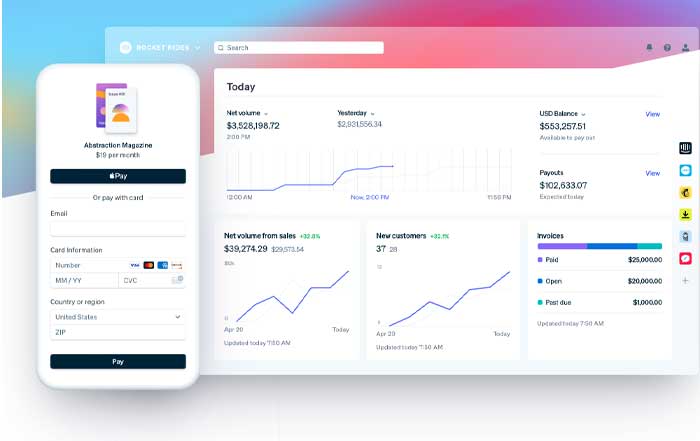

Embedded finance has become one of the defining themes of the 2026 payments landscape. Rather than interacting with standalone banking apps, consumers increasingly encounter financial services within non-financial platforms, whether through buy-now-pay-later options at checkout, integrated working capital solutions for merchants on e-commerce marketplaces, or in-app insurance and savings features within mobility and gig-work platforms. This shift blurs the boundaries between financial services and other industries, creating new competitive dynamics and regulatory questions around liability, consumer protection, and data sharing. Businesses seeking to understand these shifts can explore analysis on banking transformation and its intersection with digital commerce on Financetechx.

For cross-border commerce, payment innovation is increasingly tied to regulatory initiatives such as the Single Euro Payments Area (SEPA) in Europe, faster payments in the United States, and regional real-time payment linkages in Asia and the Gulf. Institutions such as the Bank for International Settlements have been focusing on multi-currency payment platforms and central bank collaboration to reduce friction in international transfers and remittances. Learn more about how cross-border payment initiatives are reshaping global trade and remittances through resources provided by the Bank for International Settlements at bis.org.

Artificial Intelligence: From Hype to Regulated Infrastructure

Artificial intelligence has moved from experimentation to core infrastructure across the financial sector. In 2026, banks, insurers, asset managers, and fintech startups alike deploy AI models for credit scoring, fraud detection, algorithmic trading, personalized product recommendations, and operational automation. The rise of generative AI since 2023 has added new capabilities in document analysis, customer service, and software development, enabling institutions to streamline onboarding, compliance checks, and client communication while reducing manual workloads.

However, this mainstream adoption has triggered a parallel wave of regulatory scrutiny. Authorities in the United States, the European Union, the United Kingdom, and Asia are increasingly focused on algorithmic transparency, model governance, and bias mitigation, particularly in lending and insurance. The European Union's AI Act, for example, classifies many financial AI applications as high-risk, requiring rigorous testing, documentation, and oversight. In the United States, agencies such as the Consumer Financial Protection Bureau (CFPB) and Federal Reserve have issued guidance on the use of AI in credit decisions and risk management, emphasizing fair lending and explainability.

For professionals tracking AI's impact on financial services, Financetechx AI provides ongoing coverage of regulatory developments, practical deployment case studies, and workforce implications. Complementing this, organizations such as The Alan Turing Institute and MIT Sloan School of Management publish research on responsible AI in finance, offering frameworks and tools for institutions that need to balance innovation with compliance and trust. Learn more about responsible AI practices in financial services through resources from The Alan Turing Institute.

Blockchain, Digital Assets, and the Institutionalization of Crypto

In 2026, blockchain and digital assets occupy a more complex position than at any time since the launch of Bitcoin. The speculative booms and busts of earlier years have given way to a bifurcated landscape: on one side, a maturing institutional market for tokenized assets, stablecoins, and compliant digital asset exchanges; on the other, a still-volatile world of decentralized finance and experimental protocols that continues to challenge regulators and risk managers.

Central bank digital currency (CBDC) projects have advanced significantly. The People's Bank of China has expanded the digital yuan's pilot programs across additional cities and cross-border scenarios, while the European Central Bank continues its work on a potential digital euro design. The Bank of England and other central banks in the United Kingdom, Canada, and the Nordics are conducting detailed consultations on the architecture, privacy safeguards, and financial stability implications of retail and wholesale CBDCs. These initiatives could reshape the relationship between central banks, commercial banks, and fintech intermediaries, particularly in cross-border settlement and programmable money use cases.

At the same time, tokenization of traditional assets has moved from proof-of-concept to early commercialization. Major financial institutions in the United States, Europe, and Asia are experimenting with tokenized money market funds, bonds, and real-estate vehicles, seeking efficiency gains in issuance, settlement, and secondary trading. Stablecoins, particularly those fully backed by high-quality liquid assets, are increasingly integrated into institutional payment and treasury operations, though they remain subject to tightening regulatory frameworks in jurisdictions such as the United States and the European Union.

For readers of Financetechx, the evolution of crypto and digital assets is covered in depth on Financetechx Crypto, where the focus is on the intersection between innovation, regulation, and institutional adoption. Those seeking broader context on central bank initiatives can consult the International Monetary Fund's analyses on digital money and financial stability at imf.org, which provide a global perspective on how digital currencies may interact with capital flows, banking models, and monetary policy.

Green and Sustainable Fintech: From Niche to Strategic Imperative

Sustainability has shifted from branding exercise to strategic requirement across the financial industry, and fintech is no exception. In 2026, green fintech encompasses a broad range of solutions: platforms that enable retail and institutional investors to align portfolios with environmental, social, and governance (ESG) goals; tools that help corporates and banks measure financed emissions; digital marketplaces for carbon credits; and data analytics providers that model climate risk across assets and geographies.

Europe remains at the forefront of sustainable finance regulation, with the European Union's Sustainable Finance Disclosure Regulation (SFDR) and taxonomy rules pushing asset managers and banks to improve transparency and data quality. This regulatory pressure has created a fertile environment for fintech startups specializing in ESG data, impact measurement, and climate scenario analysis. In the United States, the Securities and Exchange Commission (SEC) has advanced climate disclosure requirements for public companies, which in turn drives demand for technology solutions that can ingest, standardize, and report complex environmental data.

Emerging markets are also leveraging green fintech to support climate resilience and transition financing. In regions such as Southeast Asia, Africa, and Latin America, digital platforms are enabling small businesses and households to access green loans, solar leasing, and climate-smart agriculture finance, often in partnership with development banks and international organizations. The World Bank and other multilaterals increasingly reference digital tools as critical enablers of sustainable finance flows to the Global South. Learn more about sustainable business practices and climate finance through resources from the World Bank at worldbank.org.

For the Financetechx community, sustainable innovation is tracked in detail on Financetechx Green Fintech and Financetechx Environment, where the focus is on how technology, regulation, and capital markets converge to support the transition to a low-carbon economy.

Regional Perspectives: United States, Europe, Asia, Africa, and Latin America

In the United States, fintech in 2026 is characterized by a tension between innovation and regulatory consolidation. Digital banks, payments companies, and wealthtech platforms face heightened scrutiny from agencies such as the SEC, CFPB, and Office of the Comptroller of the Currency (OCC), particularly around consumer protection, data privacy, and the use of AI. At the same time, collaboration between large banks and fintechs has deepened, with many incumbents choosing to partner or acquire rather than build every capability in-house. The U.S. remains a global leader in venture-backed fintech, yet capital is increasingly concentrated in proven platforms and infrastructure providers that serve enterprise clients.

In Europe, the interplay between regulation and innovation continues to define the ecosystem. The United Kingdom, despite political and economic uncertainty, maintains a strong pipeline of fintech talent and investment, while the European Union advances initiatives in open finance, instant payments, and digital identity. Countries such as Germany, France, the Netherlands, Sweden, and Denmark host thriving clusters focused on regtech, lending, and sustainable finance. Institutions like the European Central Bank and European Banking Authority play a central role in shaping standards that affect not only EU markets but also global players seeking access to European customers.

Asia presents a diverse and dynamic picture. China's regulatory reset in technology and fintech has led to a more controlled environment for big-tech platforms, yet innovation continues in digital payments, wealth management, and blockchain infrastructure. India's public digital infrastructure, including the Unified Payments Interface (UPI) and Aadhaar identity system, remains a global reference point for inclusive digital finance, inspiring similar initiatives in markets from Brazil to Singapore. Southeast Asia, with Singapore as a regulatory and innovation hub, continues to see strong growth in digital banks, lending platforms, and SME-focused solutions. Japan and South Korea push forward in digital securities, AI-enabled trading, and advanced regtech.

Africa's fintech story in 2026 is one of rapid scaling from a mobile money foundation to more complex, multi-product platforms. Nigeria, Kenya, South Africa, and Egypt are home to startups that offer payments, credit, savings, insurance, and merchant services to both banked and previously unbanked populations. Regulatory frameworks are gradually catching up, with central banks and financial authorities working to balance innovation with systemic risk management and consumer protection. International investors increasingly view African fintech as a long-term structural opportunity rather than a speculative bet, particularly in segments that address SME financing and cross-border trade.

Latin America continues to build on the momentum of the early 2020s. Brazil's instant payment system Pix has transformed the payments landscape, spurring competition and innovation in retail banking and merchant services. Digital banks such as Nubank and other regional players have expanded across borders, while Mexico, Colombia, and Chile refine fintech regulations that aim to foster innovation while addressing money laundering and consumer risks. Across the region, fintech is closely tied to financial inclusion goals, with digital wallets, micro-savings, and alternative credit scoring models playing a central role.

Readers interested in comparative perspectives across these regions can find ongoing coverage on Financetechx World and Financetechx Economy, where regional developments are analyzed through the lens of macroeconomics, regulation, and capital flows.

Security, Regulation, and the Trust Imperative

As fintech's role in the financial system has expanded, so too have the stakes around cybersecurity, operational resilience, and regulatory compliance. High-profile data breaches, ransomware attacks, and fraud incidents in recent years have underscored the systemic implications of vulnerabilities in digital finance infrastructure. Regulators in the United States, United Kingdom, European Union, and Asia have responded with more stringent requirements on incident reporting, third-party risk management, and cloud concentration risk, recognizing that many financial institutions now depend on a small number of technology providers.

Cybersecurity is no longer treated as a back-office IT function but as a board-level strategic priority. Fintech firms, particularly those handling payments, identity, and custody of digital assets, are investing heavily in advanced threat detection, encryption, zero-trust architectures, and secure software development practices. Collaboration between public authorities and the private sector has intensified, with organizations such as the Financial Stability Board and OECD publishing guidance on cyber resilience and operational risk in financial services. Learn more about international standards for financial stability and cyber resilience through resources from the Financial Stability Board at fsb.org.

For the Financetechx audience, the intersection of cybersecurity, regulation, and business strategy is covered in depth on Financetechx Security, where case studies and expert commentary highlight how firms can build trust while operating in an environment of escalating threats and regulatory expectations.

Talent, Skills, and the Future of Work in Fintech

The expansion and maturation of fintech have reshaped labor markets across the United States, Europe, Asia, and beyond. In 2026, demand is strongest for professionals who combine technical expertise with regulatory and domain knowledge: AI engineers who understand model risk management, product managers who can navigate payment regulations in multiple jurisdictions, cybersecurity specialists familiar with financial sector standards, and sustainability experts who can translate climate data into actionable risk metrics for banks and asset managers.

Educational institutions have responded with specialized degrees and executive programs focused on fintech, digital finance, and financial data science. Universities in the United States, United Kingdom, Germany, Singapore, and Australia offer master's programs that blend computer science, finance, and regulation, while online platforms provide modular learning for mid-career professionals seeking to upskill. Organizations such as the CFA Institute have incorporated fintech and ESG topics more deeply into their curricula, reflecting the changing competency profile required in financial services. Learn more about evolving financial education and professional standards through the CFA Institute at cfainstitute.org.

For job seekers and employers alike, Financetechx Jobs offers a window into how roles are evolving across fintech, banking, asset management, and technology. The most competitive employers in 2026 are those that can not only attract scarce technical talent but also provide clear pathways for continuous learning, cross-functional collaboration, and responsible innovation.

Founders, Ecosystems, and the Next Wave of Innovation

Despite more stringent funding conditions than in the early 2020s, entrepreneurial energy in fintech remains strong. Founders in the United States, United Kingdom, Germany, Singapore, Brazil, Nigeria, and beyond are increasingly focused on infrastructure, B2B services, and niche verticals where deep expertise and regulatory fluency create defensible advantages. The archetype of the fintech founder has evolved from the outsider disruptor to a more hybrid profile, often combining experience in banking, consulting, or regulation with technical and product skills.

Ecosystems play a critical role in this new phase. Regulatory sandboxes in the United Kingdom, Singapore, and the United Arab Emirates, innovation hubs in New York, London, Berlin, Paris, Toronto, Sydney, and Amsterdam, and accelerators backed by major banks and technology firms all contribute to a more structured path from prototype to scaled deployment. For founders seeking to understand how to navigate this environment, Financetechx Founders provides insights into fundraising, compliance, partnerships, and international expansion.

Looking ahead, the next wave of fintech innovation is likely to emerge at the intersections: between AI and sustainability, between digital identity and cross-border payments, between tokenization and traditional capital markets, and between financial services and sectors such as health, mobility, and energy. For business leaders and policymakers who follow Financetechx News and the broader coverage on Financetechx, the challenge is to distinguish transient hype from durable structural change, while building organizational capabilities that can adapt to an increasingly digital, data-driven, and interconnected financial system.

A Defining Decade for Global Finance

As of 2026, fintech stands at the center of a defining decade for global finance. It has demonstrated its capacity to expand financial access, increase efficiency, and catalyze new business models across the United States, Europe, Asia, Africa, and Latin America. At the same time, it now bears responsibilities commensurate with its scale and systemic importance: safeguarding data and infrastructure, operating within evolving regulatory frameworks, contributing to climate and social objectives, and maintaining trust in an era of rapid technological change.

For the global community that turns to Financetechx for analysis across fintech, business, economy, banking, crypto, and green fintech, the message is clear: fintech is no longer a side story to the financial system; it is the operating logic through which modern finance increasingly functions. The organizations, regulators, founders, and investors that recognize this and build strategies grounded in experience, expertise, authoritativeness, and trustworthiness will be best positioned to shape - and benefit from - the financial landscape of the 2030s and beyond.