AI-Driven Market Forecasting in 2026: From Advantage to Necessity

AI Forecasting as a Strategic Core in Global Finance

By 2026, artificial intelligence has become a foundational pillar of market forecasting rather than a peripheral experiment, and FinanceTechX has been closely embedded in this transformation through ongoing engagement with founders, institutional investors, regulators, and technology leaders across North America, Europe, Asia, Africa, and Latin America. What began a decade ago as a series of isolated proofs of concept layered on top of traditional econometric models has matured into a deeply integrated ecosystem of machine learning platforms, real-time data infrastructures, and decision-intelligence applications that now underpin how leading organizations anticipate market movements, navigate macroeconomic uncertainty, and allocate capital in increasingly complex environments. For global readers following fintech innovation on the FinanceTechX fintech insights hub, AI forecasting is no longer a differentiator reserved for a handful of quantitative firms; it is a baseline capability for banks, asset managers, corporates, and even growth-stage startups that expect to compete at scale in 2026.

This shift has been accelerated by several converging forces: the normalization of cloud-native financial architectures, the proliferation of high-frequency and alternative data sets, the rapid commercialization of large language models, and the intensifying regulatory focus on forward-looking risk management in jurisdictions such as the United States, the United Kingdom, the European Union, and key Asian markets including Singapore, Japan, South Korea, and China. Institutions that once relied on quarterly macroeconomic reports and static scenario analysis now operate with continuously updated, probabilistic views of the future, generated by AI systems that ingest structured and unstructured information, reconcile conflicting signals, and surface insights that can be acted on in trading, treasury, and strategic planning workflows. Within this landscape, FinanceTechX has positioned itself as a trusted guide for executives who seek to understand not only the technology itself but also its implications for business models, regulation, and organizational capabilities.

Data Foundations: From Macro Indicators to Planet-Scale Signals

The effectiveness of AI-driven forecasting in 2026 rests on increasingly sophisticated data foundations, and the breadth, depth, and timeliness of available information have expanded dramatically compared with even a few years ago. Traditional macroeconomic indicators-GDP growth, inflation, employment, trade balances, and policy rates-remain essential baselines, and institutions still rely on resources such as the World Bank's data portal and the International Monetary Fund to anchor their global views across advanced and emerging markets. However, the center of gravity has shifted toward high-frequency, granular data that captures real-time economic activity, including payment flows, supply-chain telemetry, point-of-sale statistics, and shipping and logistics feeds, which are increasingly integrated into enterprise data lakes and forecasting pipelines.

A defining characteristic of modern forecasting architectures is the integration of alternative and geospatial data that provide early signals of sectoral and regional shifts, particularly in large economies such as the United States, China, Germany, the United Kingdom, and India, as well as in globally connected hubs like Singapore and the Netherlands. Satellite imagery is now processed at scale to estimate industrial output, construction activity, agricultural yields, and port congestion, while mobility and location data help infer consumer behavior and tourism patterns across Europe, North America, and Asia-Pacific. Natural language processing systems continuously parse corporate filings, earnings calls, policy papers, and global news coverage from sources including Reuters and the Financial Times, transforming unstructured text into structured, time-stamped signals that feed into forecasting models. Institutions that invest in rigorous data governance-covering lineage, validation, access controls, and privacy-are not only improving forecast reliability but also strengthening their overall operational resilience and cyber posture, themes that align closely with the enterprise risk narratives covered on the FinanceTechX security channel.

Advanced Machine Learning Techniques and Probabilistic Thinking

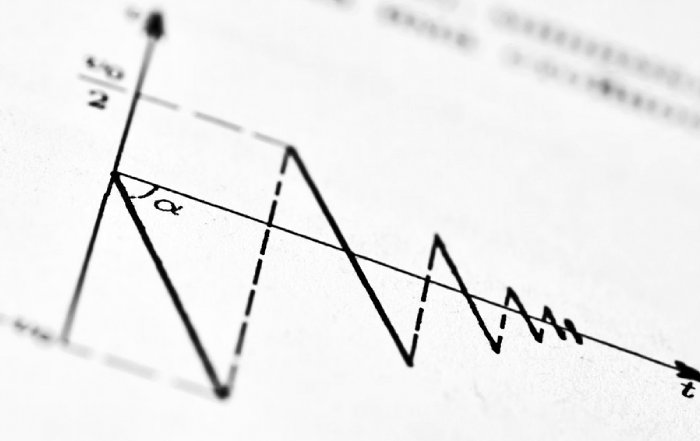

At the technical core of AI forecasting in 2026 lies a diverse and increasingly mature toolkit of machine learning methods that are designed to capture non-linear relationships, regime changes, and cross-market interactions that traditional linear models cannot adequately represent. Time-series forecasting has evolved beyond simple autoregressive techniques to embrace gradient-boosted decision trees, temporal convolutional networks, recurrent architectures, and transformer-based models that can handle long-range dependencies in financial and macroeconomic data. Research communities and practitioners continue to draw on open resources such as the arXiv machine learning archive and the work of organizations like OpenAI, which publish research and tools that influence how forecasting models are designed, trained, and evaluated in production environments.

Equally important has been the mainstreaming of probabilistic forecasting and Bayesian approaches, which support risk-aware decision-making by providing full distributions rather than single-point estimates. Financial institutions and corporates increasingly rely on Bayesian structural time-series models, ensemble methods, and scenario-based simulation frameworks to quantify uncertainty under different macro, policy, and geopolitical conditions. This probabilistic orientation aligns with the expectations of regulators such as the Bank of England and the European Central Bank, which continue to emphasize stress testing, reverse stress testing, and scenario analysis as core pillars of prudential supervision. For readers of the FinanceTechX economy and markets hub, this methodological evolution is not an academic detail; it is reshaping how capital buffers are calibrated, how liquidity is managed, and how systemic risk is monitored across interconnected markets.

Generative AI, Language Models, and Decision Intelligence

The rise of generative AI and large language models has added a powerful new dimension to forecasting capabilities by enabling systems to understand, synthesize, and contextualize the textual and visual information that surrounds financial and economic events. Institutions across the United States, Canada, the United Kingdom, Germany, France, Singapore, Japan, and Australia now deploy language models, often fine-tuned on proprietary corpora, to continuously interpret central bank speeches, regulatory consultations, corporate earnings transcripts, and industry research. These models convert complex narratives into structured features-such as sentiment scores, topic vectors, and policy risk indicators-that can be integrated into quantitative forecasting engines, enhancing their sensitivity to qualitative shifts in policy or corporate strategy.

Decision-intelligence platforms, a theme regularly examined on the FinanceTechX AI and automation section, sit on top of these forecasting engines and provide interactive interfaces for traders, risk officers, CFOs, and board members. Users can query forecasts in natural language, explore scenario narratives generated by AI, and receive prescriptive recommendations on actions such as portfolio rebalancing, hedging, capital expenditure timing, and geographic expansion. This convergence of predictive analytics, generative storytelling, and prescriptive guidance is transforming AI from a back-office analytical tool into an embedded decision partner, changing how organizations structure investment committees, risk forums, and executive reviews. In this context, the ability to explain model outputs in clear, business-relevant language has become as important as raw predictive accuracy.

Cross-Asset and Cross-Sector Applications in 2026 Markets

By 2026, AI-enhanced forecasting has permeated virtually every major asset class and financial sector, influencing how liquidity is provided, how risk is priced, and how portfolios are constructed across global markets. In public equity markets, asset managers and hedge funds are using machine learning models to forecast earnings surprises, factor dynamics, and cross-sectional returns, drawing on a combination of fundamental, technical, and alternative data. These models are increasingly integrated into execution algorithms that respond dynamically to order-book conditions and volatility regimes, informed in part by market structure data from organizations such as the World Federation of Exchanges. For readers who follow equity and derivatives developments on the FinanceTechX stock-exchange coverage, this integration of AI into both alpha generation and market microstructure is reshaping the competitive landscape for trading firms and liquidity providers.

In fixed income and rates markets, AI systems forecast yield curve shifts, credit spread behavior, and default probabilities across sovereign, corporate, and structured products, using macroeconomic indicators, issuer financials, credit bureau records, and sector-specific signals. These forecasts support decisions on duration positioning, curve trades, credit allocations, and hedging strategies, while also informing pricing models used by banks and insurers subject to regulatory frameworks overseen by authorities such as the U.S. Federal Reserve and the European Securities and Markets Authority. Commodities and foreign exchange markets, which are heavily influenced by geopolitical events, supply-chain disruptions, and climate-related shocks, increasingly rely on AI models that blend traditional time-series analysis with news and sentiment signals, providing early warnings of regime shifts that can affect corporates and investors worldwide.

Crypto, Digital Assets, and On-Chain Intelligence

The digital asset ecosystem has emerged as one of the most dynamic arenas for AI-based forecasting, in part because blockchain networks generate transparent, high-frequency data that can be analyzed in real time. Exchanges, market makers, and institutional investors are deploying deep learning models to forecast short-term price movements, volatility clusters, and liquidity conditions across major cryptocurrencies, stablecoins, and tokenized assets, using both on-chain metrics and off-chain sentiment indicators. Data platforms such as CoinMarketCap and Glassnode provide extensive feeds that are integrated into forecasting pipelines, while regulatory developments from bodies like the U.S. Securities and Exchange Commission and the Monetary Authority of Singapore shape how these models are used in compliant trading and risk management frameworks.

For the community following digital asset innovation on the FinanceTechX crypto and Web3 section, the convergence of AI analytics with blockchain transparency is redefining how both retail and institutional participants assess counterparty risk, liquidity fragmentation, and systemic vulnerabilities related to stablecoins and decentralized finance protocols. AI models are now routinely employed to detect anomalous transaction patterns, identify potential fraud or market manipulation, and evaluate the resilience of token ecosystems under stress scenarios. This is particularly relevant in jurisdictions such as Switzerland, the United Kingdom, Germany, South Korea, and the United Arab Emirates, where regulatory clarity has encouraged institutional experimentation with tokenization and digital asset custody, but where supervisors increasingly expect robust, data-driven risk controls.

Corporate Finance, Treasury, and Strategic Planning

Beyond the trading floor, AI forecasting has become deeply embedded in corporate finance, treasury management, and strategic planning for companies across industries including technology, manufacturing, retail, healthcare, and energy. Corporates headquartered in the United States, Canada, the United Kingdom, Germany, France, Italy, Spain, the Nordics, Singapore, Australia, and Brazil are deploying AI models to forecast revenue, margin compression, working capital needs, and foreign exchange exposures under multiple macroeconomic and sector-specific scenarios. These forecasts inform decisions on capital expenditure timing, inventory management, debt issuance, share repurchases, and M&A strategy, and they are increasingly scrutinized by boards and investors who expect data-driven justifications for capital allocation choices. Executives often turn to thought leadership from sources such as Harvard Business Review and the McKinsey Global Institute to benchmark their approaches against emerging best practices.

For mid-market firms and high-growth startups, many of which are profiled on the FinanceTechX founders and entrepreneurship page, AI forecasting is becoming a pragmatic tool for professionalizing financial planning and investor communication without the overhead of large in-house analytics teams. Cloud-based platforms offered by fintech providers allow founders to simulate funding scenarios, monitor burn and runway under different revenue trajectories, and evaluate the financial impact of expansion into new geographies such as Southeast Asia, the Middle East, or Eastern Europe. These tools are particularly valuable in a funding environment that remains selective and data-driven, where investors in markets like the United States, the United Kingdom, Germany, and Singapore expect founders to demonstrate rigorous scenario thinking and disciplined capital allocation.

Banking, Regulation, and Risk Management in an AI-First Era

In banking, AI-driven forecasting has moved from the innovation lab into the core of credit, liquidity, and capital management frameworks, as supervisors in the United States, the United Kingdom, the European Union, and key Asian jurisdictions demand more robust forward-looking capabilities. Banks now routinely use machine learning models to forecast loan performance, prepayment behavior, and portfolio losses across retail, SME, and corporate books, integrating macroeconomic scenarios informed by guidance and statistics from organizations such as the Bank for International Settlements and the Organisation for Economic Co-operation and Development. These forecasts feed into capital planning, provisioning decisions under accounting standards such as IFRS 9 and CECL, and early-warning systems that identify emerging pockets of vulnerability across sectors and regions.

The FinanceTechX banking vertical has documented how this evolution is reshaping bank operating models, driving investments in data infrastructure, model governance, and explainable AI frameworks that can withstand regulatory scrutiny. Supervisors have become increasingly explicit that while advanced analytics can enhance risk identification and pricing, they do not absolve boards and senior management of accountability for model risk and ethical considerations. Banks in regions such as the Eurozone, the United States, the United Kingdom, and China are therefore building multidisciplinary model risk management functions that combine quantitative expertise with legal, compliance, and operational perspectives, ensuring that AI forecasting augments rather than replaces sound human judgment.

Talent, Jobs, and the New Skills Matrix

The widespread adoption of AI forecasting is reshaping labor markets and job profiles across finance, technology, consulting, and corporate sectors, a development that resonates deeply with readers of the FinanceTechX jobs and careers channel. Rather than simply automating existing roles, AI is transforming the nature of work by elevating the importance of hybrid skill sets that blend quantitative finance, data engineering, machine learning, business acumen, and regulatory literacy. In financial centers such as New York, London, Frankfurt, Zurich, Paris, Toronto, Singapore, Hong Kong, Sydney, and Dubai, employers are actively recruiting professionals who can design and maintain robust data pipelines, interpret complex model outputs, and translate analytical insights into strategic recommendations that are intelligible to boards, regulators, and clients.

At the same time, automation is reducing the time spent on repetitive tasks such as manual data reconciliation, basic reporting, and routine scenario analysis, allowing analysts and managers to focus on higher-value activities including product innovation, client advisory, and cross-functional collaboration. To remain competitive, professionals at all career stages are investing in upskilling through programs offered by organizations like the CFA Institute and academic institutions such as the MIT Sloan School of Management, which provide curricula on AI, data science, and digital transformation. FinanceTechX regularly highlights such initiatives on its education and learning hub, recognizing that human capital development is an essential enabler of trustworthy and effective AI deployment across global financial markets.

Sustainability, Climate Risk, and Green Fintech Forecasting

One of the most consequential frontiers for AI forecasting in 2026 lies at the intersection of finance, sustainability, and climate science, where investors, regulators, and corporates require sophisticated tools to assess environmental risk and opportunity. Climate-related disclosure frameworks advanced by initiatives such as the Task Force on Climate-related Financial Disclosures and standard-setting bodies like the International Sustainability Standards Board have crystallized expectations that financial institutions and large corporates will model both transition and physical risks under multiple climate scenarios. AI techniques are particularly well-suited to this challenge because they can integrate climate models, geospatial data, engineering parameters, and economic projections into coherent forecasting systems that estimate the impact of extreme weather events, carbon pricing, and technological shifts on asset values, credit risk, and supply-chain resilience.

For the FinanceTechX audience, which closely tracks developments on the environment and climate page and the dedicated green fintech section, the rise of climate-aware AI forecasting represents both a risk management imperative and a business opportunity. Financial institutions in Europe, North America, and Asia-Pacific are collaborating with climate scientists, data providers, and technology firms to build platforms that quantify climate exposure at the asset, portfolio, and counterparty level, while also identifying opportunities in renewable energy, energy efficiency, and sustainable infrastructure. These efforts draw on scientific research synthesized by the Intergovernmental Panel on Climate Change and satellite-based climate data from agencies such as NASA's Earth Observing System, underscoring the importance of interdisciplinary collaboration in building credible, decision-ready climate forecasts that can support net-zero commitments and regulatory compliance.

Governance, Ethics, and Building Trust in AI Forecasts

As AI forecasting becomes more deeply embedded in capital allocation, risk management, and even public policy, questions of governance, ethics, and trust have moved to the center of strategic discussions in boardrooms and regulatory agencies. Financial institutions, technology providers, and policymakers increasingly recognize that the legitimacy of AI-driven decisions depends on robust governance frameworks that address bias, robustness, explainability, accountability, and data protection. International bodies and national regulators, including the European Commission and the National Institute of Standards and Technology, have published guidelines and frameworks for trustworthy AI, and these principles are gradually being embedded into model development lifecycles, validation processes, and operational controls.

From the perspective of FinanceTechX, which emphasizes trust and transparency across its business and strategy coverage, the organizations that will sustain a durable advantage in AI forecasting are those that combine technical excellence with clear governance and candid communication. This entails maintaining detailed documentation of model architectures, data sources, and assumptions; implementing rigorous backtesting and challenge processes; and providing interpretable outputs that enable decision-makers to understand the drivers behind model recommendations. It also involves being explicit about uncertainty, limitations, and potential failure modes, particularly in domains such as geopolitical risk, climate change, and systemic financial stability where historical data may be an imperfect guide to the future. Supervisory expectations are converging on the view that AI should augment, not replace, human judgment, and that boards must retain ultimate responsibility for the risk implications of AI-enabled decisions.

Global Perspectives and the Road Ahead for AI Forecasting

The trajectory of AI-driven market forecasting in 2026 is shaped by global dynamics, with different regions adopting and regulating these technologies in distinct ways, yet converging on the recognition that advanced analytics are indispensable in a volatile, interconnected world. In North America, deep capital markets and a strong technology ecosystem continue to foster close collaboration between major banks, asset managers, and AI firms, while in the United Kingdom, Germany, France, the Netherlands, and the Nordics, financial centers are leveraging regulatory sophistication and academic excellence to position themselves as hubs for responsible AI in finance. In Asia, countries such as Singapore, Japan, South Korea, and China are investing heavily in AI infrastructure, digital public goods, and talent development, aiming to lead in areas ranging from digital trade finance to real-time macro monitoring. Meanwhile, markets in Africa and South America, including South Africa and Brazil, are exploring AI forecasting in the context of development finance, commodity cycles, and currency volatility, often in partnership with multilaterals and development banks.

For global readers of FinanceTechX, who track macroeconomic and market developments on the world and global trends page and follow real-time updates on the news and analysis hub, the fundamental strategic question is no longer whether AI will reshape market forecasting, but how to harness its capabilities responsibly and competitively. Over the coming years, AI forecasting systems are likely to become more tightly integrated with transaction flows, real-time risk controls, and regulatory reporting, potentially creating a more adaptive and data-rich financial system that can respond more quickly to shocks, but that also introduces new forms of concentration, model dependence, and cyber vulnerability.

As this evolution continues, FinanceTechX will remain focused on providing executives, founders, policymakers, and practitioners with clear, evidence-based analysis of how AI forecasting is transforming fintech, banking, crypto, sustainability, employment, and education. Readers who wish to stay ahead of these developments can explore the broader FinanceTechX global finance and technology portal, where AI-driven market forecasting is treated not as a niche technical topic, but as a central lens through which to understand how modern finance operates, competes, and supports economies across Europe, Asia, Africa, South America, and North America in 2026 and beyond.